Money Floods into Terra (Luna) Network as Sector Regains Confidence in UST

There were many issues that raised uncertainty and doubt over Terra (Luna) Networks stable coin UST and it's native token Luna and with many recently launched Terra (Luna) Protocols losing ground after launch people were beginning to think twice about Terra (Luna) Network.

Scrolling back through the official Anchor discord server you can see the community reception of the thought that Anchor's reserve was drying up fast leaving the high yields at risk of not being able to be honoured.

However, since then Do Kwon announced the purchasing of a $US1 Billion dollar Bitcoin fund to secure UST's price which I covered in my previous article [https://leofinance.io/@melbourneswest/terra-luna-network-backs-its-reserve-with-usdus1-billion-in-bitcoin-and-how-you-could-make-usdus10-million](Terra (Luna) Network backs its reserve with $US1 Billion in Bitcoin and how you could make $US10 Million) along with restocking the $UST reserves.

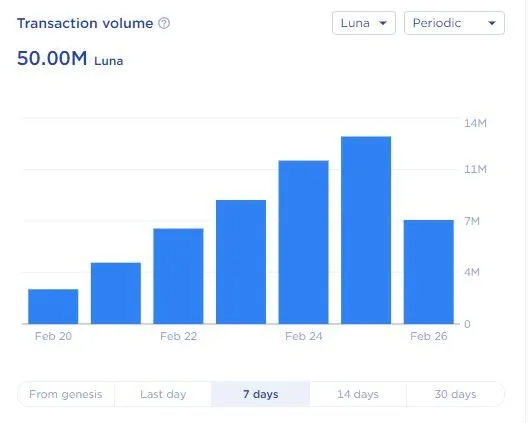

Image Sourced from Terra Station

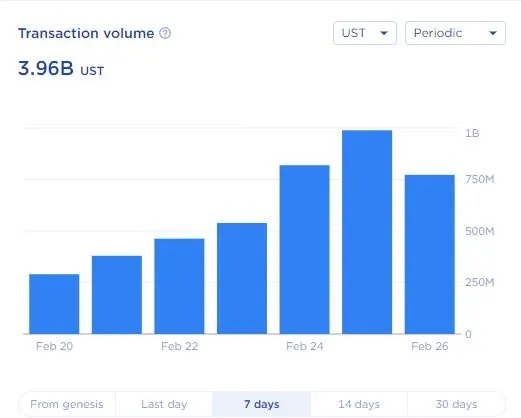

Since the announcement of the Bitcoin security fund and the topping up of Anchor's yield reserve there has been almost 4 Billion UST trading volume over the past 7 days and a significant surge in Luna the native token of Terra Network's price.

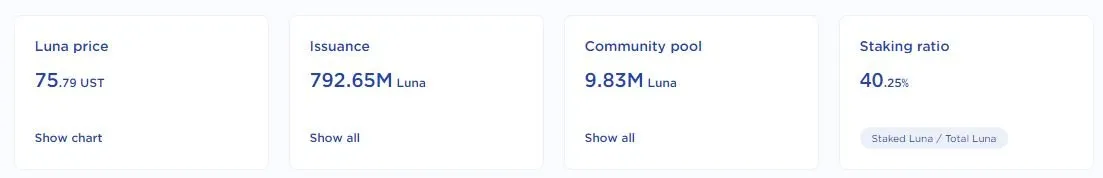

Image Source Terra Station

Over the past 7 days alone there has been continued growth of Luna trading which has seen 50 Million Luna transacted with at it's current price of $US 75.79 per Luna that equates to almost $US3.8 Billion dollars. Not a bad run for a 7 day window.

Image Sourced Terra Station

Issuance of Luna has also spiked with now 792 Million Luna being issues seeing the community pool now growing to 9.8 million and a welcoming sight of the amount of Luna now staked growing to 40%. As this number grows we will see Luna's value also continue to rise. With the current APY for stakers sitting at 8.2% it provides a decent return on investment which is paid in Luna and a number of other stable coins.

