It's PolyCUB Provide Liquidity Week!!!!

How deep can we go?

Well guys, if you don't know what PolyCUB is by now... I'm sorry. It's the DeFi platform brought to you by the LeoFinance team and there's so much transparency it's scary. The goal is to be the most sustainable yield optimization platform ever, and to do that there needs to be a ton more TVL (total value locked). This is where we come in. The community. The ambassadors. The lions.

If this is your first time reading a post on LeoFinance, I invite you to take a look around and maybe even sign up. You can earn crypto by blogging and there's always tons of contests going on where you can bag even more crypto. On top of blogging, we have a full fledged ecosystem of decentralized finance applications, blockchain gaming, and much more to explore. The reason we're here today is... It's time to deepen the liquidity pools on PolyCUB.

We have big dreams for the platform and without support from crypto people like you, there's not much of a platform at all. With no liquidity, there is no yield. With no yield, there is no yield optimization. Got it?

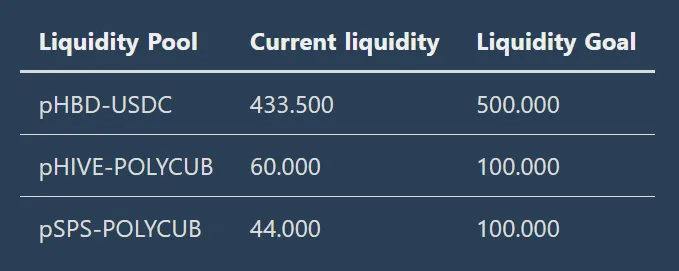

The goals for each pool in terms of dollar value is shown above. This image is from the official Provide Liquidity Week announcement, and since that post the numbers have changed a bit. In the right direction for sure.

