A report put out by Westpac Bank in Australia found a surprise (completely not) finding, that the sale of antidepressants increased significantly at the start of the Corona pandemic, which is aligned with what the WHO have also "discovered", that anxiety and depression increased about 25% globally in the first year. But, on top of this, the report also noted that consumer spending had increased 56% in the last two years or so - which is massive.

The increasing interest rates and inflation don't cover all of this, so it seems that "retail therapy" is indeed alive and well in Australia, which combined with the supply chain bottlenecks and transport issues, shows that "consumer demand" has increased the pressure.

But more importantly it shows, that despite the opportunity to use the money "wisely", consumer desire overpowered the senses and people spent. However, what also needs to be taken into consideration is, there were also savings being made and, plenty of money being made by some companies, because people weren't travelling. So, rather than Australians spending their money overseas, more of them were spending it locally, or through the globalized marketplaces, like Amazon.

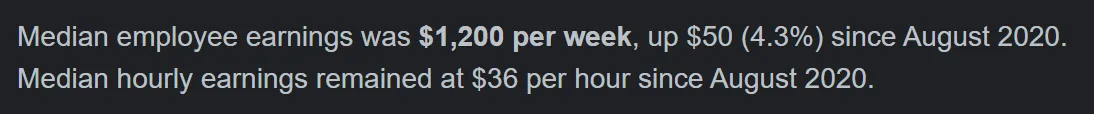

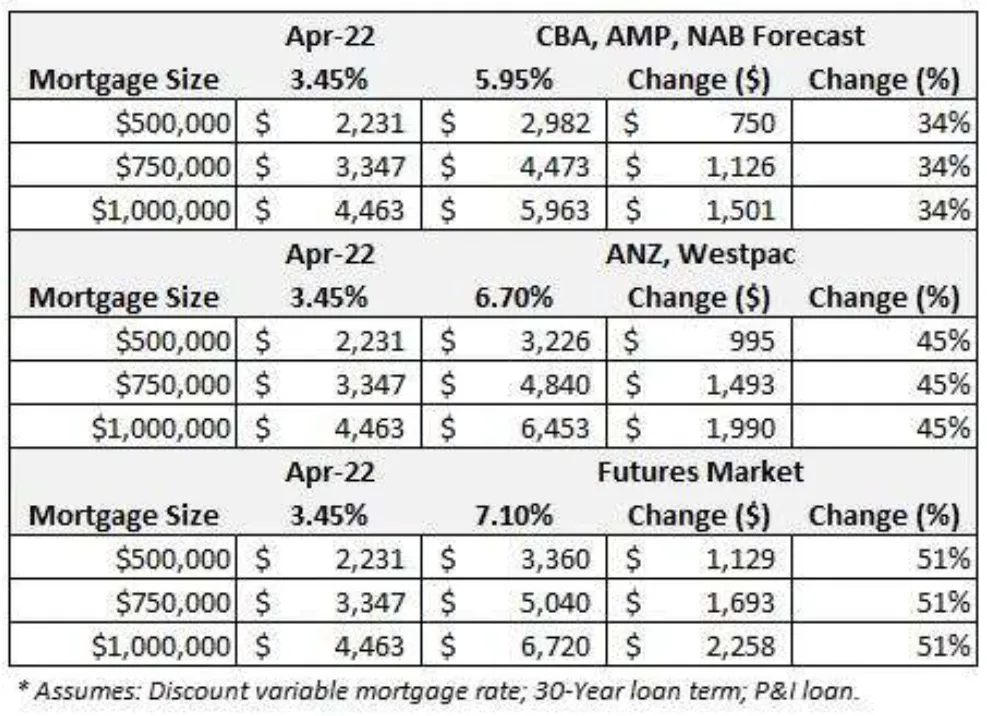

And in another Article, I found this chart, which has a look at the predictions of mortgage increase changes under the predictions of the banks and the futures markets.

51% increase in the mortgage costs!

But realistically, how many people have a million dollar house?

Oh.

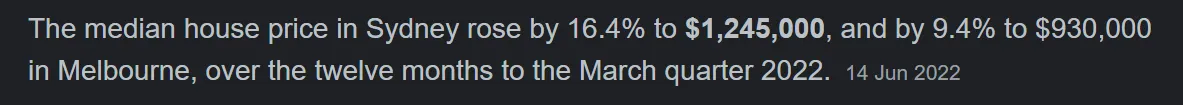

So, with all of the FOMO to get into the house market, combined with a low supply of new homes there are now plenty of people with very large mortgages which already stretched them to their limits, and are now facing a potential 50% increase in the monthly costs. If the median house price in these areas is near a million, the median salary is a good indicator of what the salaries of people might be who bought the houses.

