Image from Pixabay

Well, the last few weeks I've found several articles about Taylor Winklevoss whipping out a prediction for the $500,000 Bitcoin prize.

I skimmed through the articles until I came across a small detail; none of the articles had a source for the statement. So I guess it was up to me to go on a search...

Thanks to Google it didn't take too long and I found the supposed source. But what is that? The article on winklevosscapital.com was already published in August...

Surely this has nothing to do with the fact that the price has now risen and more nonsensical articles are thrown out regarding a possible bull run.

But so be it. Regardless of this, the article is actually quite exciting and it turns out that there is no clickbait behind it.

The article is about the status quo of the USD Dollar and - who would have thought it - it doesn't get good grades. What started with a shot in the arm in 2008, the credit Kirse in America, sees no end. The debt system, which has become dependent, is difficult or impossible to correct. Here is a quote:

All of this pre-COVID excess was made possible through a combination of borrowing and printing. From July 2009 up to the pandemic, the line item for mortgage-backed securities on the Fed's balance sheet grew approximately 3x from $545 billion to $1.6 trillion. Similarly, the book entry for Treasuries with a maturity date of greater than five years grew almost 3x from $315 billion to $872 billion. Together, these assets represent $1.6 trillion dollars printed out of thin air. They also demonstrate just how far the Fed wandered outside of its traditional mandate of promoting maximum employment and stable prices. While a central bank is expected to buy and sell short-term debt (Treasury bills or T-bills in the U.S.) in order to manage short-term interest rates, when it extends its open market activities to long-term Treasuries and other assets, it is operating firmly in the unconventional land of quantitative easing.

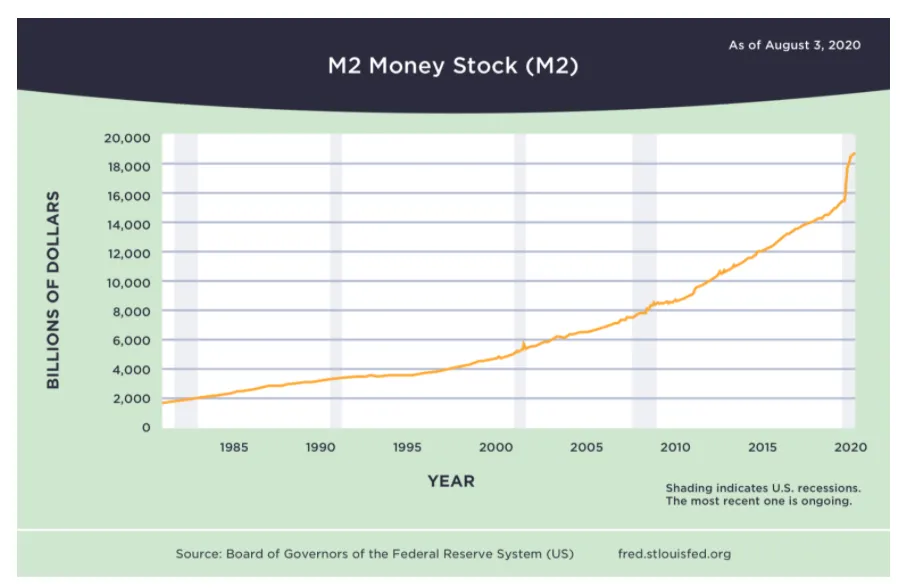

An interesting example of how Covid has affected the chart of the existing money stock:

As we can see, Corona has brought a considerable increase in the amount of money. The balance sheets of the Federal Reserve do not necessarily look much better either. But since I don't want to take over all the graphics from the article, you will have to look at it on the linked source page.

About the winners and losers of this system, and the problems of oil and gold, the paper finally comes to "The Answer". At first, however, it lists general ideas, since the author's final estimate is based largely on these ideas:

Money is a technology and an invention.

Like any technology, money can always be improved and repeated. People have developed money from the beginning, cryptography is only the latest iteration.

