People need to stop freaking out about Anchor yield reserves

It's unsustainable! that is the cry of people who are not familiar with Anchor protocol and how it actually works and how Luna, UST and aUST are all tied in together. In short - it is sustainable and the work in the background to build bitcoin and many other token reserves is proof.

I wrote a post yesterday Down the Terra Rabbit Hole but I am not sure if everyone read it. In it I gave a really great breakdown of what is actually occurring with Anchor and informed people that Anchor isn't actually paying anyone UST. Instead the protocol has a confirmed growth rate of close to 20% APY. IT does this by increasing that value of aUST so when you sell it you get more UST.

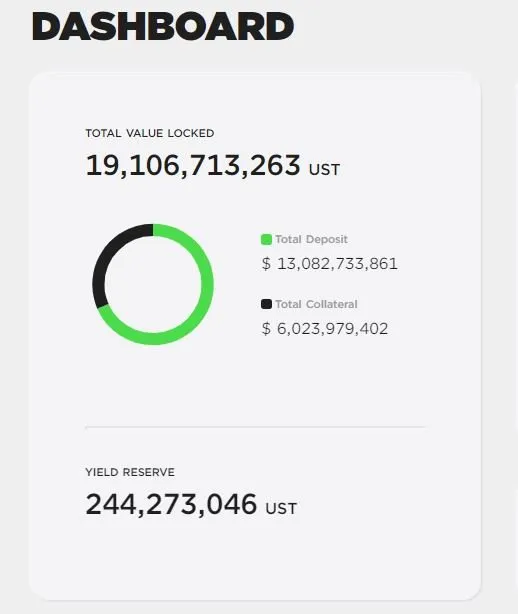

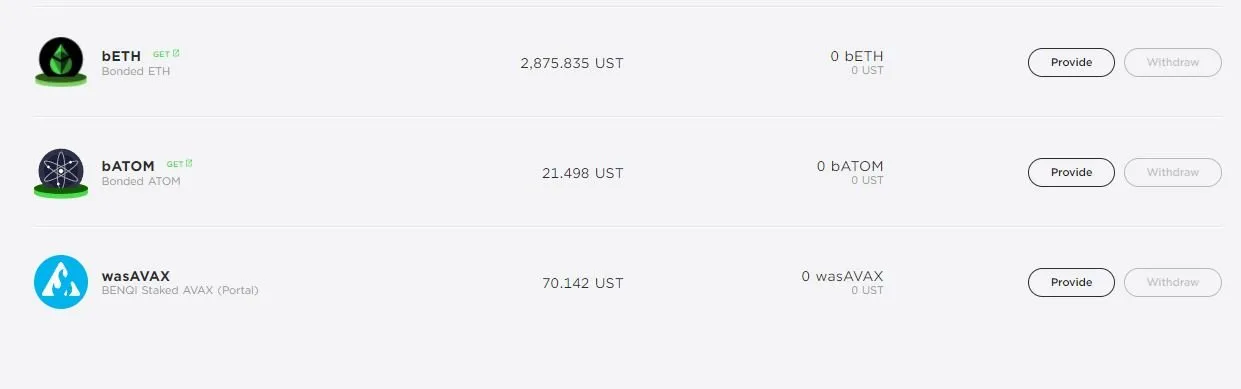

This can be evidenced not only in the Anchor Protocol Documents but also in the top right hand corner of the actual protocol itself where it currently sits at 1.239 UST per 1 aUST

In the beginning

aUST is a completely separate token to UST and when it first launched on day 1 you could purchase one aUST for 1 UST but as the token value increased every 6.4s it appreciates in value. It is also beneficial for TerraFormLabs to continuously refill the pool and we don't want them to stop and we will get to it in a moment.

But first I want to try and explain this a little better in the hopes to dismiss some FUD that is being spread.

Anchor token - aUST

I want you to think of Anchor as having two tokens aUST which is it's yield token and Anc which is it's governance token. At current there is 19 Billion total value locked in Anchor 13 Billion has been purchased and deposited with a further 6 Billion as collateral with the protocol reporting only 3 billion is loaned out as aUST.

