I was skimming through a trash news site (it is free) from Australia as I do most days, and an article caught my eye about a Buy Now, Pay Later (BNPL) company and how someone supposedly racked-up 80K of spending through it in quite a short time span.

80K is over a year's average salary in Australia.

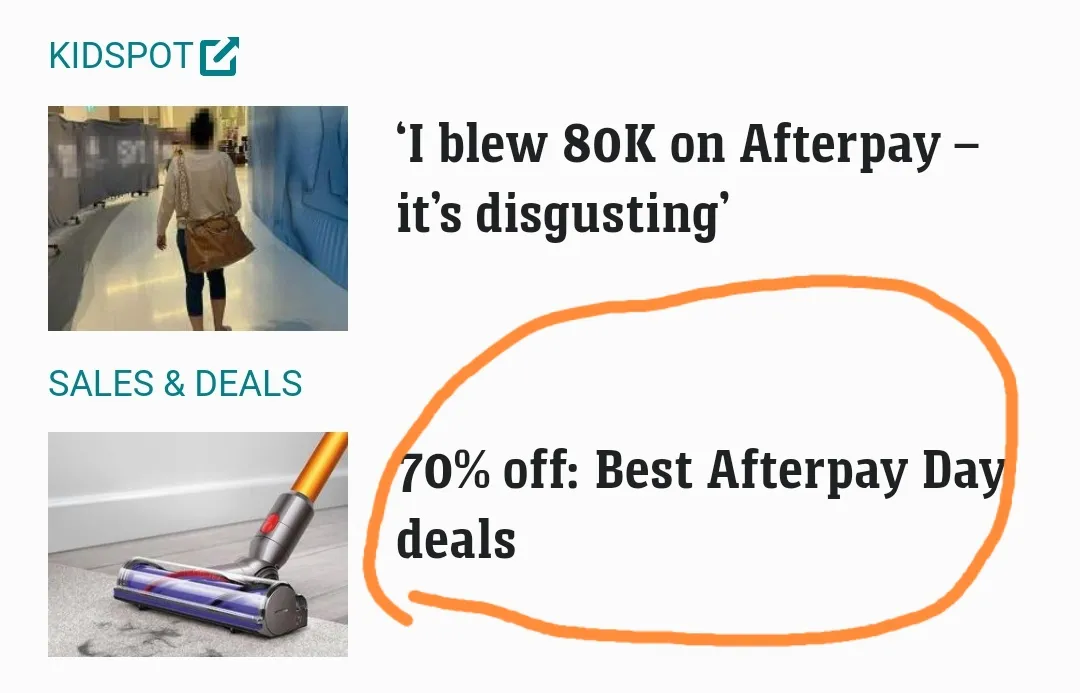

But, other than the sheer silliness of what the person was saying and the excuses they were making as to how they justified the spending, the interesting thing that I found after skimming the article was after I left it.

I went back to get this screenshot of a line.

Because of this advert.

Yes, that is a Dyson vacuum in the image.

And no, it isn't Afterpay's fault. They are just incentivized to profit from our behaviors, which includes influencing our behaviors to increase their profits. If there is a demand for a service, no matter what it is, someone will generate a supply - no matter how harmful or depraved the demand may be.

Humans are very predictable in their behavior, especially at scale, which is what has driven so much of the online advertising and consumer activity, because they can identify and generate demand trends, then target triggers to drive a particular purchase activity. It might not be a particular product, it could be a group or a concept, but the process is the same.

However, a lot of these BNPL businesses are struggling lately in share price:

As you can see, that chart ends in January of this year, because Square acquired Afterpay for 29 billion dollars. One of their rivals from Sweden, Klarna, which is not publicly listed yet, has had its own valuations discounted heavily recently when securing more financing, coming in at less than 15% of what it was a year ago.

And while some take this as a sign that BNPLs aren't going to survive, that is only true for most of them, as just like the acquisition of Afterpay by Square, they are looking to consolidate, after an explosion in competition and a heavy drive to build customer base and claim market share, by burning through cash.

Square (now called Block) hasn't been immune to the market movements either.

If you bought Block at the top and BTC at the top, you are down on both, but more down on Block. Bitcoin is at around 34% of where it was from the high, Block is around 29%.

Neither are dead.

However, this is what I am calling the "Highlander Phase" of the BNPL industry.

There can be only one.

Okay, there won't technically be "only one", but this consolidation period is going to force more acquisitions and mergers to maintain market share, or weed out the weakest and releasing their market share back into the pool to be claimed. After this period, there will likely be far fewer player of far greater size, earning significantly better than what they were, as they are able to scale their activities, cutdown overheads and will no longer need to be aggressively burning through cash to attract customers. Brand loyalty of a kind will also likely set in a bit, locking people into certain providers out of habit and incentive.

And, they will probably do well overall, because their business model in theory is sound, because they know that on average, people do not have the financial literacy or aptitude to manage their finances effectively, so they will always have customers. The only way that they can fail is if people start to take more responsibility for their own financial wellbeing and improve their economic hygiene through changed behaviors.

“It’s so easy to say that you’ll spoil yourself if you’ve had a hard week at work, but I’ve realised I need to prioritise my future instead.”

Prioritizing our future is far easier said than done, because we are in-built with consumer instant gratification tendencies, meaning that there is more force driving us to "buy now" than save for later. These companies leverage these traits, but as we are ultimately responsible for our own experience in this life, it is up to us to identify the challenge and handle it. Some are better at this than other.

Talking about financial considerations for kids with a client today, he was saying how his daughters are very different from each other. One is good with money and looks to invest, the other looks to spend, even though they have both been raised under the same roof and similar conditions, without too much of an age gap.

However, regardless of how much is nature or nurture, each of them is going to have to experience their own outcomes and with a straight line path to the future, it would seem that one will be financially comfortably, the other struggle.

Which is more likely to use a BNPL?

And if they both do, which is more likely to use it strategically to increase their wealth, and which because they must?

We are consumers by nature, but the financial system isn't natural, even though the laws of economics may be. This results in us needing to actively learn how to use the system to our advantage and if we don't, we are going to be used through it by the people who do know how to use it.

Essentially, the financial economy is a technology like a computer, with complex processes and mechanisms involved that means that there can be a spectrum of users. Those who understand the system well, all the way down to those who understand just enough to use it as an interface, a consumer, not a creator.

This is business.

And if we don't take care of our own business, someone will take care to build their own business, with our resources.

“A Fool And His Money Are Soon Parted”

_Thomas Tusser

By nature, we are all largely born economic fools, demanding that someone takes care of our needs for us, reliant on those around us to provide. As we grow, we are expected to learn and take on more responsibility for ourselves and add to our community through our activity, earning capital ownership of some kind in the process. We then choose how we use our resources and through our consumer behaviors, we signal who we are and what is important to us.

Action expresses priorities

_Ghandi

What does it mean when we are getting into debt, buying nothing of consequence?

That is something to think upon perhaps, but the fact is that because this is what we demand, the supply for services that enable us to do it more easily, aren't going to go away any time soon.

Whether the return is for us or for someone else, every purchase we make is an investment.

Taraz

[ Gen1: Hive ]