Money has been many things over the years, including, but not limited to, shells, beads, metal, paper and so on. In the end, money is what we all agree on.Bitcoin is the world's first money to come from the Internet, i.e. money that was developed specifically for the Internet. It works in the same way as your e-mail, which is not the case with all other forms of money.

Crypto currencies like Bitcoin are networks and should be evaluated according to Metcalfe's law.

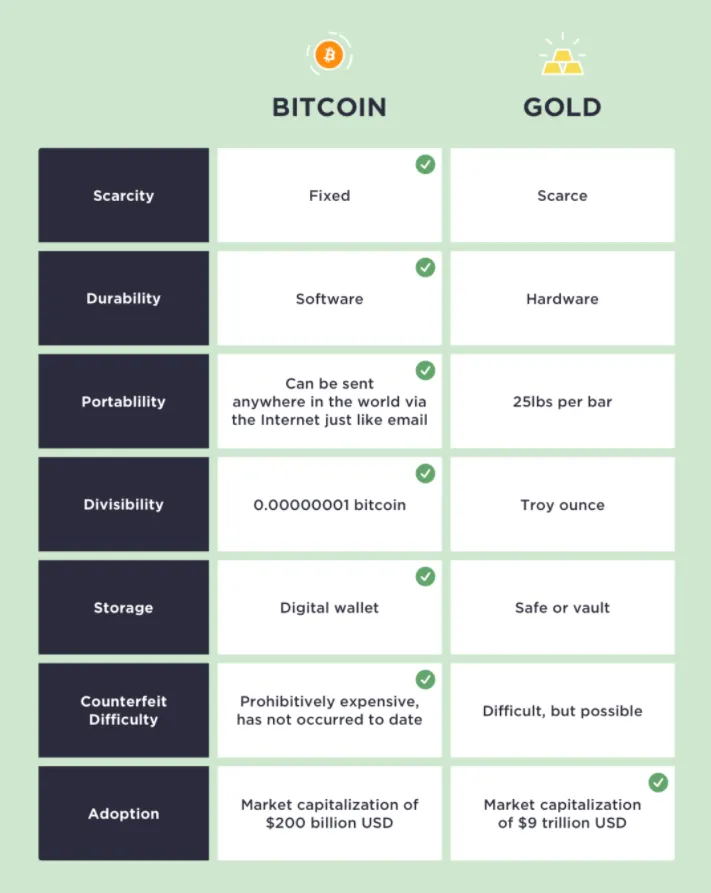

Ultimately, the author says, Bitcoin will prevail because it is the first commodity in the universe where limited supply does not follow demand. In a direct comparison with gold, Bitcoin comes out on top:

The graphic is commented with a wonderful sentence:

It turns out that Bitcoin is better at being gold than gold itself.

But where is the prediction now?

I have already kept myself very short. The original article is much more extensive than my short summary.

To The Moon - The part you old guys have been waiting for.

In order not to distort the statement I quote again:

Bitcoin has already made significant ground on gold - going from whitepaper to over $200 billion in market capitalization in under a decade. Today, the market capitalization of above-ground gold is conservatively $9 trillion. If we are right about using a gold framework to value bitcoin, and bitcoin continues on this path, then the bull case scenario for bitcoin is that it is undervalued by a multiple of 45 Said differently, the price of bitcoin could appreciate 45x from where it is today, which means we could see a price of $500,000 U.S. dollars per bitcoin.

Header 2Did I read that correctly, 500k?

That's right, you did. As mentioned in the beginning, this was a small clickbait that we were not really sure about, but an actual statement. For my part, I think that the journey will actually go in that direction.

How fast will it happen? I have no idea.

If you take a look at the Google trend graphs and compare them with those from 2017, you can see that there is no peak in the general interest. But I have already written my own post on this topic here. Feel free to drop by.

Why did MicroStrategy invest in bitcoin?

Bitcoin-Chart vs. Google-Trends

Spotify seeks director for crypto currencies

What do you recommend to new users?