Introduction

I will talk about what the endgame of Bitcoin will be. It is obvious that the price of Bitcoin cannot go up limitlessly. It will hit a ceiling. The question is what will happen then.

The appreciation of Bitcoin is closely tied to the growth of the total hashing power of the network

The higher the price of Bitcoin is, the higher the cost of mining one BTC will be. This is rather elementary because Bitcoin mining is a competitive endeavor. When the network detects an significant rise in the total hashing power of all miners, it adjusts the difficulty of mining upwards. The more buyers are willing to pay for one bitcoin, the more computing power miners will have to dedicate to mining one bitcoin.

Simultaneously, the rise of the total hashing power will make Bitcoin artificially scarce - taking care of the supply side of its value - and also safeguard the network from attacks.

The problem is PoW is energy intensive

Proof-of-Work, which is Bitcoin's consensus algorithm, is basically proof of useful energy spent. Suppose Bitcoin's appreciation continued on an exponential trajectory (it will most likely asymptotically approach a ceiling in real life). The energy consumption of BTC could begin to crowd out other, much more useful purposes, that energy could be used for to a degree that would eventually prove intolerable.

The University of Cambridge has created a tool that shows the power consumption of the Bitcoin network live: https://www.cbeci.org/

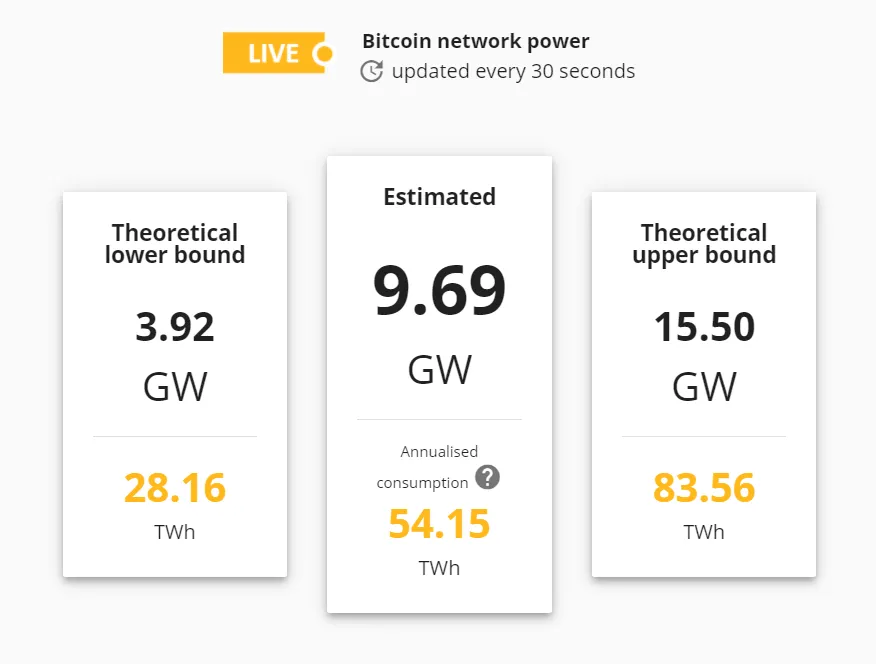

Here's the current power and annualized total energy consumed:

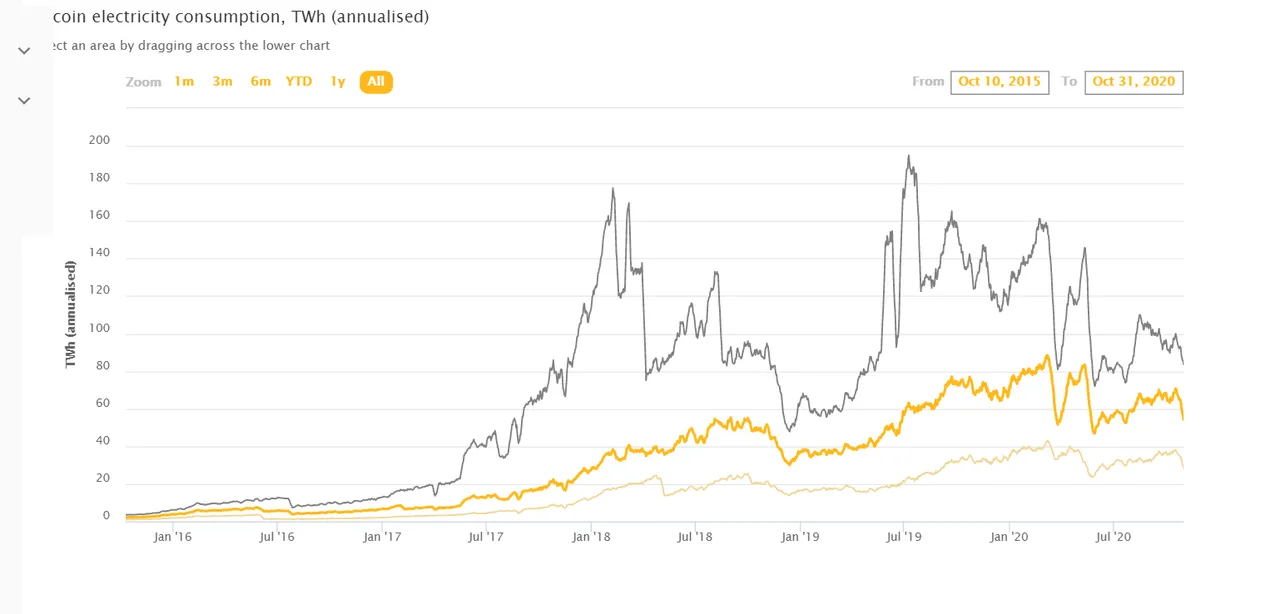

Here's the annualized energy consumption from the beginning 2016 to 31 Oct 2020:

At present, Bitcoin mining accounts for 0.21% of the world's energy supply.

Suppose the price of 1 BTC goes from $13,000 to $1.3 million, that is, grows a hundred-fold. For simplicity, let's assume that the world's energy supply remains constant. At $1.3 million per coin, Bitcoin mining would account for a whopping 20% of the world's energy supply.

Conclusion

Bitcoin's energy consumption is on a completely unsustainable trajectory. After all, Bitcoin is just money. It's a savings technology. I don't think the world needs or ultimately even tolerates a savings technology that uses up a fifth of its energy supply.

That observation is the fundamental reason why much more efficient consensus algorithms than PoW have a place in the world. Proof-of-Stake and its variants such as Delegated-Proof-of-Stake do not overpay for security but are sufficient for most purposes where decentralization and trustlessness are needed. The devil is in the details, however. Hive has a long way to go to decentralize both its infrastructure and stake distribution. I believe Ethereum could take the #1 spot in market cap at a future time after it has transitioned into PoS.