Yes, so at that 51%, just the increase in mortgage cost on a variable loan of around a million dollars, is the same as almost two weeks of the median income, before tax. Damn - that is going to be painful. And, while Australians might have been squirreling cash away into the banks with some reports saying that is 40k, which would give a good 18 month buffer, but is it really so much?

According to Westpac Bank and their customers:

The average Australian savings account balance varies depending on your age. According to a Westpac survey released in December 2021, the average customer has $22,020 in their savings account. The bank said this figure was likely skewed by larger deposit holders and pointed to a “more realistic figure” of $3,559. Westpac says this is the median between $500 and $20,000, meaning half of their customers have $3,559 or more in their savings account.

source

Oops...!

If this data that is taken from the records of the bank is correct, that means the average person may only bee able to cover that futures prediction of 51% for a couple of months, before falling into arrears.

Will they be forced to sell?

ANZ, another large, Australian bank has predicted housing prices to fall by around 20% in 2023.

Double Oops!!

Even what is considered the "lowball" increases by the the three other large banks, would see mortgage expenses increase by 34%. If you went to your local bar and bought a beer for 5 dollars and then an hour later ordered another the same and it cost $6.70, you'd be pretty annoyed. That is a 34% increase, except it is happening on what is for most people, the biggest keg they are ever going to buy and, they don't actually own it, can't give it back and have to hold it.

While I am hoping that this period of pain isn't going to extend for too long, it is goin to be long enough that many people are going to struggle a lot and, that generates even more pressure, more stress.

But don't worry, there are drugs for that!

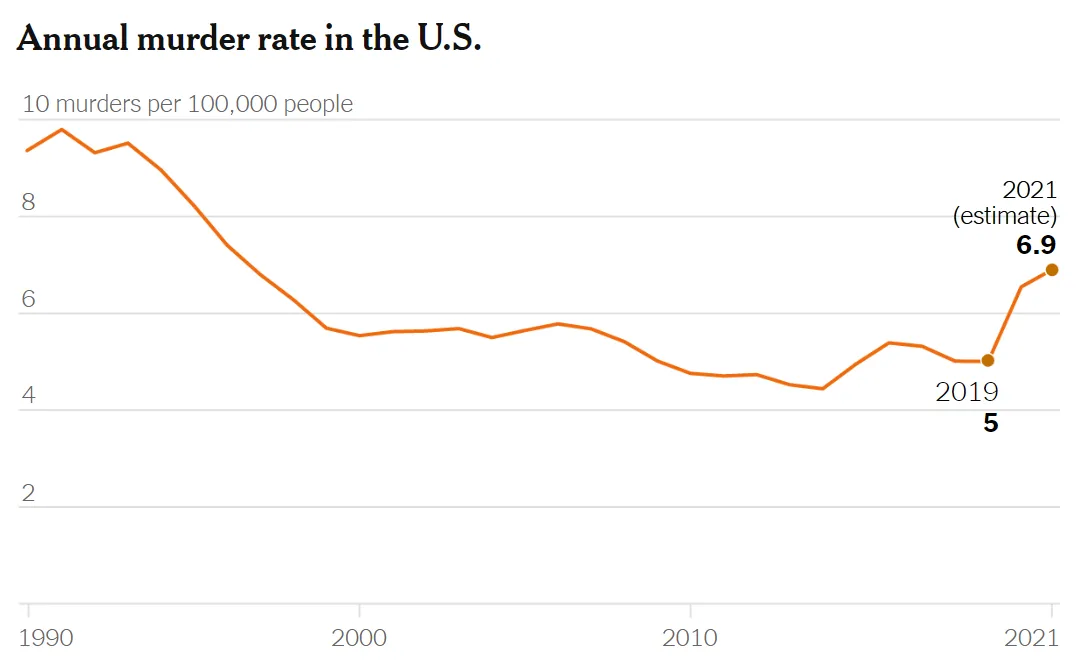

Stress isn't a killer. How we cope with it however, definitely plays a part. And, I suspect that this is not a problem isolated to Australia. Most likely, this is happening globally and not only will it show through depression and anxiety increases, but I also predict that general violence will increase also, as people start to crack, physically, mentally and emotionally from the circumstances.

Quite a rise.

And, some of those circumstances are because of the pandemic that was forced upon them too, because so many people are more disconnected and isolated from their friends than they were earlier. Sure, the pandemic might be over for the most part, but the societal dysfunction it enabled is going to have ramifications well into the future.

All of these things are connected to the economy, because the economy is not just about money, it is about our very behaviors. It is not a one-way road of influence, we influence it, it influences us and at the end of the day, it is "us" who have to face the emotional repercussions and dealing with our position. The economy doesn't have feelings, it doesn't care about anything at all - it is just a reflection of our activity, behaviors and where and how we have chosen to use our resources.

A tough pill to swallow at times.

Taraz

[ Gen1: Hive ]