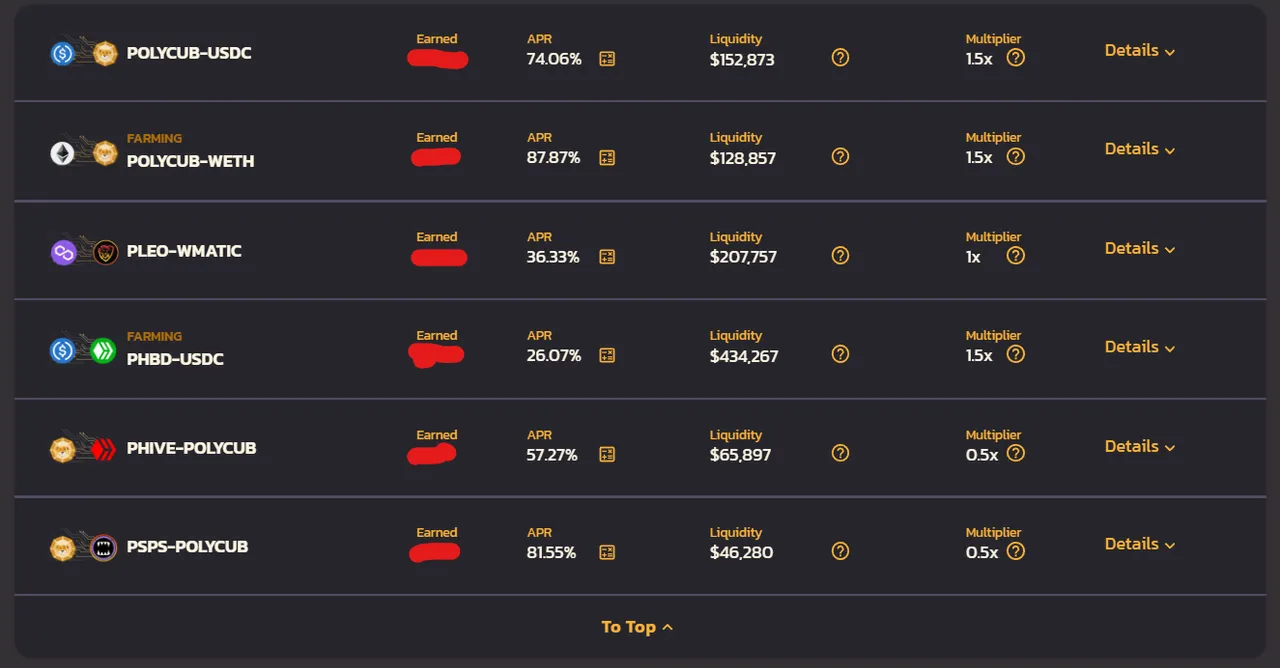

- pHBD-USDC - $434,267

- pHIVE-POLYCUB - $65,897

- pSPS-POLYCUB - $46,280

As you can see based on current numbers, the liquidity in these focus pools has increase a significant amount, but the goals are pretty far off. These are the focus pools because they are assets launched via PolyCUB's Multi Token Bridge which aims to provide cross-chain liquidity for Hive blockchain assets. To hit the goals, we need an influx of a total around $154,000 which is a tiny number in comparison to other less reliable DeFi projects.

These pools earn massive amounts of yield for PolyCUB's protocol owned liquidity, or treasury, that buys POLYCUB on the market. This POLYCUB is then distributed as yield to the different liquidity pools. One of the main issues with a lot of assets on the Hive blockchain is that they have very little liquidity. PolyCUB is giving these assets a major upgrade by making them cross-chain.

Now you're probably sitting there thinking "why the hell do I care about helping the platform grow?". Valid question - but there's a few reasons. Number 1, you get to get in on the ground floor of an emerging DeFi protocol that's got incredible backing. Number 2, these yields rates are insane! Number 3, there's a chance to win some crypto this week!

I could name more reasons that you should be interested in taking a dive into the PolyCUB pool, but I won't bore you with that. We're here to do one thing, and that's to provide some liquidity. Honestly, I don't have extra cash to throw in since I do already have liquidity in some of these pools but I'll do it for the team. After all, you guys make it possible for me to earn crypto that I can put to work in these pools anyway.

