Top ways to invest in Terra (Luna) Network

Terra (Luna) Network has been hitting some serious milestones lately and has the crypto world in a buzz. It is fast becoming one of the most talked about protocols and it's development and strategy is currently unrivalled but it is leaving a lot of unanswered questions. Like what is currently on offer over at Terra (Luna) Network.

I want to be clear that this post is not financial advice and readers should undertake their own research or seek professional financial services. This article will point out a few of the current options available on Terra (Luna) Network. What you choose to do is totally up to you and you should ensure you are well informed prior to making any financial decisions.

Terra Station Wallet

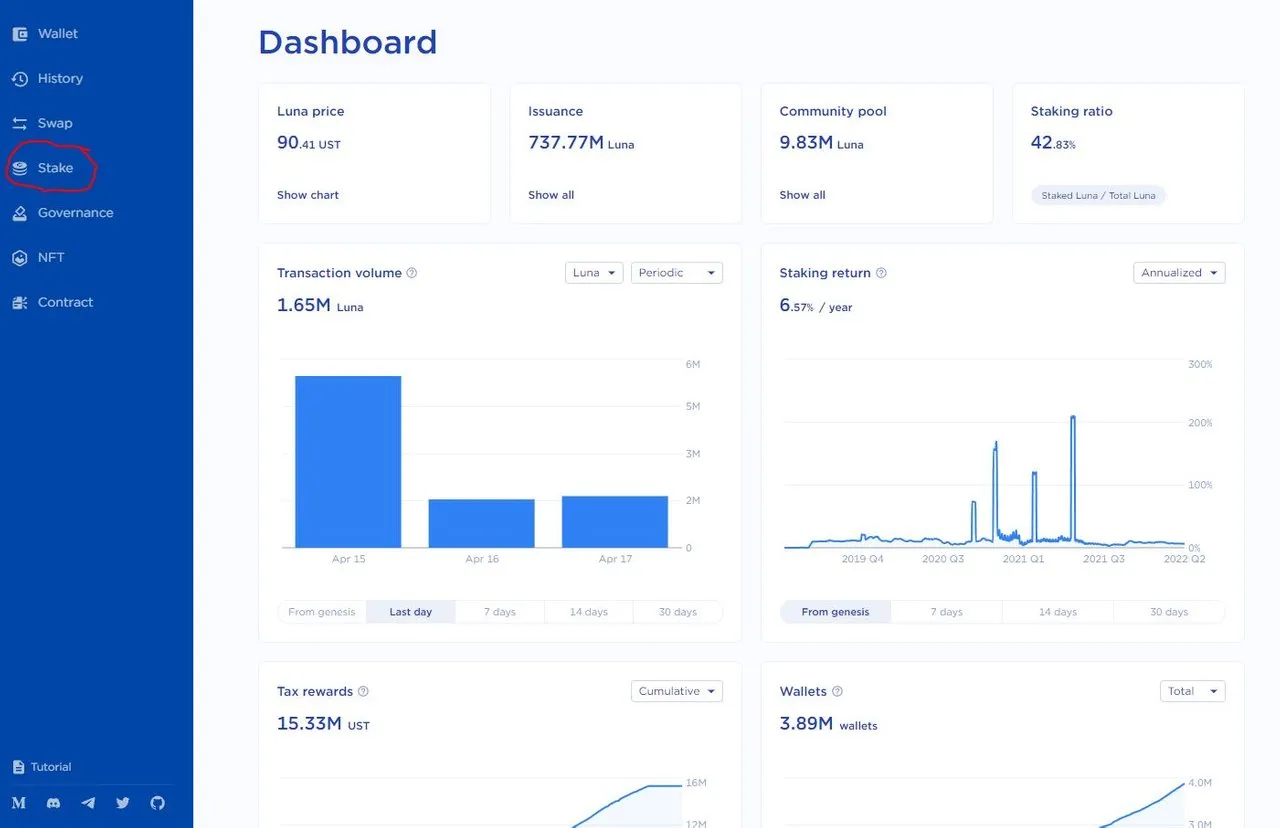

The easiest way is to head over to Terra Money and download the Terra Station dApp which can be saved as a desktop short cut. This will first of all give you access to the Terra (Luna) Network and all the crypto currencies on their ecosystem.

