Who do you go to ?

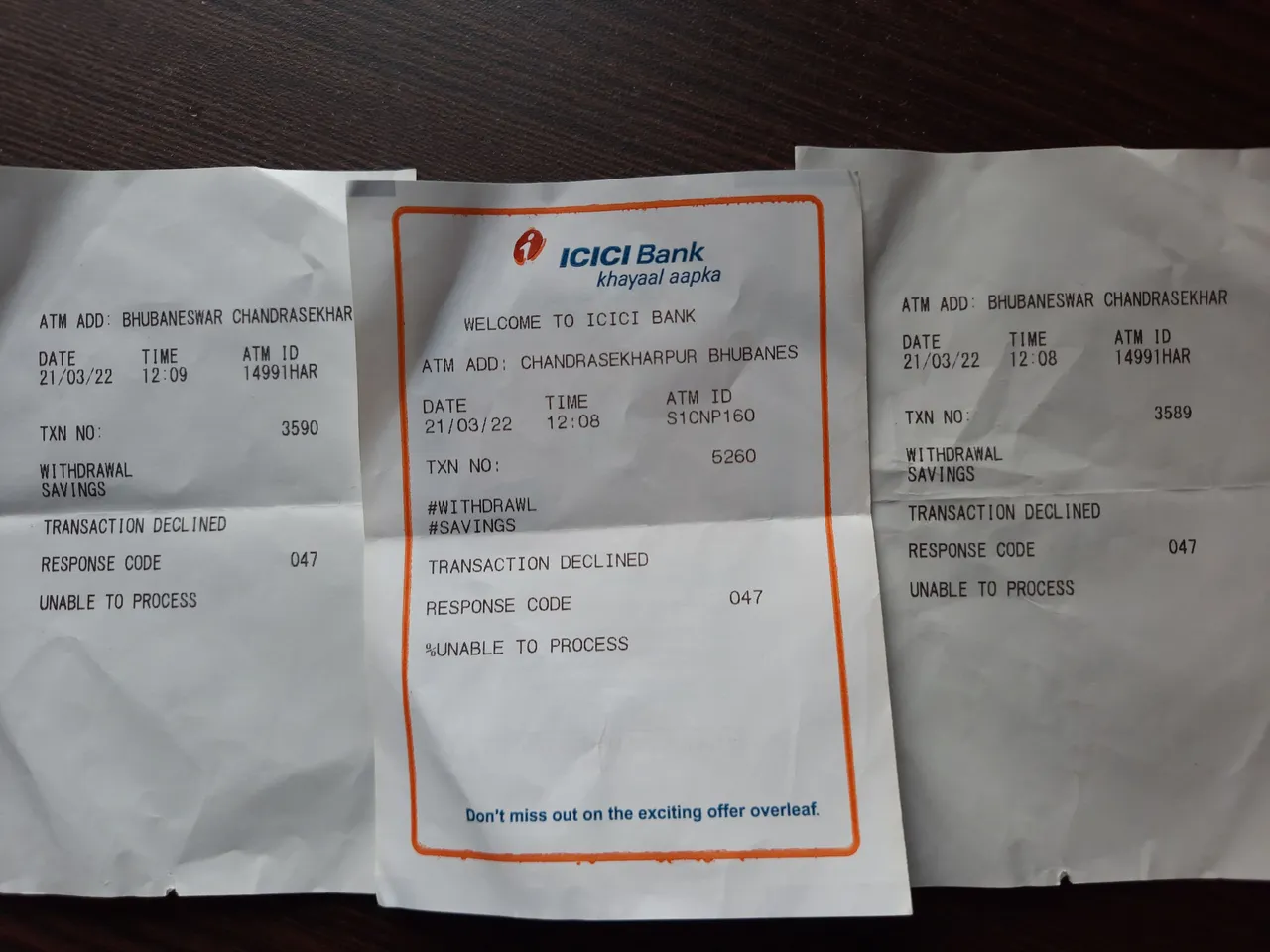

This morning, my own bank declined me to withdraw money from ATM - declining the transaction without any valid reason. It was a long holiday weekend and since we went for the trip, I desperately needed some cash. There were two ATM machines and both declined with same response code. The Security guy who barely understands anything was telling me it could be server issue, try at some other bank ATM :) May be he has heard that and tells the same to everyone who experience this. I did not have any choice, so I thought I would try at some other ATM. While I was driving an unknown call came in which I attended and it was an automated call telling me - "Dear Customer, You are trying to do a transaction of so and so amount from your Debit Card, if it's you then please confirm by pressing 1". I was shocked to stop the vehicle and look at my wallet for the Card - did I leave it at the ATM and somebody is trying to take out money and even knows my password !! To my relief, the card was there in my wallet. I was thinking what to do and then after taking few minutes break, I decided to drive back to the branch and inquire there.

When I asked over the counter the answer was - you will have to call the Customer Care - we don't know why you got a call . So the bank people themselves cannot help you and instead gave a number to dial in. After going through several button press over the call menu, someone joined and after hearing me, she put me on hold for 2 minutes. And then she came back to tell me that, they have activated some fraud modules in my account very recently, so I have to confirm the transaction else the first transaction gets blocked for half an hour. If I do not confirm in the next transaction, then the card gets blocked for the entire day. And is there a way you can disable this ? No Sir, this cannot be disabled. Can you tell me a reason, why you choose my account to activate this so called fraud module ? Because, someone did a fraud in your Credit Card few years back, so we activated it in your Debit Card. Come on - you are forcing me something that I do not want. And that too, you are activating on my Debit Card prohibiting me to take my own money !! That too, you are calling me after I am nowhere near the ATM and the transaction already completed at the physical machine (ATM). If you really want to provide more safety to me, then you should hold that transaction at ATM and call me there and give me my money after I confirm.

