How many times have we heard about the money printing by the governments or the central banks? The reality is that, when it comes to the major currencies, there is no printing. That is a total illusion perpetuated by people who really do not understand the system or want to mislead people.

In this article we will clarify how things work and what is truly taking place. Since the masses believe the misdirection, it is safe to say they could be on the wrong side of things. Nevertheless, in an effort to education we will put forth the facts. Unfortunately, religion is a tough thing to break since people give their heart and souls to their faith, even when it is economic in nature.

Source

There Is No "Money Printing"

There is no printing in the US Dollar. This is something that everyone should be aware of. And no we are not referring to the actually production of physical dollars by the Bureau of Engraving and Printing. Most are aware that very little of the money supply is in physical form.

Instead, we are referring to the idea that money is a bunch of numbers that someone decides to throw on a screen somewhere. It appears many believe that when the US Congress passes a spending bill, either Treasury or the Fed tosses some numbers out and drops money on people. This not how it works.

So once again, there is no money printing. The expansion of the US Dollar is not due to some arbitrary idea that someone like the Fed Chair decides to do one day. Once this is understood, we see how the narrative that is espoused by many collapses.

I often wonder how Peter Schiff keeps espousing his viewpoint. The guy is intelligent and you would think that he fully understands what is taking place. Nevertheless, year after year, for more than a decade, he made his gold calls based upon the "money printing is going to lead to hyperinflation" narrative. That is a long time to be wrong.

Nevertheless, he keeps beating the drum in hopes that gold will run. Of course, he does make a commission of the sales from his websites, so perhaps that is his real objective.

Perhaps the fact that outlets like CNBC keep putting him on air should be a warning.

The Intersection of Lender and Borrower

If dollars are not magically printed out of thin air, then how to they come into existence.

Basically, money expansion is an agreement between two parties. To understand this, we need to grasp who is tasked with the creation of USD. It is not the government nor is it the Fed. This is why those cute memes of the USD having just one node is completely false. There is no single entity that creates dollars.

The entities that are responsible for the expansion of the currency is the commercial banking system. Thus, the fiat system in the United States is not run by the government but, rather, private entities. Banks have full control over the money supply.

Therefore, when a lender and borrower come together, USD is printed. This happens when one exercises a line of credit for a business, a mortgage is written, car loan taken out, or someone taps into a HELOC. When any of these things take place, USD are created.

Of course, the reverse is true. Each time someone makes a payment that goes to principle, the money supply contracts. The acceleration of this is when defaults happen and writes off take place. For example, as real estate collapsed during the Great Financial Crisis, foreclosures were happening all over the place. The write downs were astounding. At that time, the money supply collapsed almost over night.

The Myth of Unlimited Money Creation

We also hear how money can keep being creating without limit. This is actually not true. Since there is no printing, we are dependent upon borrowing and lending.

One might say that people are always going to be willing to borrow money. That could be true. However, a lender is still required. And here is where the theory breaks down.

At the end of the day, banks are going to operate in their own best interest. This is something that few can deny. They are not in the business of being altruistic. Banks operate to make money and they are always going to avoid those situations that are detrimental to them.

Before going further, we have to clarify the different types of banks. We have depository banking which is akin to the traditional banking of the past. Although it evolved, think of Bank of America or Well Fargo. This contrasts with investment banks which are the likes of Goldman Sachs or JP Morgan (although JPM is a depository bank through the ownership of Chase).

Depository banks are always prudent lenders. They consistently have to operate under sound risk management equations. The reason for this is because they are regulated heavily due to deposits along with being limited to the product offerings they can develop ie their money creation. Investment banks have a much wider arena from which they can generate revenues.

Many feel that the housing crisis in 2004-2007 was evidence how the banks did the opposite of what is stated here. The reality is these banks operated in their best interest while employing sound risk strategies.

That is baffling to people until you realize the bank was not at risk. When writing an unsound mortgage, that is not a problem if it is going to be sold off within 48 hours. These banks were not assuming great risk. In fact, they were reducing it by unloading the loans and collecting a few points for origination and servicing the loans. To them, it was about as risk free as it got.

We saw how Wall Street had such a thirst for loans. Companies like Lehman was amassing all the mortgages they could get their hands on. The banks were willing to loan since they were not at risk.

