Most people are completely unaware of how the world actually operates. They go to their job, work hard, spend time with their family, and pursue their hobbies if they have free time. They go to sleep believing that presidents and governments are the people who make decisions and control the world. However, this couldn’t be further from the truth. The reality is that large companies and organizations are who actually control everything that is happening. Those who have the money, control the world. They lobby and control politicians, shaping the world into a place that benefits them greatly.

But there is one company that sits on top of the mountain. This is a company that most people outside of the financial world have never even heard of. The reality is that this “secret” company rules the world. Their name is Blackrock.

Blackrock is an investment company that holds trillions of dollars worth of assets. The most in the world by far. They own large percentages of many of the largest companies in the world. Such as Apple, Disney, Microsoft, NVIDIA, Google, and hundreds of other companies. They were also the group that started the whole ESG investing thesis during the last few years. This was one of the main reasons during the last bull market.

The truth is that what Blackrock wants, Blackrock gets.

And they have set their sights on a Bitcoin Spot ETF.

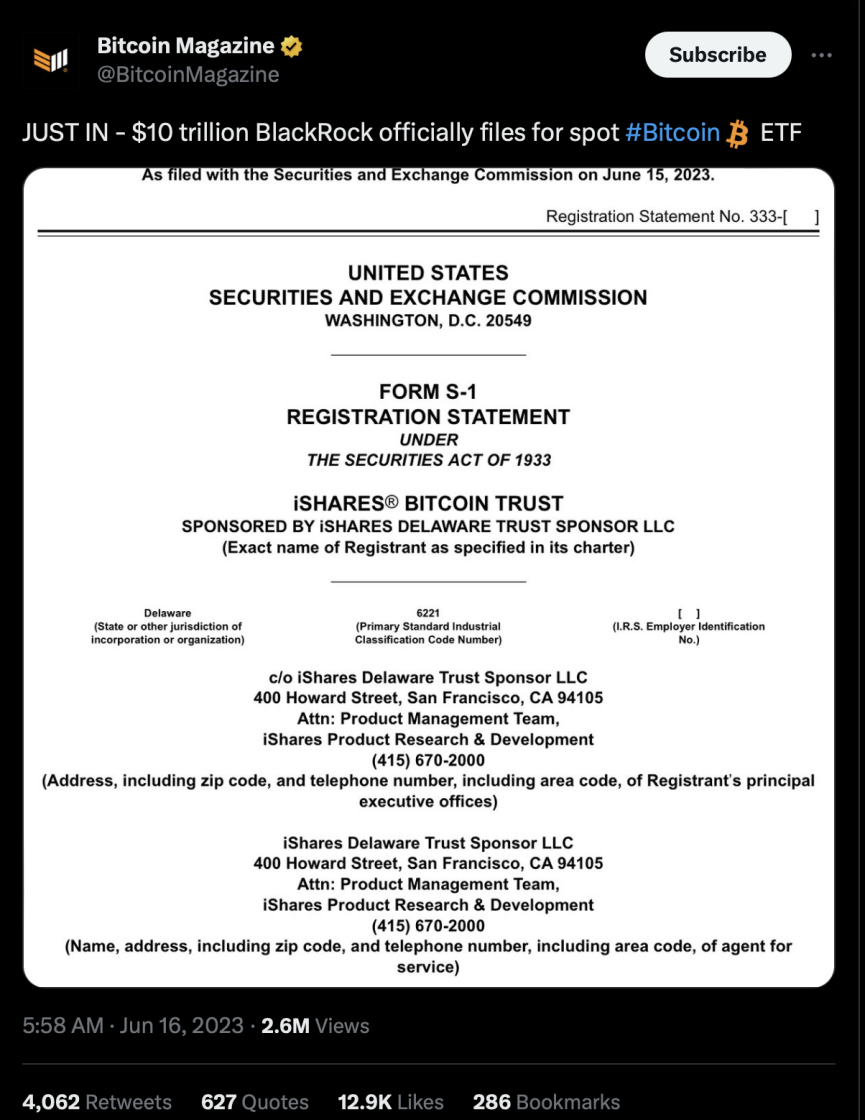

The largest and most powerful company in the world has officially applied for a Spot Bitcoin ETF and this will change everything.