Such a poor design of software, being in the same industry, I know how a fraud module should work. Why are you relying on old historical data, that is not relevant at all ? Little did she hear - is there anything else that I can assist ? Yes, please tell me when can I withdraw my money ? Please try after half an hour and please confirm after the withdrawal. It was already more than 15 minutes, so I roamed around and went back after 15 minutes, the ATM did gave the money but then the call came after 2 minutes. And I confirmed, because I wanted to withdraw one more time. And it called again after the second withdrawal - stupid, don't you recognize me now !! I am the same person at the same ATM using the same card withdrawing the same amount (because you can give only 40 notes of 500 denomination) !!

This is where the quality matters. Fraud is a big concern in the financial industry and its very challenging to come up with a fraud prevention mechanism that adheres to evolving patterns of fraud without relying much on historical data, as historical data becomes less relevant. Recently our Data Science team built our patented new solution for fraud prevention that got us the Best Application of AI in a Large Enterprise at the Irish AI Awards. It was featured in the Microsoft pulse blog, you can see it here :

The solution uses the concept of incremental learning to improve itself and decide for itself enhancing its performance or keeping it at the same level as it was previously but not at the cost of disruption of service to the client. Here are some excerpts from the blog :

“Our goal was to be able to have a fraud detection model decide for itself when it needed to change to keep its performance at the same level as it was previously,” explains Hennessy. “Over time, fraud behaviors change and fraudsters do different things, so the historical data becomes less relevant and the model degrades.”

While the AI can identify and adapt to new types of fraud, it also operates within set thresholds, so clients don’t suddenly have to contend with sudden, significant changes made without human intervention.

Probably the people who designed the new fraud solution in my Bank, did not realize these challenges but they should have at least tested it well. From a client perspective, it should be like a silent success without any disruption. Else it breaks the very basic purpose of serving the customer.

Did you ever face such a situation ? FYI, few years back ( may be 5-6 years), someone used my credit card to buy a bike for around 70000/- at Pune, India. I was there for some time and departed from there, just a day before the fraud happened. The bank called me to ask if I did the transaction, and upon me denying, they blocked the card and did not charge me anything for that and would have done some investigation. But that was Credit Card and I still use their Credit Card, they do not call me for even very high value transactions on the Credit card - which has more chance for fraud. May be I should consider changing my bank !!

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.