One of the first things I have done since taking over the admin of LBI is to take a big position in the relatively new token on Hive Engine - RUG.

A brand new wallet - @lbi-dab was funded with 10,000 HIVE. The vast majority was used then to buy 4800 RUG tokens at 2.07 HIVE each. The remaining HIVE was put into a little market order to buy some DBOND - which has recently been filled and we now have 63.9 DBOND staked.

So, for those that are unaware, what is RUG?

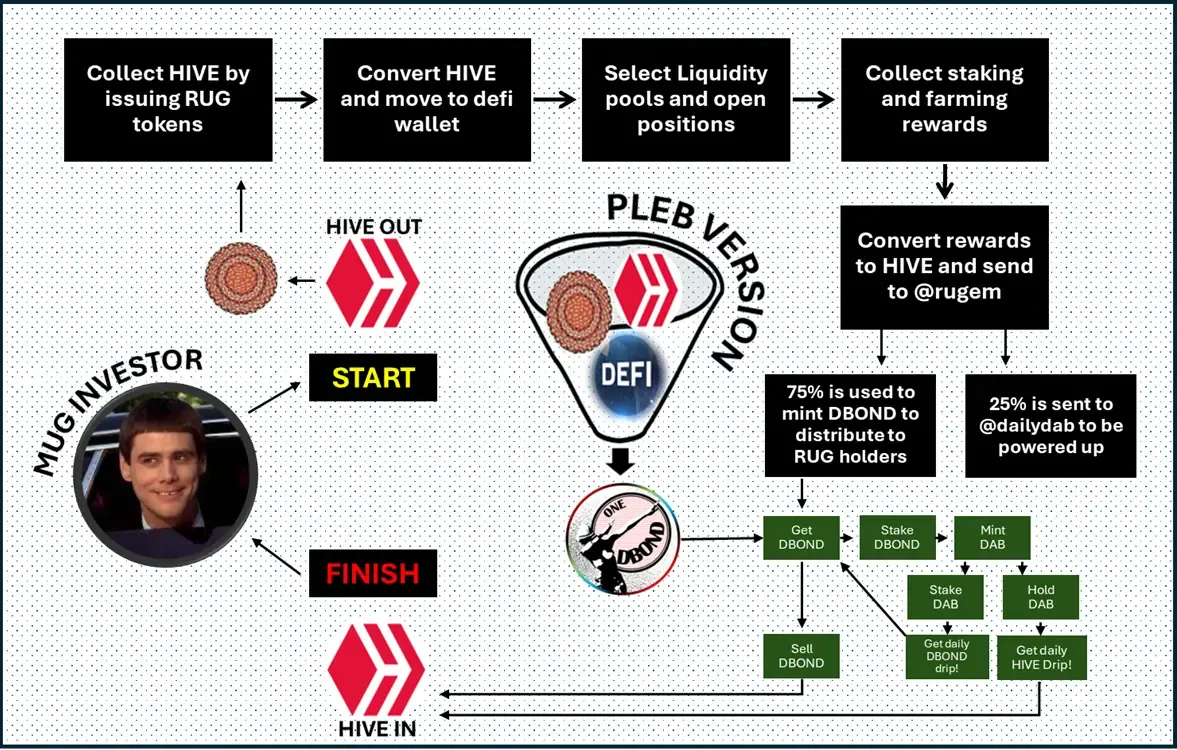

Our approach for RUG is clear: maximize returns from DeFi farming and staking, then bring those rewards back to HIVE to distribute DBOND tokens to our users. We've all experienced setbacks with unreliable DeFi projects, but now it's time for a strategic response. We engage with the DeFi space like its a war without commitment to any specific chain, platform, or cryptocurrency. We target the highest APYs, convert the harvested tokens into HIVE, and ensure consistent returns paid out as sweet DBOND tokens.

We transform low-value shitty farm tokens into DBOND, which are pegged with HIVE. You have the option to stake DBOND to mint DAB for a daily HIVE return or sell DBOND in the market for HIVE.

You can see the RUG launch post to get all the details, (that's where the above quotes came from)

Basically, the project raises money from the sale of RUG tokens. It invests those funds off chain, in liquidity pools offering high yield. The yield generated is then traded back to HIVE. The hive is used to mint and back DBOND tokens which are then sent out to RUG holders as their yield.

@silverstackeruk runs this project, and has a number of years experience managing many of the most successful pooled investment projects on HIVE. SPI, EDS, (up until recently) LBI and is the operational brains behind the DAB project (along with @raymondspeaks from BRO).

What's the plan for LBI?

Basically, we bought a big chunk of RUG, and are currently the number 1 holder with over 11% of the supply.

The plan now is to sit back, and let SSUK do all the work for us. Owning RUG gives us back an "off-chain" exposure to the wider crypto market via the pools SSUK invests into. Each week, the value of the rug tokens will be updated to whatever the value is that week. The income generated will be received as DBOND - a token that is backed and pegged to 1 HIVE. As our DBOND stash grows, we will start to mint DAB tokens. These are the tokens that generate a daily HIVE drip. The HIVE generated at the end of this process will then go to the distribution wallet to go out as part of LBI's weekly dividend when they resume.

The beauty for us is that RUG bakes in layers of passive asset growth for us, and will result in an income flow that will start small, but grow over time. This investment is trully in the tradition of SPI's "get rich slowly" model.

What are the risks?

RUG could get rugged. Rather ironic to name an investment token RUG, but SSUK has gone for a cheeky them and marketing gimmick for the token. However, in all seriousness, it is important to note that RUG does require trusting SSUK not to steal funds. He has operated similar projects for many years, and has built a reputation as an honest operator, but it is a (in my opinion tiny) risk that must be acknowledged.

The crypto market could tank. The main risk for the RUG token is that the market crashes, black swan events or changes to regulation disrupt things. This would obviously hurt more than just our RUG investment.

More important than the small risk of SSUK rugging RUG - there is the key man risk of what happens if something happens to SSUK. If he gets hit by a bus tomorrow (let's hope not) what happens. I presume that there is a plan in place for the horrible possibility, but it would be good to get clarity on that.

So what is LBI's plan?

Simple:

- Hold RUG long term.

- Stack DBOND long term (weekly asset growth)

- Build a DAB position (will start to mint from DBOND, which is a miner token) (more asset growth)

- The drips from DAB go to the weekly distribution amount (growing dividends for LBI holders over time).

Currently, the @lbi-dab wallet makes up 8.8% of the total LBI fund assets. It will be interesting to watch this change over time, to see if this has been a good move for us or not. I'm personally tipping that this will grow to be a very significant position for the fund.

And best of all, it is all now very passive. @silverstackeruk may not be running LBI anymore, but he is still working to pump our bags.

Hope you found benefit from this post, let me know in the comments what you think of this move for LBI.

Cheers,

JK.