Transaction Fees for e-Banking with Fiat is Sucking

Banks are financial institutions that are licensed by governments to receive deposits and make loans. Some might also be authorized to provide wealth management and currency exchange - @leoglossary. Banks play a vital role in the economy. Technological advancements in the banking sector birthed e-banking. E-banking, short for electronic banking is an arrangement between a bank or a financial institution and its customers that enables encrypted transactions over the internet. E-banking has various types that cater to customers' different requirements, which can be resolved online.

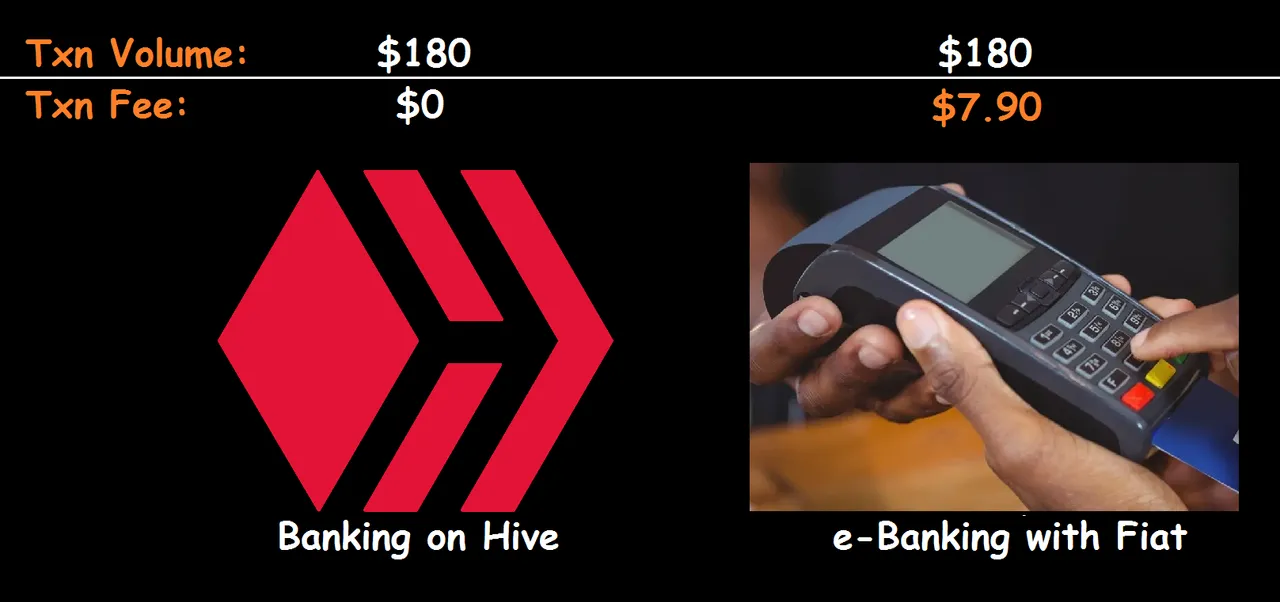

While e-banking has helped customers to bank at their convenience and from homes, it comes with a huge cost that is growing daily and becoming overbearing on the teaming users. While probing my recent bank transactions, I discovered that I spent $7.9 for $180 volume of fiat. That is highly ridiculous - about one-fifth of minimum wage. Then, I remembered that I've been making lots of transaction on Hive blockchain ranging from cash transfers to data purchase, payment for goods and services, subscriptions and more. A similar $180 worth of transaction on Hive using $HBD and $HIVE cost me $0 (Zero dollars). This made to seen how much wealth can been preserved with web3 banking on a blockchain like Hive.

Comparing money transaction volumes and related fees on Hive and Fiat Bank

To support my financial loss due to exorbitant fees, a recent documentary revealed how Nigerian bank customers of nine leading commercial banks pay NGN154bn (about $197.5 million) fees for e-banking services in the first half of the year (H1’23) and summarizes account maintenance fee at NGN66.7bn (about $85.5 million).

