Introduction

Given the current inflationary ailments present in the World's economy (as well as the other maladies, i.e. employment), it is no wonder that assets are battling to earn the title of 'safe haven'. And it should be of no surprise that Bitcoin is at the center of this debate.

So, your next question should be what do we compare bitcoin to? Well, face it folks, Gold has long been recognized as the safe haven asset worldwide. And just how do we go about this comparison? We rely upon statistical analysis to accomplish this goal and more precisely we utilize mathematical correlation to examine the relationship between gold and bitcoin.

But first ...

Understanding Mathematical Correlations [Easy Version]

Most of us have only a vague understanding of what in fact 'correlation' is. In that this is such an integral comparative tool let's take a few minutes and understand exactly what this mathematical operation is and does.

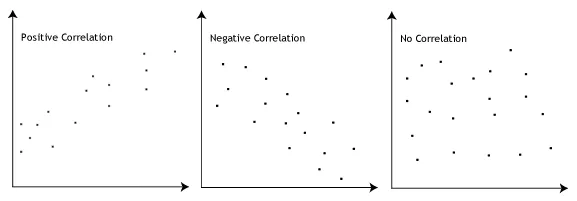

Correlation is "a measure of how well two variables are related to each other. There are positive as well as negative correlation. Positive Correlation: It refers to the extent to which the two variables increases or decreases in parallel ( think of this as directly proportional, one increases other will increase, one decreases other will follow the same). Negative Correlation: It refers to the extent to which one of the two variables increases as the other decreases (think of this as inversely proportional, one increases other will decrease or if one decreases other will increase)" [Singh, V. Pearson Correlation, a Mathematical Understanding!. (Accessed October 25, 2022)].

Within the statistical realm, the Pearson Product Moment Correlation (PPMC) is the most commonly utilized measure. "In layman terms, it’s a number between “+1” to “-1” which represents how strongly the two variables are associated. Or to put this in more simple words, it states the measure of the strength of linear association between two variables" [Id].

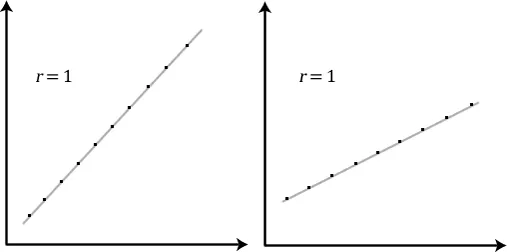

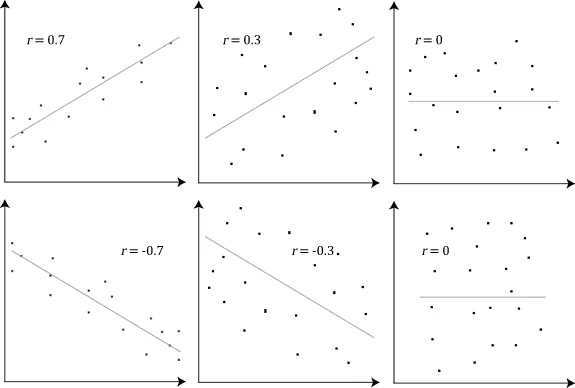

Basically, a Pearson Product Moment Correlation (PPMC) attempts to draw a line to best fit through the data of the given two variables, and the Pearson correlation coefficient “r” indicates how far away all these data points are from the line of best fit. The value of “r” ranges from +1 to -1 where:

- r= +1/-1 represents that al our data points lie on the line of best fit only i.e there is no data point which shows any variation from the line of best fit.

- Hence, the stronger the association between the two variables, the closer r will be to +1/-1.

- r = 0 means that there is no correlation between the two variables.

- The values of r between +1 and -1 indicate that there is a variation of data around the line.

- The closer the values of r to 0, the greater the variation of data points around the line of best fit.

[Id].

And the formula used to calculate the Pearson correlation coefficient is:

Looking at the Bitcoin Correlation with Gold

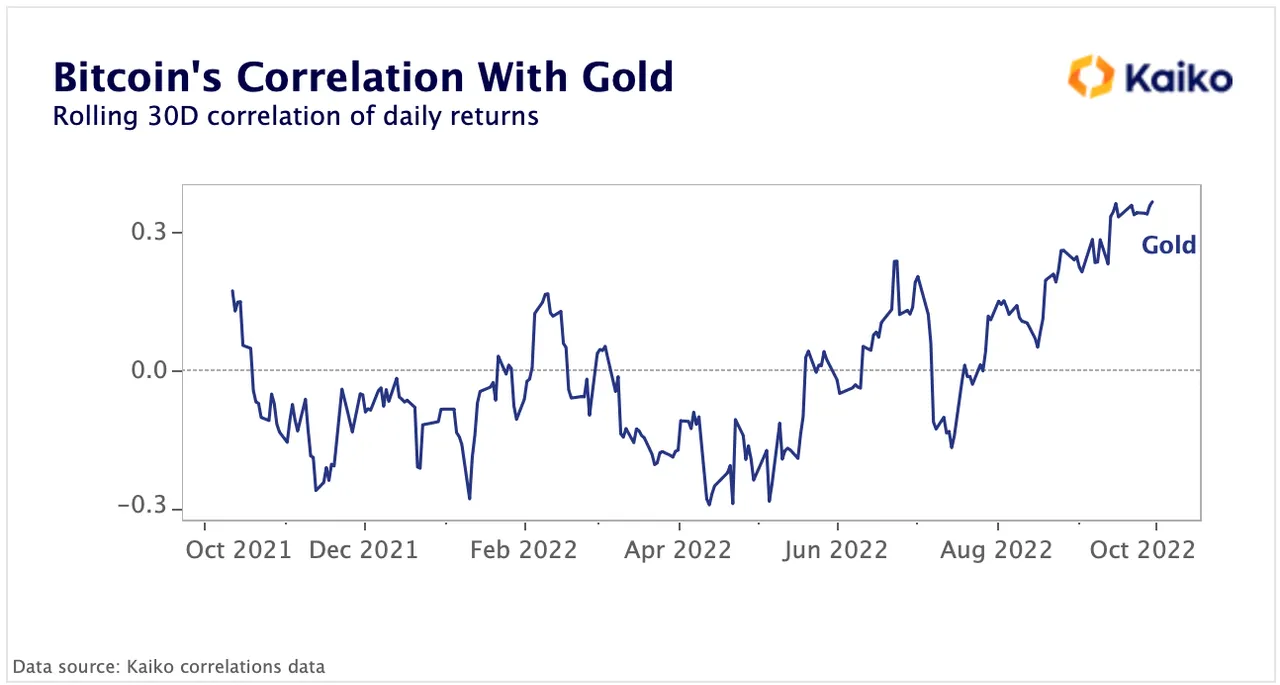

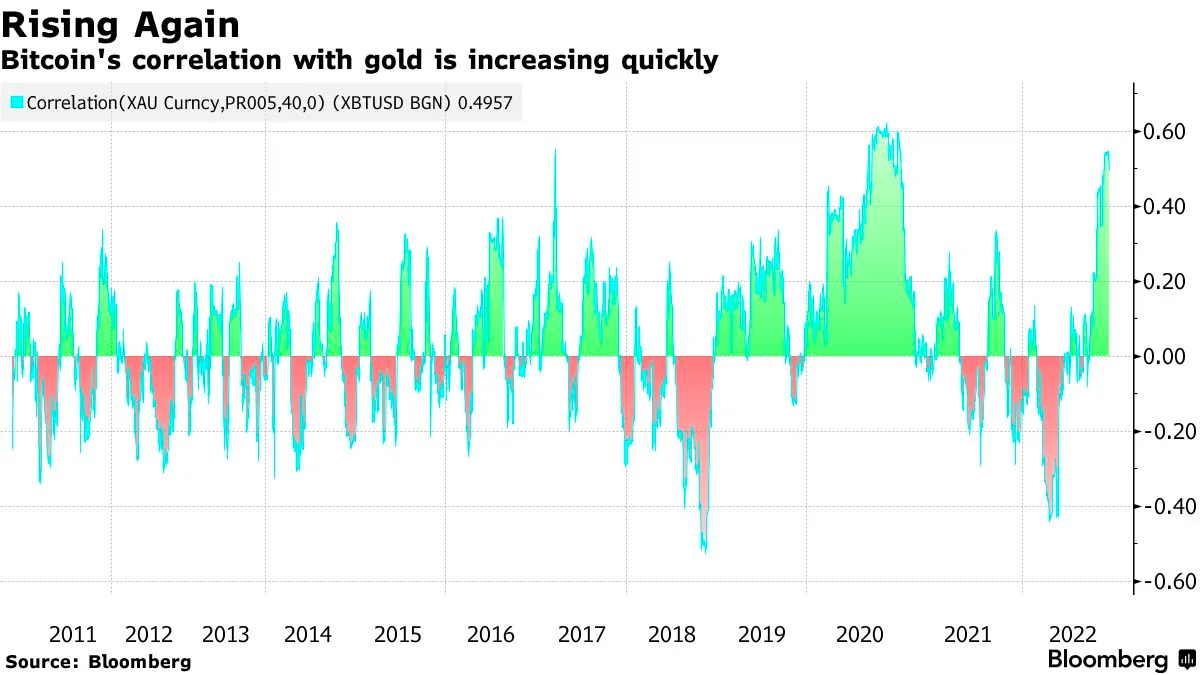

"Despite the ongoing cryptocurrency bear market, investors have been increasingly looking at Bitcoin as a safe haven, a new study suggests. The rise in correlation between Bitcoin and gold (XAU) is one of major indicators demonstrating investors’ confidence in BTC amid the ongoing economic downturn, according to digital strategists at the Bank of America. Bitcoin’s correlation with gold — which is commonly viewed as an inflation hedge — has been on the rise this year, hitting its highest yearly levels in early October. The growing correlation trend started on Sept. 5 after remaining close to zero from June 2021 and turning negative in March 2022, BofA strategists Alkesh Shah and Andrew Moss said in the report" [Partz, H. Gold vs BTC correlation signals Bitcoin becoming safe haven: BofA. (Accessed October 25, 2022)].