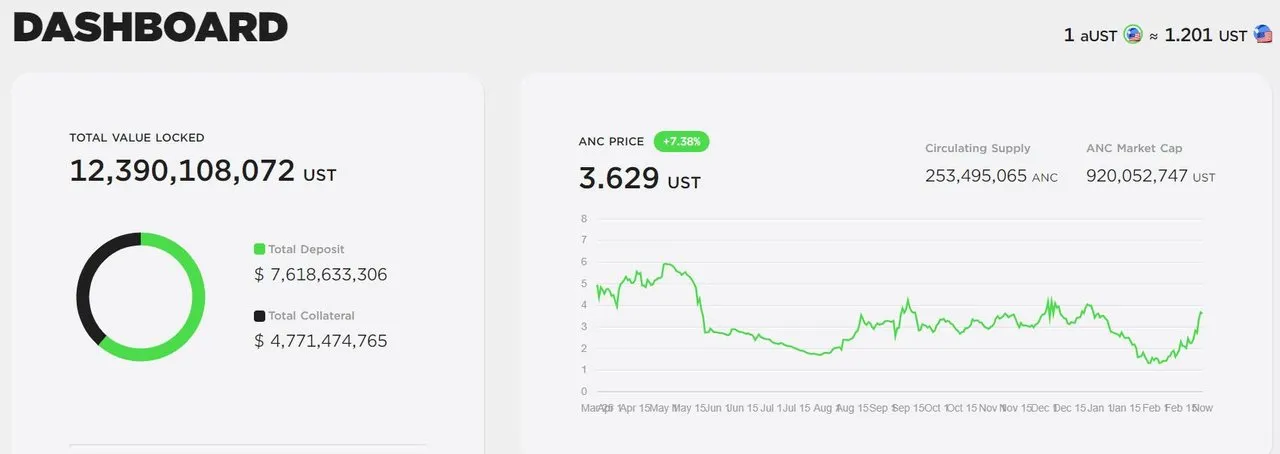

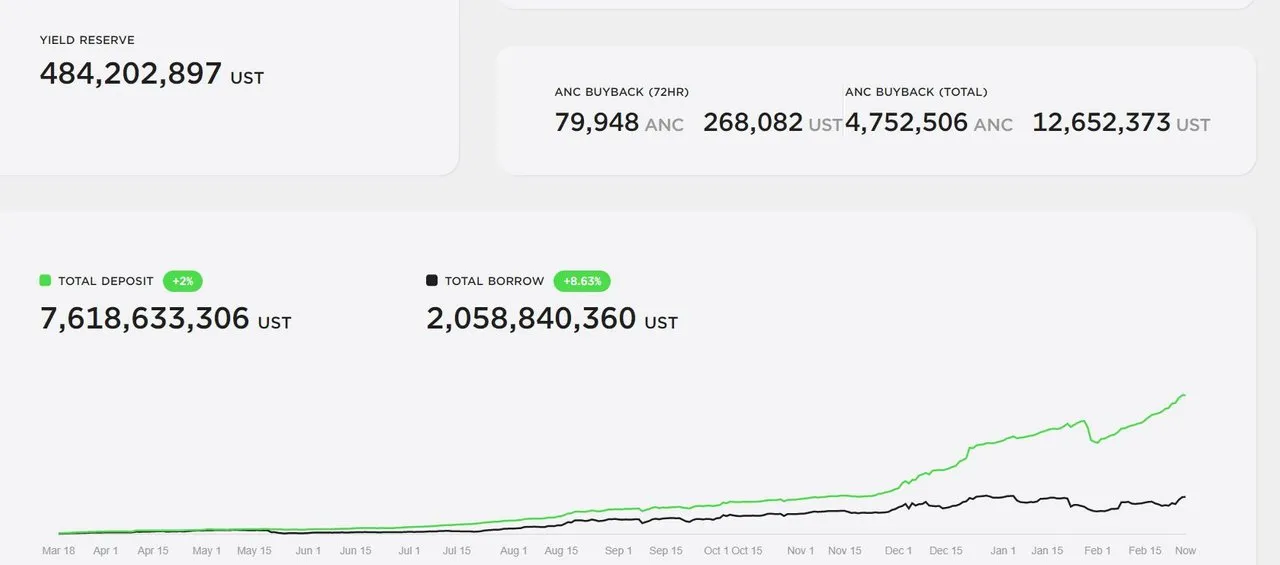

After experiencing a slight loss of TVL due to concerns over the yield reserve Anchor protocol has seen a rapid increase to over $12 Billion total value locked also driving Anchors price back up to $US3.62 and regaining market confidence with its succession amongst a current dip being quite impressive.

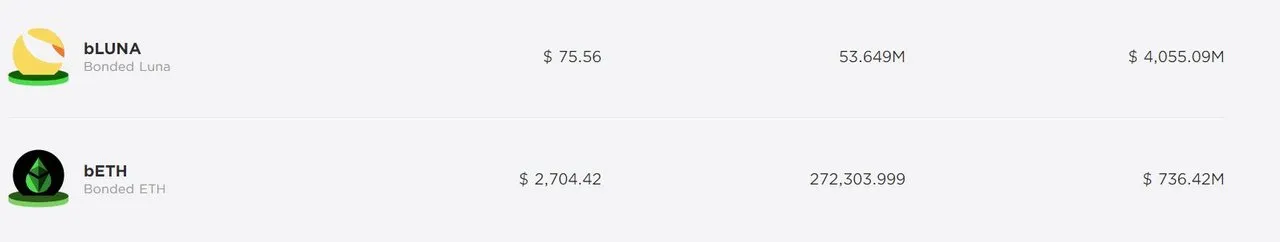

The yield reserve has been topped up with 500 million UST and Anchor is also buying back it's native token ANC with a total buy back valued at over $US12 Million. There is currently a disparity between funds deposited and funds borrowed which could be a sign of the market being cautious at the current economic instability of a potential all out war with Russia and at the prospects of going through another dip as a number of users had lost collateral through the previous dip.

Given that the majority of assets deposited is bLUNA the disparity could also be currently caused by the price fluctuation seeing the amount of Luna staked in Anchor seeing its value surge. Investors maybe waiting for a more stable period to borrow more from their deposited asset.

Boost in Market Confidence

The boost in market confidence is a direct link to the added security of having $UST backed by Bitcoin with announcements that Do Kwon will be continuing to build a range of assets to safe guard UST price which in turn ensures Luna's price is also secured.

An investment in Luna or UST is effectively an investment into all Blockchain tokens if the reserve continues to grow. This is the first native token backed by a reserve of this kind. Typically reserves are used to maintain the price of stable coins but in Terra (Luna) Networks case their stable coin being algorithmic securing it against multiple assets also means securing their native token.

If successful, in my opinion. There will be no other better investment currently in the market than Luna.

Well played Mr Kwon, well played

Image sources provided supplemented by Canva pro. This is not financial advice and readers are advised to undertake their own research or seek professional financial services