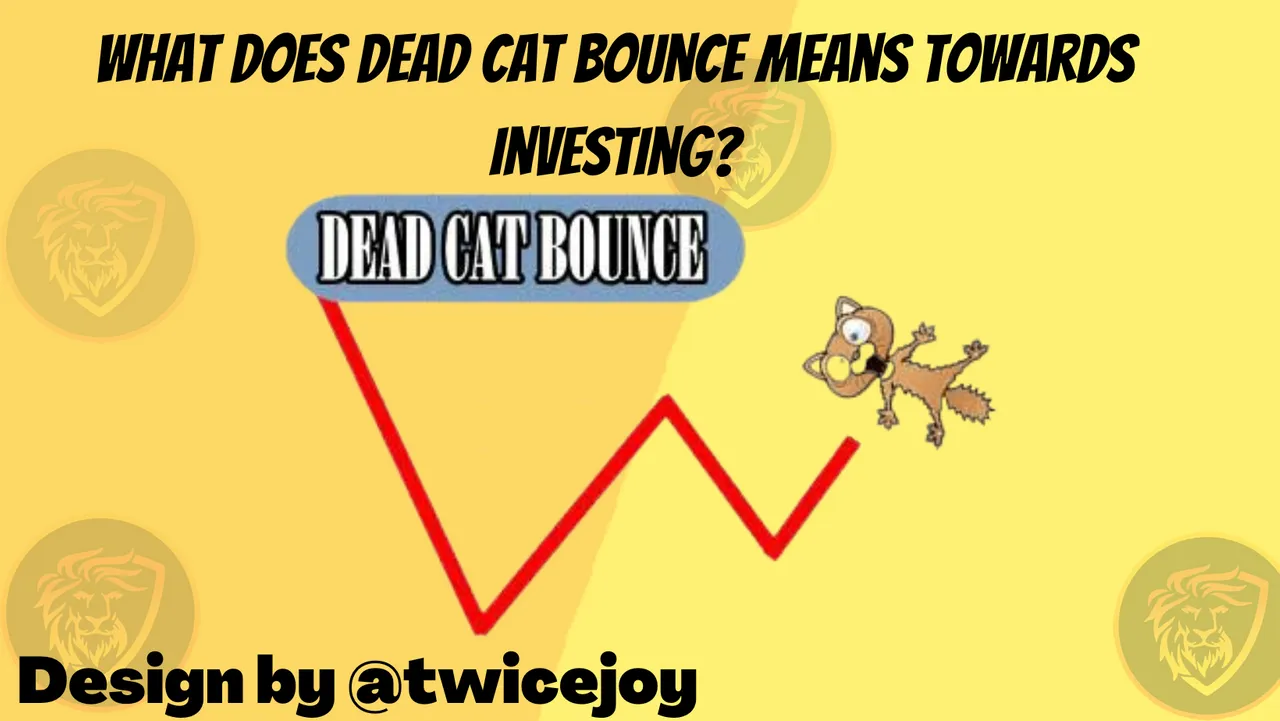

In investing, a dead cat bounce is referred to as the provisional, momentary recuperation of asset values from a lengthen decrease or a bear 🐻 market that is accompanied by the prolongation of the decline. Very often, downturn are punctuated by short terms of recuperation. The tagged "dead cat 🐈 bounce" is related to the fact that a dead cat can bounce if it drops from afar at quick succession.

A dead cat bounce is a price device which is being utilized by technical analysts. It is regarded as a prolongation device, in which initially, the bounce may seems to be a U-turn of the triumphing tendency, but it is fastly accompanied by a prolongation of the decrease in price movement. Then, this becomes a dead cat bounce following the price decline beneath it's preliminary deficient.

During markets decline, a consolation rally may affect investors to think that they have got over the worst. Nevertheless, this could be a dead cat bounce in disguise, in which a keen bull move in a contrarily profane bear market. Investors who fall victims of a dead cat bounce could go through huge losses due market bottoms timing which is very complicated and too risky.

Thanks for visiting my blog and have a wonderful day

I really appreciate your upvote and support

@twicejoy cares ♥️♥️♥️