Hi HODLers and traders,

Following on my last post which got quite some traction as it is just the way to be in these volatile crypto markets: Hope for the best, prepare for the worst.

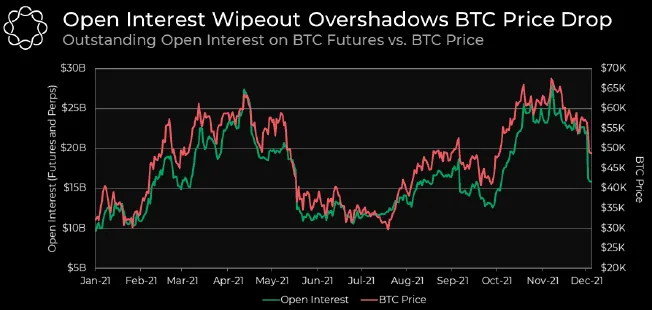

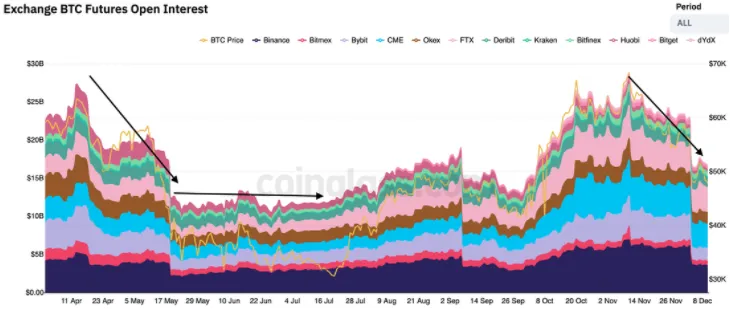

One metric that I watch very closely is Bitcoin Open Interest, you could sum it up as the open leveraged positions. As we know, it is common that whales just dump to liquidate some users. By doing so, these overleveraged users are liquidated and their exchange platform therefore sell their position into the market, putting downward pressure on bitcoin and liquidating other users...

Where do we sit today?

Open interest has been cleaned out following the few dumps we had over the past 7-8 weeks and I feel we are close to healthy levels. Meaning there are not many leverage position and going forward, if Bitcoin bounce back we could see the opposite happening, users opening positions and therefore increasing demand => BTC price goes up

According to Deribit:

“The 30-day % decline in OI for BTC has reached levels that previously signaled a bottom was forming (or wasn’t too far out).”

This is not financial advice.

Stay safe out there frenz,