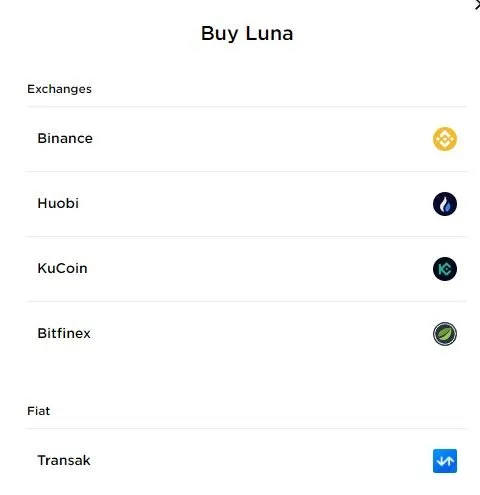

It is the bear basic you will need to delve into the world of Terra. It also enables you to buy Luna and UST directly with Fiat currency or direct you to current exchange listings which is a wonderful addition if you don't want to have to transfer tokens around all over the place getting charged fees.

From here you can stake your tokens by delegating them to a validator and earn interest by helping to secure the network. You have a large selection of validators to choose from all with their own fees and charges for delegating.

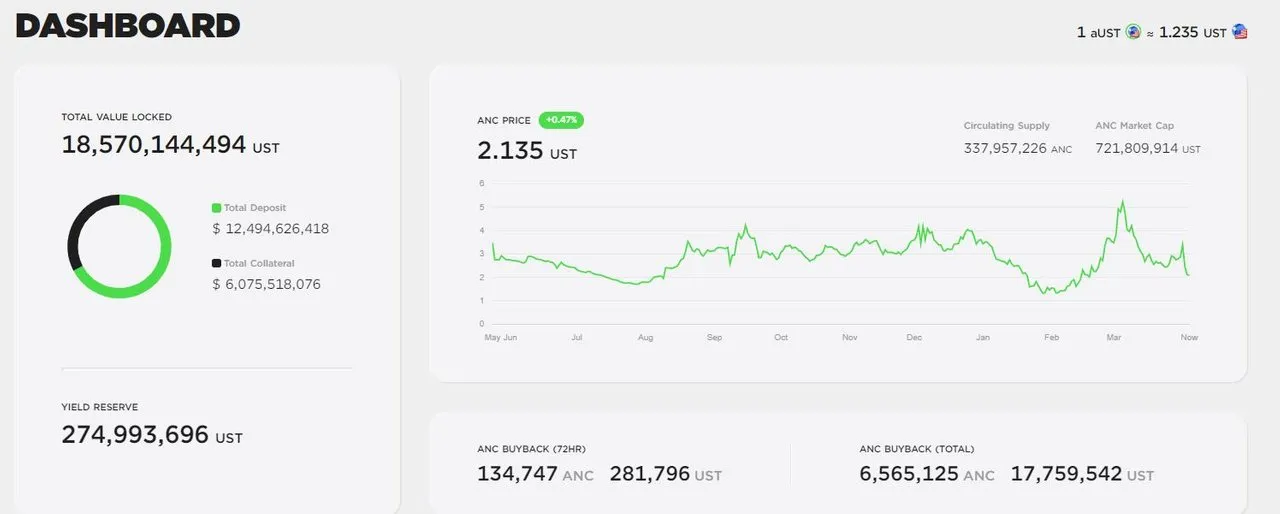

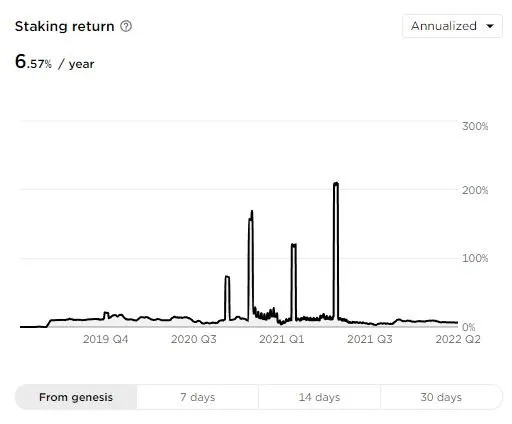

The current staking return for delegating your Luna tokens is 6.57% but this figure also often increases and decreases depending on how many people are participating in the validation of the network.

