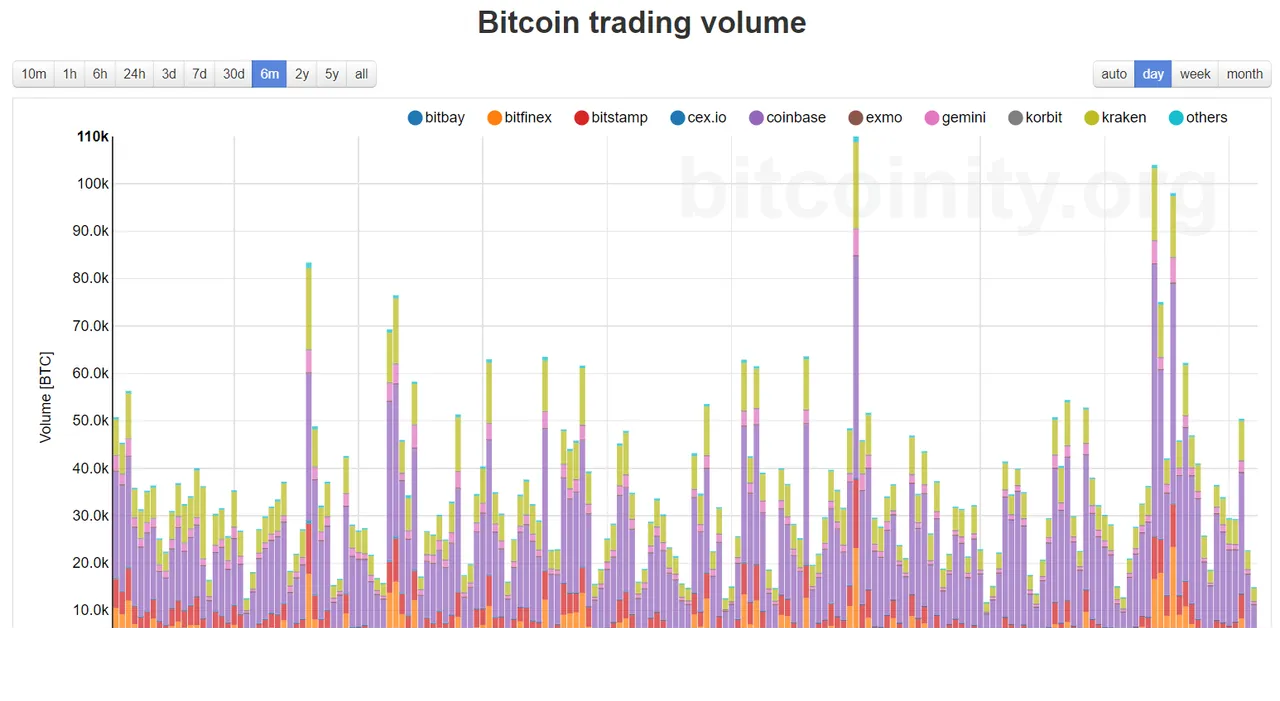

Bitcoin is currently trading slightly below the $43k mark. 50 DMA for Bitcoin is $42,815 and at the time of writing, Bitcoin is a few dollars above that level. 200 DMA for Bitcoin is closer to the $50k mark, at $49,194. The price increase of Bitcoin should have excited many because it started trading above $40k. The large green candle on Friday looked pretty bullish. However, I do not think there is much steam left. RSI is slowly approaching overbought levels. Volume, at least on the Coinbase chart was nothing spectacular. 50 DMA should itself be a tough resistance to break, given macroeconomic action across the globe. Let's take a look at some of the other data I share each week to see what it is suggesting.

Not just Coinbase, volumes have been pretty low across the board during this rally in Bitcoin. Volume is surely indicating that this rally is not built on a strong foundation.