Web3 Banking Explained

Web3 banking can be defined as a decentralized financial ecosystem that leverages blockchain technology and smart contracts to provide a wide range of financial services without the need for traditional intermediaries like banks. Web3 banking is the heart of transformation in the finance world as a result of blockchain technology and cryptocurrency. Today, decentralized systems continue to gain momentum, and this has become a formidable challenger to traditional banking institutions. This paradigm shift promises to redefine how we save, invest, transact, and interact with financial services.

At its core, Web3 banking aims to democratize finance, giving individuals greater control over their assets and financial decisions. Selling features of web3 banking include decentralization, digital identity, smart contracts, tokenization, Decentralized Finance (DeFi), cross border transactions, among others. these features gives web3 banking an edge and potentially pitches web3 baking for financial inclusion, reduced fees, ownership and control, global accessibility and innovation.

Web3 banking represents a transformative shift in the financial landscape, offering a decentralized, efficient, and inclusive alternative to traditional banking. As the ecosystem continues to mature, it has the potential to revolutionize the way we think about finance, ultimately putting more control and financial power in the hands of individuals.

Feeless Transactions on Hive and Wealth Preservation

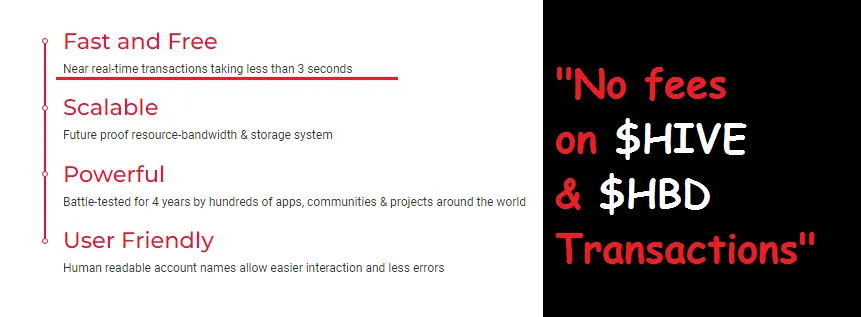

Hive blockchain is known for its unique feeless transaction model, which is distinct from many other blockchain networks. The feeless transactions on Hive has contributed to wealth creation and wealth preservation for its teaming and growing users.

There are many sources through which feeless banking on Hive preserves wealth for tis users, they include:

Feeless transactions means cost efficient transactions. Hive users don't have to spend cryptocurrency on transaction fees. This save their money. The effect of this would be so tangible when when making frequent and recurring transactions or micro-transactions, potentially allowing them to keep more of their assets.

Feeless transactions make Hive blockchain technology more accessible to a broader audience. unlike on other chains that users pay high gas fees, Hive as users don't need to worry about fluctuating gas fees or transaction costs. This would certainly bring more users here as knowledge grows.

- Feeless transactions aids micropayments. Where the transactions involves small amounts, fees can exaggerate the cost, but with hive's feeless transactions, micropayments and micro-transaction payments are seamless.

- Feeless transactions is an economic incentive. Feeless transactions can also be seen as an economic incentive for users to transact and engage within the Hive network. Where there is no extra cost on transaction, that can be considered as a bonus and an addition to the user's asset base.

Final Words

Wealth preservation is a thing on the Hive blockchain. While feeless transactions may not directly create wealth, they can help preserve wealth by reducing transaction costs and barriers to entry. Hive users can allocate their resources that would have been spent on fees to other investments, potentially leading to better their financial outcomes.

What is your thoughts on Web3 banking on Hive blockchain?

If you found the article interesting or helpful, please hit the upvote button, share for visibility to other hive friends to see. More importantly, drop a comment beneath. Thank you!

This post was created via LeoFInance, What is LeoFinance?

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: https://leofinance.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966