It is important to note that when you delegate your tokens you do not have them in your possession and if you want them back it will take 21 days for the protocol to provide your tokens back to you. In return you are receiving the allocated interest rate.

If you choose to stake on the network which is the easiest form of earning on Terra (Luna) Network then you need to be aware that if a validator participates in bad behaviour on the network with your tokens they maybe slashed.

Slashed or Slashing is when the system takes all or part of the delegated tokens for participating in bad behaviour as disciplinary action so make sure you choose a good and trust validator.

Staking on the Terra Station dApp will also mean you're eligible for token air drops of emerging protocols as a provided benefit of staking your Luna. The APY earned through staking also consists of Luna, UST and a number of other international stable coins so it is broken up quite a bit.

Anchor Protocol

If you haven't heard about Anchor protocol as yet... why? It is the main draw card for Terra (Luna) Network and its what really put the network on the map.

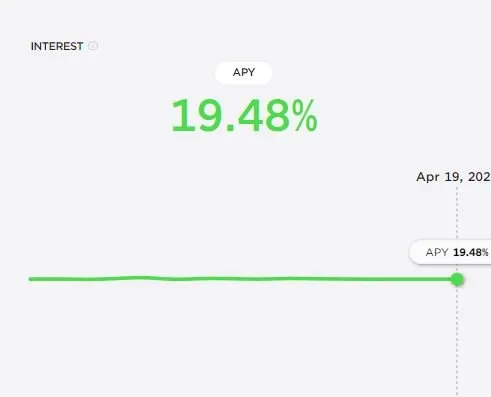

Anchor Protocol currently offers between 19.40% to 19.50% APY for staking UST the native stable coin of the Terra (Luna) Network. The protocol first offered 20% APY but as it has grown in popularity the figure continues to lower.

Exciting news for Anchor is that it is expanding to Avalanche to also provide the APY on stable coins and we can undoubtedly continue to see the protocol grow on other Cosmo ecosystems over the next few years.

Anchor doesn't just offer APY on stable coins it also has a few other cool features.

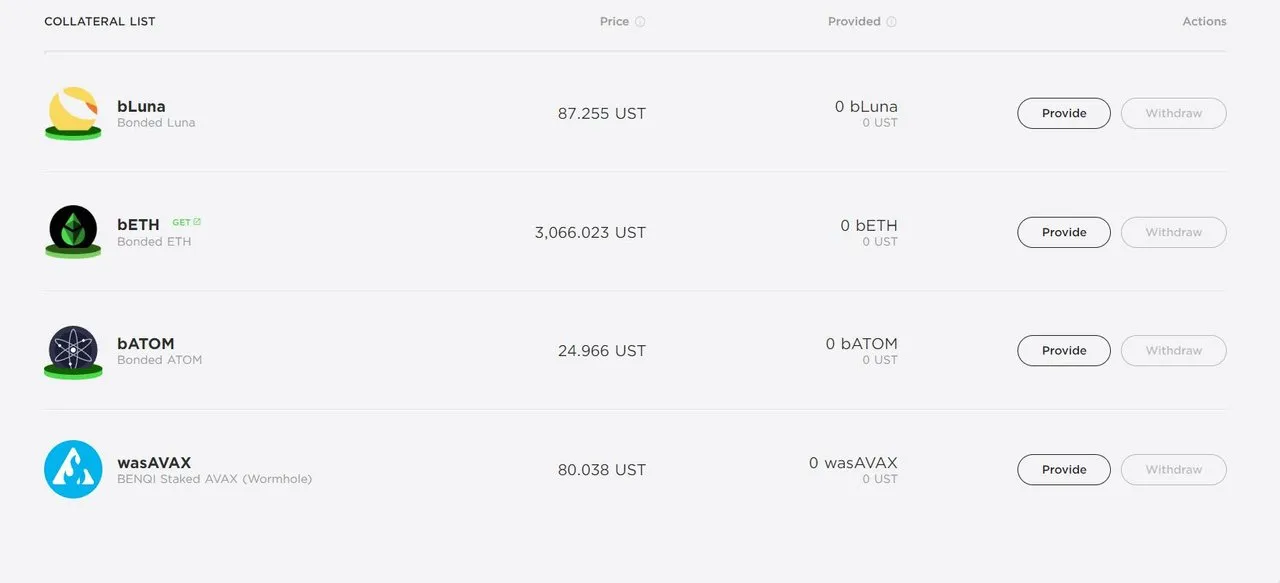

bAssets

bAssets as minted when you deposit the native token into Anchor protocol or more readily available swapping Luna or other tokens for the bAsset which can than be used as collateral. But before we move onto the collateral and loans I wanted to make people aware that minting bLuna and simply holding it in your wallet will still generate the same amount of rewards as staking it in your Terra Station Wallet.