"For years, Bitcoin (BTC) proponents have maintained that the crypto is in line to become a safe haven asset and a hedge against inflation with the possibility of replacing gold. Notably, the reality of becoming a safe haven might be realized with the flagship cryptocurrency recording increased correlation with the precious metal amid prevailing macroeconomic factors. In particular, Bitcoin has hit a 40-day correlation with gold standing at 0.50 after the value stood at around zero in mid-August, Bloomberg reported on October 22" [Paul L. Bitcoin correlation with gold hits 40-day high as battle for safe haven asset intensifies. (Accessed October 25, 2022)].

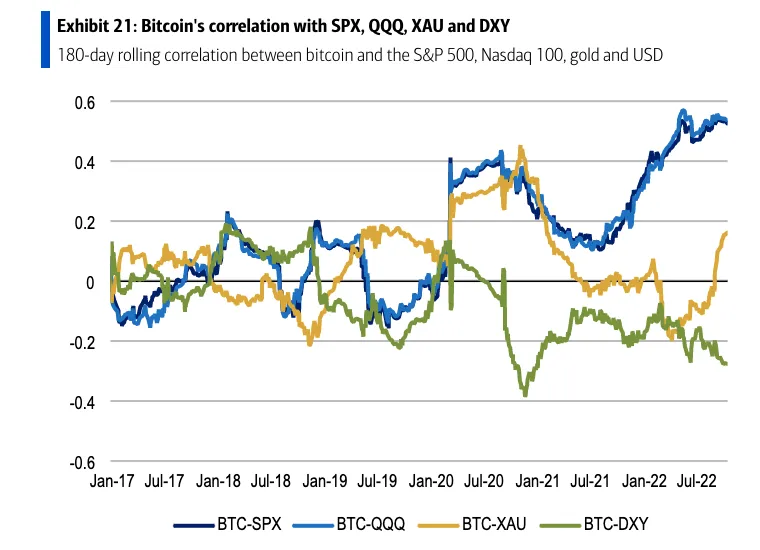

The current turmoil in financial markets added to the geopolitical tensions has run havoc on the majority of the assets that investors prefer to invest in during times of financial crisis. Bitcoin has lost nearly 70% of its market cap since the market top last year while gold, which strengthened its position in the first quarter of the year despite the Russia-Ukraine crisis, is currently down by 10% year-to-date. The negative market condition has forced BTC to shed its correlation with tech stocks, while at the same time, the top cryptocurrency’s correlation with the precious metal has reached levels not seen in over a year.

[Jha, P. Bitcoin and gold face headwinds amid strengthening dollar. (Accessed October 25, 2022)].

While the correlations are higher with the S&P 500, at 0.69, and Nasdaq 100 at 0.72, they’ve flattened out and are below record levels from a few months ago. BofA digital strategists Alkesh Shah and Andrew Moss see that as a sign that things could be changing. 'A decelerating positive correlation with SPX/QQQ and a rapidly rising correlation with XAU indicate that investors may view Bitcoin as a relative safe haven as macro uncertainty continues and a market bottom remains to be seen,' the strategists wrote. (emphasis added)

[Ossinger, J. Bitcoin’s Changing Correlations May Mean It’s Becoming a Haven Again, BofA Says. (Accessed October 25, 2022)].

"The BofA note dovetails with recent comments from the likes of Mike Novogratz, who said on Thursday that he sees Bitcoin as 'the canary in the coal mine' alongside gold and expects it to rally before other tokens, as well as Lauren Goodwin from New York Life Investments, who has said that Bitcoin and gold could both be perceived as a central-bank hedge" [Id].

"BofA strategists also mentioned massive Bitcoin outflows from exchanges to personal or self-hosted wallets. According to the study, weekly BTC exchange outflows in early October were the largest since mid-June, marking the third consecutive week of outflows. The strategists emphasized that large and continuous outflows to personal wallets indicate limited near-term sell pressure, stating: 'Investors transfer tokens from exchange wallets to their personal wallets when they intend to HODL, indicating a potential decrease in sell pressure" [Partz, supra].

"[...] Bitcoin’s ability to remain stable after the latest Federal Reserve interest rate hikes indicates that the asset is maturing. In the meantime, Bitcoin continues to consolidate around the $19,000 level [...]" [Paul L., supra].

Face it, no one wants to invest in a supposed 'safe haven' that exhibits high degrees of volatility. In fact, a highly volatile safe haven is an oxymoron.

Final Thoughts

'The blockchain’s transparency gives us insight into the digital asset ecosystem that’s not available in traditional financial markets,' the analysts stated. The new report comes amid the rising risks of the global economic recession, driving more demand for the inflation hedge. Bitcoin has lost about 70% of its market value amid the massive crypto winter of 2022, triggering more skepticism over its status as an inflation hedge.

[Partz, supra].

So apparently, while a good case may be made for Bitcoin to be labeled a 'safe haven', the grim macroeconomic conditions present in the system and the on-going crypto winter lead the jury to still be out on this call.