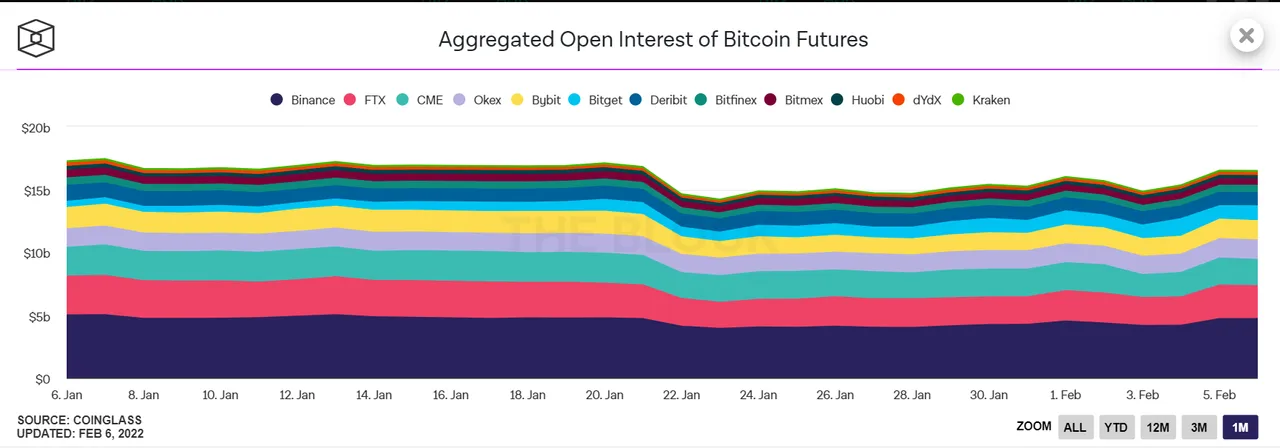

Open Interest is on the rise and there is some bullishness in the futures market. That is a good sign, but only for the short term. Most players in the futures market are looking at short-term profits and the open interest situation can change pretty soon. The only positive one can take from here is that institutional players are getting back to buying Bitcoin. This may give a slight push to Bitcoin prices in the near term.

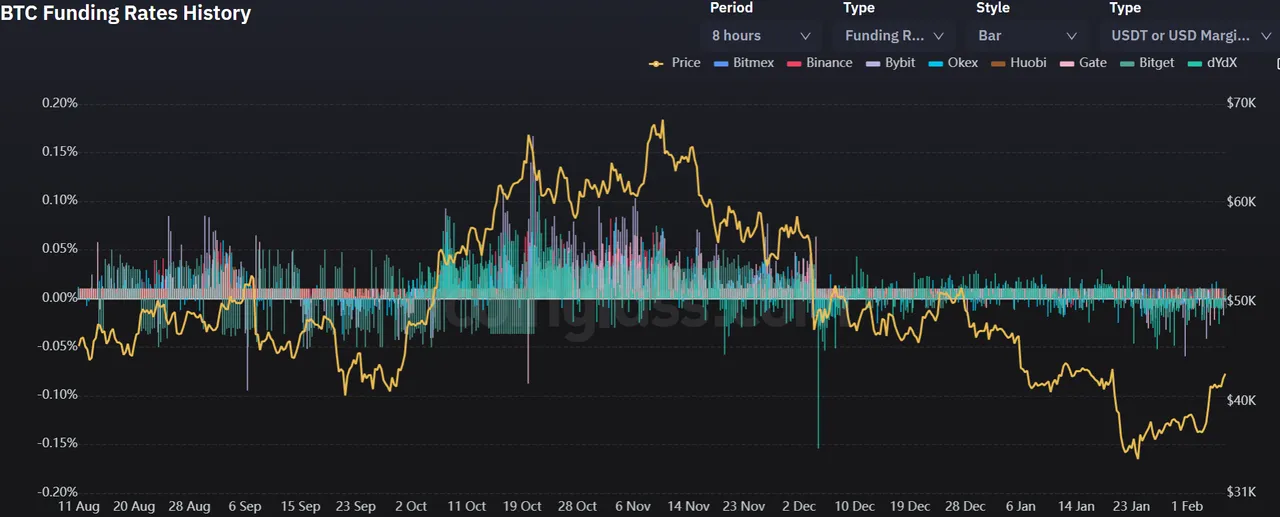

Funding rates are far from showing any risk. In fact, funding rates are quite low and the slight uptick is because of the weekend action. On a longer time frame, Bitcoin is oversold but in the near term, there can be some bullishness to take funding rates to 0. There is no clear indication from the funding rates, to be honest.

S&P futures have started trading in the negative territory this morning. Japan's Nikkei, Hang Seng, India's Nifty, are all trading in the red today. Brent Crude is approaching $94! It is important for S&P to cross 50 DMA before one can assess the markets again. I think global equity markets will be range-bound this week and this will be a week of increased volatility. The markets may be focussing on economic data coming out this week (ADP Employment change, Initial Jobless Claims, PMI, etc.). Enough to keep the markets busy. Really strong numbers can toss out my range-bound expectations. Bitcoin should follow the same trend. A retreat from $43k is likely and the lower bound should be $39k to $40k.