The difference is you won't get other tokens for doing so, all you will receive is the entirety of the APY paid out in UST. bLuna is effectively staked Luna anyway so if you're looking for a way to not have to wait 21 days to unstake than this option maybe for you.

High Risk Borrowing

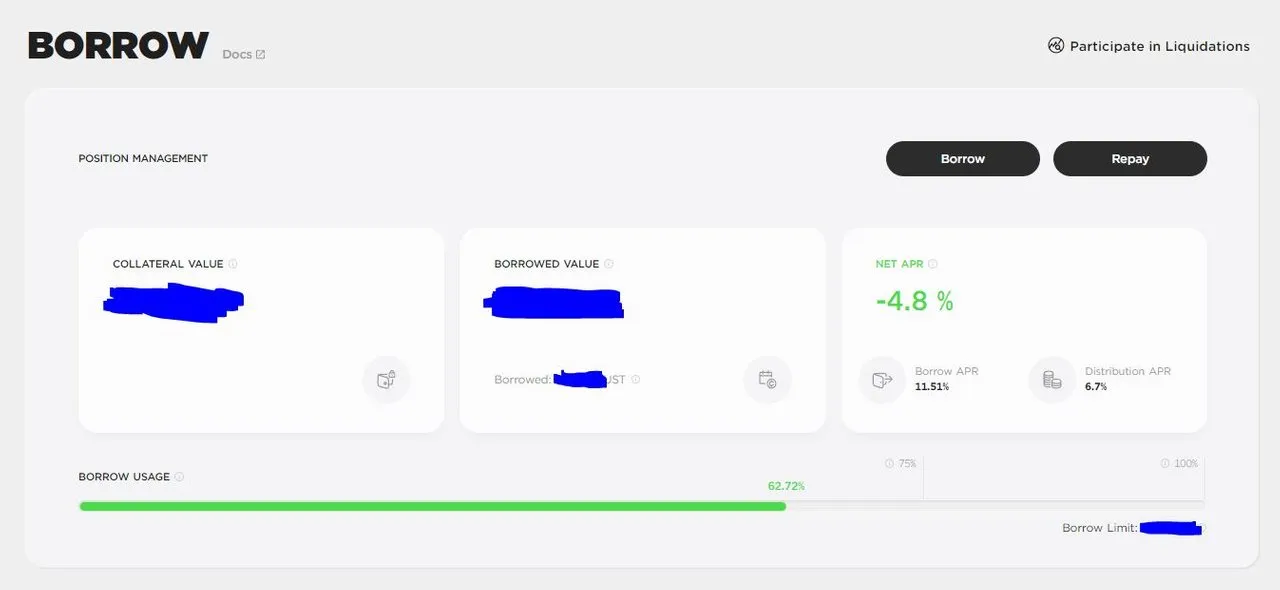

Now that you are familiar with some of the basic forms of staking and earning rewards there is another option available to people on Anchor protocol which is a great way for those wanting to stake UST for the high APY but not wanting to miss out on the Luna price pumps.

once you have minted your bLuna you can provide it as collateral and than borrow against it. Once you have borrow against your bLuna ensuring you do not take too big of a loan out as if the price was to dump you will be Liquidated. Which effectively means the protocol takes your provided asset and pays off your debt in part or in full.

But once deposited as collateral you will be provided with the ability to take out a loan in UST which you can either purchase more bLuna and provide it once again to bring down your debt ratio which is called Borrow usage. Or directly deposit it into Anchor protocol to earn those 20% APY while also HODLing your Luna keeping your investment in tact.

I personally don't have a lot of money in Terra but I do wish I had of bought up when it was 40c! however, I an trying to grow my holdings and utilise a bit of all these strategies and wanted to share them with you so you could have a more clear and informed choice.

Are you on Luna? Do you participate in such a way? let me know in the comments section below.

Image sources provided supplemented by Canva Pro. This is not financial advice and readers are advised to undertake their own research or seek professional financial services