So that effectively means that aUST circulating supply is roughly 12,913,640,032 Billion tokens and it has a market cap of 19 billion dollars. (rough maths as some of this hasn't worked out so I am thinking there is some unaccounted for).

Numbers are irrelevant to a few things and are only given as a guide because what we recently saw occur with aUST is it jumped BILLIONS in a matter of hours. Now if this was any other run of the mill token it would have ballooned to all time highs etc. But Anchor isn't designed to do that. It is centralised and locked.

But all that value does go somewhere and are you ready for this part?

UST is tethered tooooooo yup, LUNA.

Luna's price alone has continued to increase and its own trading has broken away from Bitcoin which controls the market. Luna has now parachuted to 8th position with a market value of $US31.8 Billion dollars.

Want to hear a kicker? it ain't getting there through people buying it in fact Luna Volume hasn't even been the biggest out of the top 10 but because it is tethered to UST through algorithmic stability it is constantly being burned to mint more..... UST. Anchor never gives you UST you only get UST when you sell aUST for it. But you can also sell aUST for a number of other tokens.

Not that many people actually hold Luna which in my Luna Pulse Check I identified that 96% of the network holds less than 100 Luna. Sounds worrying right? I was a little concerned too which is why my last few blogs have been taking deep dives into Anchor and Luna.

As it turns out the largest wallet holders are TerraFormLabs and TFL.

Should you be worried? not yet and here's why.

Yield Reserve or Luna Air drops?

The Yield reserve is currently topped up by TerraForm Labs with their own money but it isn't really their own money. They are slowly distributing Luna to everyone who stakes Anchors native token at a sustainable level.

Osmosis, Cosmos and many other chains even secret provide staking rewards far greater than 20%. And the kicker is to help the sustainability of the project punters get to stake their own tokens as collateral which, has on a number of occasion liquidated those assets due to market volatility soaking up that "unsustainability fud".

How to make Anchor more sustainable

Now be careful with this because the more you move away from the current model the more likely it becomes unsustainable because remember UST and Luna is the same token so the more TFL supplements the yield reserve the higher the price of Luna.

But if people want more sustainability or more so more value I would start looking at adding more accepted tokens. I am half wondering why a wrapped version of Bitcoin isn't get here because if it was it would be one of the largest pools with the highest return on Bitcoin and would see UST dramatically drive up a few more billion. This would also create Luna's value to go into overdrive as it continuously burns more to mint more UST.

But what about a death spiral?

Well see now this is something that could potentially occur but TerraForm Labs have been ingenious in how they are approaching this and the fix they have come up.

Most blockchains attempt a buy back and burn mechanism and some further confusion that was created was when TFG announced it's Bitcoin purchase to back up the price of UST.

Most people anticipated it as the protocol would buy back UST to retain it's price but that would mean a lot of money is spent and a lot of fees. It also would mean a lot more other people would be making money and opens the project up for being shorted.

So instead the team is creating a number of pools that if and when a mass sell off commences and a death spiral does form then the reserves become activated and people can swap their UST to their preferred token internally.

From there they could sell or trade their preferred token for something else and this process would be supported with a premium discount to ensure people traded on the network and not on an exchange.

This means that liquidity pools on exchanges and other networks would not be drained and the overall crypto market would not pick up a UST dump instead if people swapped their preferred token for fiat this would actually impact everyone else a lot more. Because other networks would be taking a direct hit and wearing that death spiral instead of Luna and UST.

That in itself is next level De-Fi planning and pretty much once rolled out will make Terra (Luna) Network the safest blockchain on the market. Imagine only ever increasing in value and never again being wiped out in a market crash. Obviously within reason but it is also why the TFL is making multiple reserves.

Also, if everything is going red and Luna is going Green in a crash, guess where everyone is going? The reserves wouldn't need to be open for long before it stabilised. It is impressive.

I hope that you found this article useful and it provided a larger insight into the tokenomics of Anchor and as always this is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Images sources provided supplemented by Canva Pro Subscription.