These are moments of euphoria for the economy, I mean the indices have performed well this week, I particularly like to follow the SP500, Nasdaq 100 and the Dow Jones, together with the analysis of these indices added to the macroeconomic news we can have a broad picture of what is happening in the main economy of the world, the United States of America.

Bulls in the Economy

In particular, being that the SP500 is the main reference, the 500 largest companies in the United States, so it is an index that tends to get more attention in recent times, taking into account that it has a great weight in the technology sector, which correlates this index with the Nasdaq.

We have witnessed new all time highs being achieved in the SP500, a couple of weeks ago I announced in an InLeo Thread that it could continue to rise after breaking through resistance at the December 2021 price level.

Screenshot in TradingView (Weekly Chart)

Something very similar occurs in the Dow Jones (industrial sector), breaking the resistance of 2021 and even having a more accentuated upward movement than the same SP500, seeing in the weekly chart a trend of almost 14 weeks of constant rises, only a weekly candle closes in red, but the movement continues with strength to have more than 4% above its maximum of 2021, the weekly chart does not show a possible change of trend.

Screenshot in TradingView (Weekly Chart)

Nasdaq100, meanwhile, has been one of the drivers of the economy in recent months, however, the movement had a resistance after touching record highs, so it shows a movement with less strength compared to other indices, however, remains in an uptrend without a confirmed divergence on the weekly chart, so it can maintain momentum despite the lack of strength of the movement.

Despite the fact that many companies in the sector have achieved good results in their quarterly reports (case of Alphabet Inc. and Microsoft), investors are observing other aspects such as less advertising revenue at Google and slowing growth in the cloud by Microsoft, among other news such as the cancellation of a salary package for Elon Musk after a lawsuit, news that have affected the NasdaQ100 performance in the last hours slowing the upward movement.

Screenshot in TradingView (Weekly Chart)

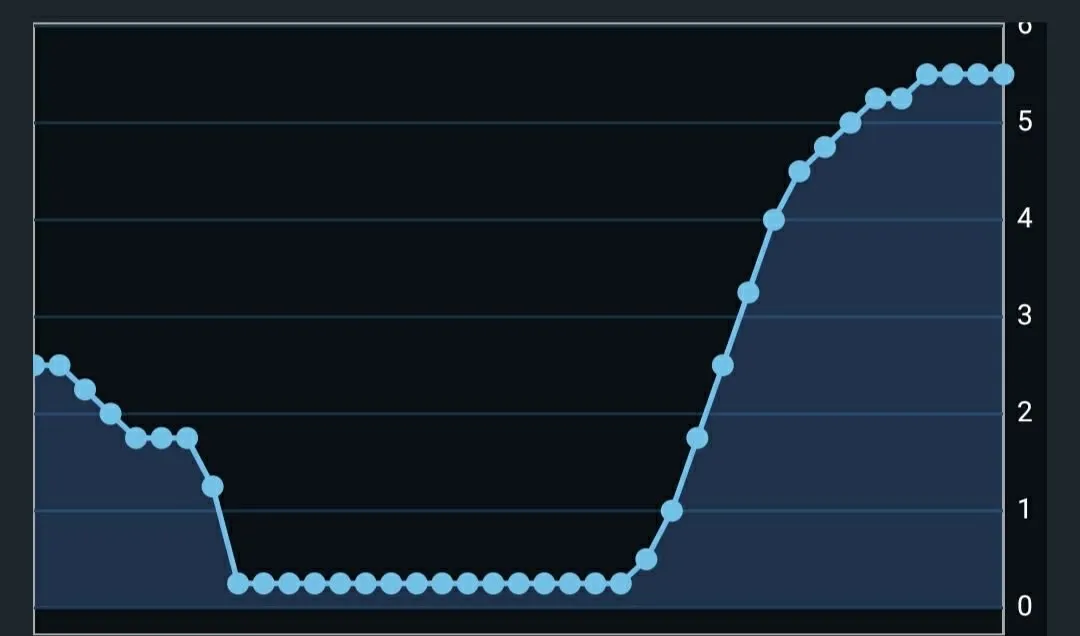

Fed Interest Rates

Today, the FED policy makers will meet and release the interest rate, something very important for the economy, it is expected to remain at 5.50, as it has been in the last few meetings, so markets may already be reacting to the possibility of keeping interest rates stable, following a less hawkish speech from the FED, in the face of positive projections on inflation.

Screenshot of Investing Mobile App, interest rate chart

Market Reaction

Normally in these types of issues the market has already assumed that interest rates will be maintained, however, if there is any change in the speech it becomes highly volatile, even if in the subsequent speech there are signs of over tightening or easing of the FED's monetary policies.

At this point in time, investors are assuming that interest rates remain on hold, leading to speculation of new highs in the coming days and bullish news for the US economy.

Technology and Long Term Chips

One of the key aspects driving the economy is the growing expansion in technology investment, a key focus being the semiconductor industry, which the US has decided to expand into as a strategic goal in global geopolitics.

The bet on AI continues to strengthen and Microsoft is one of those companies that want a privileged position in the advancement of this technology, a market that so far has not seen a ceiling, is that of advanced chips for AI, in addition, the world needs more chips every day for both civilian and military devices.

How it affects cryptocurrencies?

Although we can say that Bitcoin and altcoins are different assets than traditional ones, they have a correlation with the economy (indices), because in times of liquidity part of the capital would enter the crypto ecosystem.

We are at a historic point in history where an increasing percentage of people are turning to cryptocurrencies as a safeguard against the faltering US economy and the increasingly weak global financial system. It is therefore very likely that investors will take advantage of bank loans, for example, to diversify their investment portfolios, and among this diversification are cryptocurrencies, which are seen as a real alternative to the fiscal deficit and the US debt crisis, so we can conclude that a relaxation of interest rates, coupled with the new highs in the SP500 indices and above all the Nasdaq100 technology sector, are positive news for the crypto ecosystem.

Thank you for your reading, until next time