There are more than 300 million cryptocurrency users globally, and the number is expected to grow further. As the relevance and acceptance grow around these digital assets, it becomes more significant to understand the fundamentals underlying these innovative assets.

Any digital or virtual currency that uses a combination of cryptography, decentralization, and consensus mechanisms to secure transactions is refered to as cryptocurrency.

Bitcoin for example happens to the first cryptocurrency to register its presence in the digital world. This year it celebrated it's 13 years of existence . Since the advent of Bitcoin, the crypto market has witnessed the birth of thousands of cryptocurrencies with varied use cases and utilities.

The blockchain technology that underpins cryptocurrency is a distributed ledger shared over a network of computers.

The fact that cryptocurrencies are generally not issued by any central authority makes them theoretically immune to government censorship or manipulation.

The entire transaction history concerning cryptocurrencies is stored on the distributed ledger we know as blockchain. Once recorded, the data cannot be changed, making the transaction history transparent, secure, immutable, and entirely traceable. Cryptocurrencies are therefore stored in digital wallets.

As a newbie in the cryptosphere one might want wonder what this blockchain technology is actually used for . It is at this juncture I would like to center my article on. In simple terms I would like to dwell on the unique use cases of cryptocurrency.

Cryptocurrencies have many alternative use cases that don’t always get as much coverage in the press/media.

Cryptocurrencies have made it possible to tokenize physical assets and link them to digital tokens. Copyrights, real estate, art, stocks, and commodities can all be tokenized and represented as cryptocurrency tokens. Asset-backed tokens have intrinsic value that is directly connected to the underlying physical asset.

Asset tokenization is definitely a use case for crypto which increases the market liquidity of real-world assets like real estate. The digitization of assets also allows previously excluded investors to explore the market.

It's one thing for something to have value , it is another different thing storing or saving this value over time. Crypto offers an alternative way for people to store value, especially in places where the national fiat currency may be volatile or unstable.

For people living in countries where this is common, using a tool like stablecoins makes it possible for them to hold onto monetary value, even during times of severe inflation.

Stablecoins are cryptocurrencies that are tied to another value, like the US dollar, and maintain a comparatively steady value.

This stability allows people and businesses to continue making transactions using a currency with a known value, and enables them to build wealth despite localized market conditions.

Cryptocurrency is a store of value because it can store and transfer value over time and space. For example, Bitcoin is frequently referred to as ‘digital gold.’

Civilians in Ukraine and Russia have been exchanging domestic currency for Bitcoin and other cryptocurrencies to hedge against the war’s rapid inflation.

Bitcoin, given its phenomenal ascent, has the potential to dethrone gold and oil as the preeminent store of value. It is even expected that BTC will take the market share away from gold in the coming years.

Furthernore, Cryptocurrencies will play an important role in the digital economy in the coming web3 era and iteration of the internet. The decentralized nature of crypto, combined with low transaction costs, privacy, and security, has enticed a new generation of investors, entrepreneurs, and tech enthusiasts to join the crypto bandwagon daily.

Payments can be made using cryptocurrencies on any e-commerce site or merchants that accept cryptocurrencies. All you need is a crypto wallet to make such transactions. Over 15,000 merchants around the world accept Bitcoin with Starbucks, Tesla, McDonald’s, Visa, Mastercard, Pepsi, etc., to name a few who allow their customers to use cryptocurrency as a valid payment method. Marvelous use case for crypto you will effortlessly agree!

I must say getting onboard on Hive and particularly the Leofinance community has really being an enlighten one . I get to learn about crypto stuff as much as I can take in . Just recently I found out about the word "remittance" . Remittance is a word that comes up frequently in crypto discussions, and it simply means sending money from one party to another.

It isn't therefore far fetched why remittances so to say happens to be use case for crypto. A remittance is usually a payment, but often when used in relation to crypto, it means people sending money internationally.

Sending money through traditional payment rails is often expensive and slow. Using crypto for international transfers is both faster and, usually, cheaper.

Using crypto is also sometimes the only option for people who can’t access financial services like a bank, or where international transfers are restricted.

Guatemala a country in central America has numerous bitcoin ATMs, where users can access their non-custodial wallets and exchange BTC for local currency, and many businesses throughout the country now accept crypto as payment.

Another alternative use case for crypto certainly has to be identity management. By using blockchain technology, you can own a public address where you manage and control your data.

This technology has extended into many areas, such as online identities in Web3, healthcare ,legal records, ownership of art, and of course financial transactions.

Since the blockchain is permanent and immutable, it could serve as the most secure digital option for maintaining important records. Blockchain records can also be transferred easily, and access can be recorded without revealing the data contained within the address.

Of course the list won't be complete without charity being an alternative use case for crypto.

As the popularity of crypto has grown, so has the desire to donate it.

With charitable organizations starting to accept cryptocurrency, users have found donation to be a great use case for their crypto.

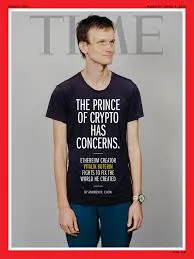

Famously, Ethereum founder Vitalik Buterin donated $1 billion to the India Covid Relief fund as well as $5 million in ETH to aid in Ukraine.

Donating crypto could have unique tax implications based on where you live, so it is important to consult a qualified tax or legal professional for more information on your specific reporting requirements.

Furthermore, Cryptocurrency and decentralized finance (DeFi) don’t require the same infrastructure as traditional finance, such as banks, creating many opportunities for entrepreneurs to use crypto in their businesses.

Using crypto and other permissionless DeFi tools that don’t require a bank or government to work means that businesses can start and grow, even if a nation’s economy or currency can’t match that growth.

In places like Africa and Latin America, business owners are using crypto to fund daily operations and perform transactions.Nigera and Salvador are ample examples respectively.

The above list of use cases isn’t exhaustive as cryptocurrency platforms, and their utilities are vast and still expanding at a great pace as cryptocurrencies continue to percolate industries and sectors around the world.

Cryptocurrencies aren’t just payment networks or digital money; they are a hybrid innovation that the world needs to embrace to continue on its path toward digitization and development.

In the coming months and years, cryptocurrency technology will continue to progress, and there’s a wide range of possibilities for crypto, DeFi and Web3 alike.

I’d love to hear what your favorite use cases for crypto are .