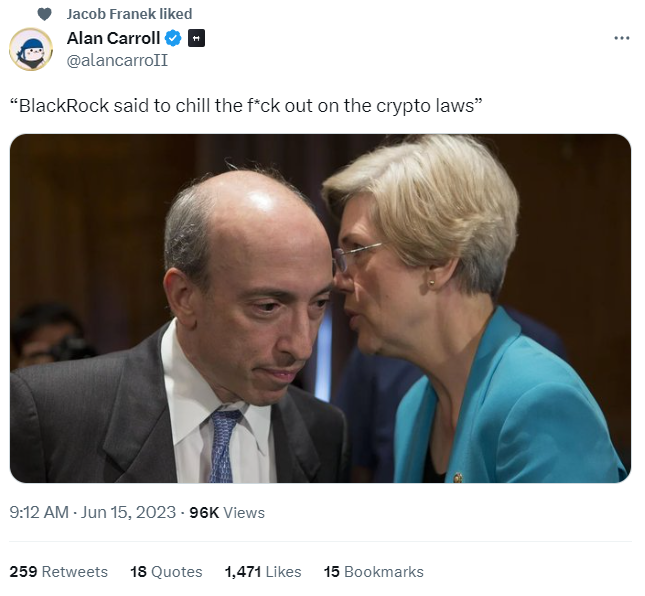

In the Bitcoin market, the Spot ETF has become almost mythical. It is thought to be the method that will finally bring companies, legitimacy, and retirement funds into Bitcoin. Most experts believe that it will cause a stampede rush of billions of dollars into Bitcoin. That it will be the catalyst that finally pushes the price of Bitcoin over $100k, and that will only be the beginning. Over the years there have been several companies that have applied to the SEC for a spot ETF. but, they have all been rejected. The SEC, and most notably Gary Gentler, has seemed to have made the entire crypto market enemy number one. There are rumors that he has been directed by Senator Elizabeth Warren to delay the progress of this industry, or even destroy it. All in order to get a job promotion.

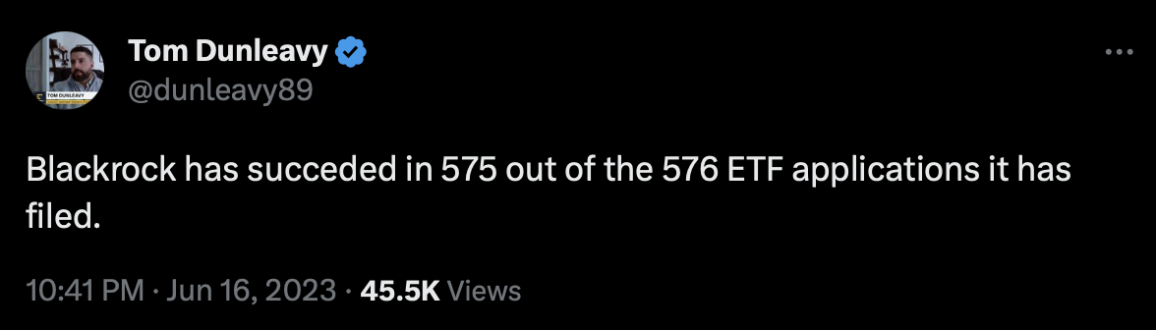

However, all of those companies that previously applied for the Spot Bitcoin ETF weren’t Blackrock.

They play by different rules.

All of a sudden the Spot Bitcoin ETF chance of being approved went from being almost impossible, to nearly certain. The tables have turned.

In the financial world, there is no company bigger than Blockrock. There is no one better respected. They are the most persuasive and have the best connections. Finally, they are extremely calculated. They don’t file anything if they don’t already know the result. It is rumored that they are aware that Grayscale will win their case against the SEC, which would open the doors for an ETF approval. They also know that their application is already going to be approved.

This will be the catalyst that begins to knock over all of the dominoes. Several other companies will follow suit and apply for spot ETFs as well. The floodgates will have been opened.

Before we become too ahead of ourselves about the future of Bitcoin. It’s important to note that this application won’t be instantly approved. It will likely take up to 9 months. Which puts us at around February or March of next year.

But this is when things become even more interesting.

Blackrocks ETF could be approved next March, which will be market-changing. And then the next Bitcoin halving will occur next April/May. Everything is lining up for something special to happen. All of a sudden those price predictions from the last cycle of Bitcoin potentially reaching $500k don’t seem so crazy. No matter what happens, things are about to get interesting. We will look back on Bitcoin’s history and say this was the moment when the corporate world dived head first into Bitcoin.

How about you? Do you think Blackrock’s Spot Bitcoin ETF will be approved?

Read My Articles first on

As always, thank you for reading!