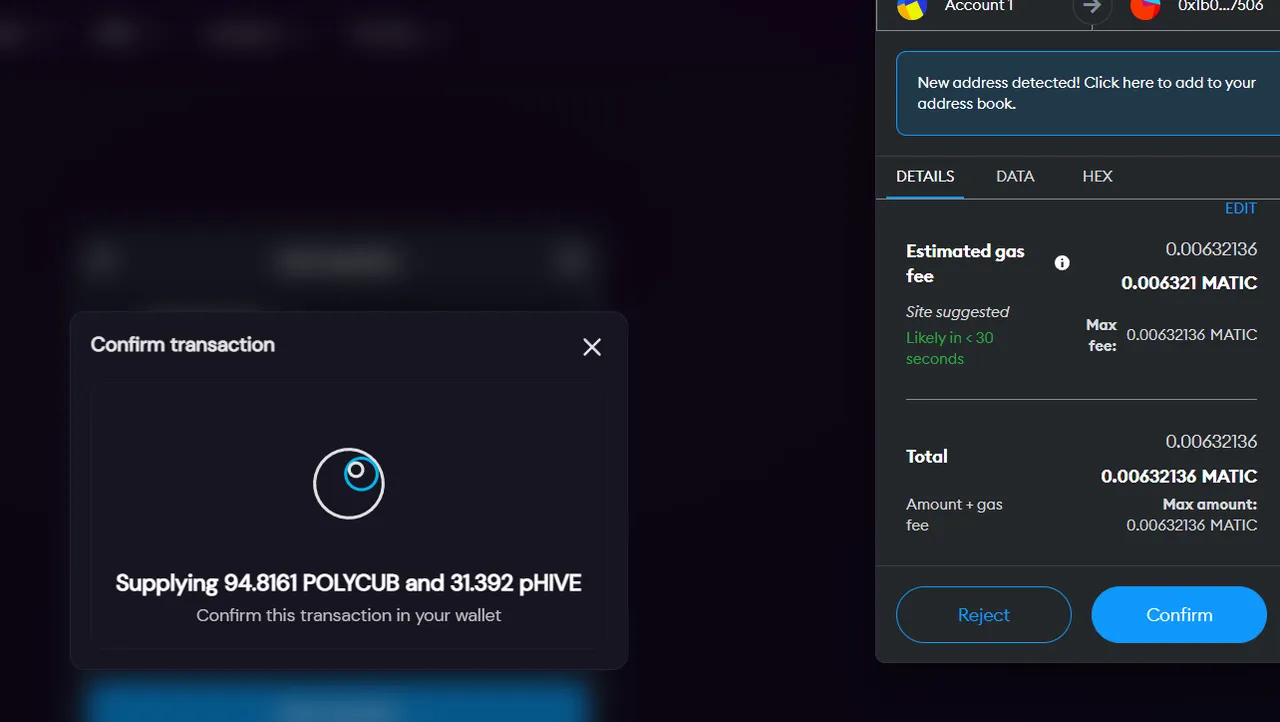

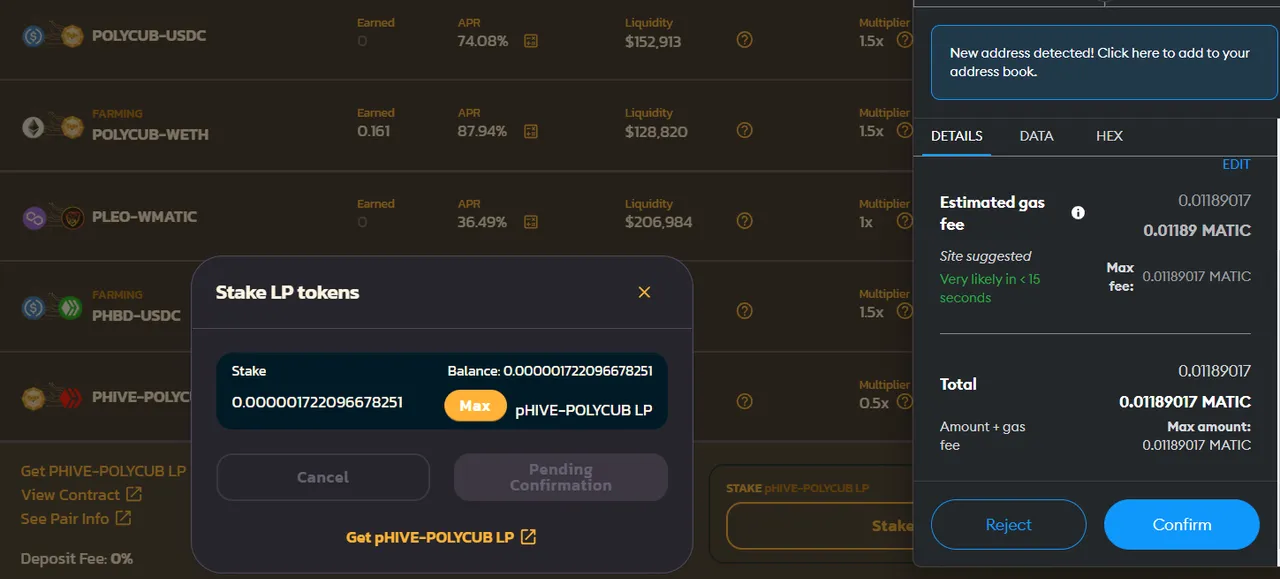

After converting some HBD to MATIC and claiming my first ever Unlocked POLYCUB from Farms... It was time to provide some liquidity. I chose to dive into the pHIVE-POLYCUB pool because I have yet to dip my toes into it. I've been in other farms since day 1 so finding some assets to move is a little difficult.

If you don't know how to provide liquidity, you can check out the guide here. This is a raffle-style contest so you will earn 1 ticket per $25 worth of liquidity added to any of those pairs above. These tickets will get you an entry to win one of 5 $100 prizes!

Don't worry - if you're like me and already have positions in these pools you'll earn one ticket per $50 already in the pool. Remember - this is about bringing in new liquidity so you will earn more tickets for newly added liquidity. It's easier than ever now with the pHBD, pSPS, and pHIVE bridges especially if you already have tokens to send over to Polygon.

Are you ready to participate in Provide Liquidity Week and get a taste of those juicy yields? They won't last forever and you have 1 week to enter the pools.

Don't worry - we're not using Ethereum here. It's not going to cost you $100 in gas fees to do the whole process. It's going to cost you probably less than 5 cents worth of MATIC since it runs on Polygon. Got paper hands and don't wanna hold your position after the contest? Wait til June 7th and remove your liquidity.

Which pool(s) will you pick?