Of course, we know how this ended up. Even the smaller banks were obliterated through this. However, it was not the writing of bad loans that caused them issues. What crushed many of the traditional banks (non-investment banks) was the fact they were buying the mortgage backed securities to put into their investment portfolios. The risk they unloaded was unknowingly brought back onto the books through the purchase of what they thought was high quality debt.

So here we see, there is a limit to what can be created. If the system cannot handle it, defaults start to occur. During that period, not only were borrowers defaulting, we have tranches of MBS going belly up all over the place.

The System Self Corrects

Here we can see how the idea of hyperinflation in the USD is almost impossible. There comes a point where the system implodes. While it can last a time, as we learned 15 years ago, eventually a point is reached where the underlying asset simply pops.

When this happens, the fallout is not orderly. Markets that are overextended can move down very quickly. We saw the debt instruments that were created evaporate almost instantly. The ride from high quality to junk status was never so quick.

This is why, at present, we have a liquidity crisis in the USD. There is not enough of it in the domestic economy and certainly too little internationally. For all the statements by the Fed, they truly have little control over the situation. For example, the entire Eurodollar system is completely outside of their control. Nevertheless, they like to act like they can actually correct things.

Notice what happens each time we head into an economic crisis. Since we are in an overly financialized system, the "money creators" get very stingy. Notice what took place over the last 20 years, starting with the dot com and going through the COVID crisis.

We are down over $500 billion in industrial and commercial lending. Is it any wonder why the economy of sluggish in spite of what the financial media tells us? Banks are not going to take on risk when it foresees economic headwinds. And with small business struggling, banks are not rushing ahead to hand out money.

So where is all the money coming from?

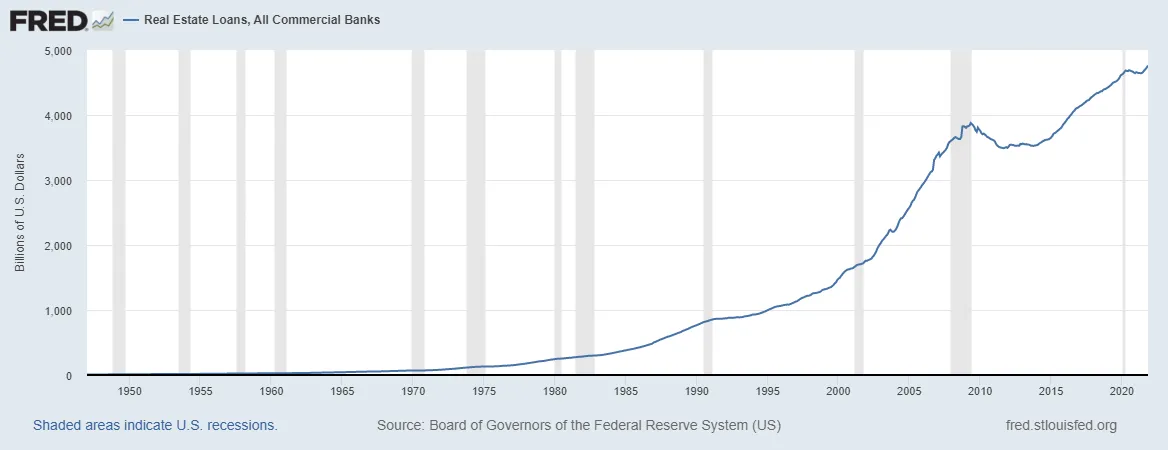

Perhaps there is one market that sums it up. Real Estate.

This should come as no surprise to anyone. Lending in this area exploded over the last 20 years. However, this is a far cry from "creating money out of thin air". People actually have to borrow (and banks lend) to be able to sustain this. Also, loans are backed by the actually property which, while possibly overvalued, is not going to result in a total loss.

Real estate tends to be a safer form of lending. Not only is it backed by an asset but the market tends not to implode (the GFC aside). Typically, the real estate market does a topping pattern and then heads down in specific markets. It could become more widespread over time yet the cracks tend to be in a few markets. In fact, it is common to see some markets heading down while others are seeing the opposition.

As always real estate is local.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z