Here's something to remember: whenever anybody is trying to make a point by using this or that billionaire investor's quote as further evidence and proof what they're saying is true, that's basically what communication experts call an 'appeal to authority', also called 'argument from authority'. And that, as far as argument-winning techniques go, is a losing strategy.

With the 'argument from authority' strategy you're esentially using the influential power of a public figure as self-evident proof to back up your argument, but the opinion of an authority is only relevant if everyone in the conversation believes in the authority. That's like saying it's true because "it says so in the Bible", that's all you need to know if you're Christian but it's obviously irrelevant if you're agnostic or follow a different religion.

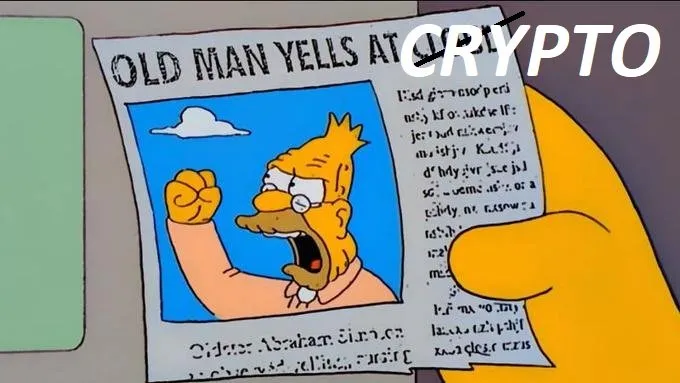

In the crypto space - and this happens every day - influential CEOs and billionaire investors share their opinions. And these opinions are used as facts by both crypto evangelists and crypto non-believers to make their point, but they're both wrong.

First of all, we should bear in mind that most billionaires became successful for one of two reasons: they were either right more times than they were wrong, or they were right once but that one time was enough to make them billionaires. Warren Buffet, for example, most likely falls under the first category. Jeff Bezos probably falls in the second category. But that doesn't mean that either of them is 100% right, 100% of the time.

There's an old saying in football (soccer, if you're reading in the U.S.), "you should count goals but you should also 'weigh' them". And it applies to opinions as well. The value and weight of people's opinion depends on what they do, and who they are. When it comes to crypto, if Vitalik Buterin is talking, everyone else listens, including Warren Buffet. When it comes to stocks, it's the other way around. When it comes to, say, smartphone technology, both should probably take a seat and listen to Tim Cook. See where I'm getting at?

And their opinions are often generic and fail to provide any actual value. A famous hedge manager, for example, recently said that the "crypto craze is overblown". What does that even mean? That's like somebody in the mid 1990s saying the "internet is overblown".

Lastly, and this is also important, I don't care what they say because they change their mind all the time. Institutional investors have a vested interest in preserving the status quo, and crypto destroys the status quo. Sooner or later they're all going to join the bandwagon, because they will have to, because crypto can't be killed. And it can't be killed because it isn't a financial instrument or an asset, it's a new type of technology.

In the meantime, I honestly couldn't care less what billionaire investors say. In the short term, I'm happy when they praise it, frustrated when they slam it, but in the long run, it doesn't make a difference, and that's why I don't care.

I've crossposted this article on my blog bitcoinea and Publish0x