Hi HODLers, Hiveans and Lions,

Despite the recent market bounce, I continue to doubt that the US economy is going to get better in the coming quarters. I do understand that we have reached probably the high-end of interest rates but there are a lot of headwinds coming.

- Geopolitical tensions might increase inflation (less trades, more defense spending and higher price for basic resources)

- US Consumers' savings are completely depleted and if you combine this with higher monthly house and auto mortgages as well as increasing payments on credit card debt. Well... the party is about to stop

As of now, massive layoffs did not happen but companies are cutting on spending (travel, extra perks...) and hiring less.

Yesterday, LVMH the leading luxury group published its 3rd quarters sales and they disappointed. Usually, they do not. Sales were slowing in Asia (China mostly), in Europe (everywhere) and in the US.

This sector has been weathering storms for the past 15 years, continuously growing and now they are sharing that the consumer is looking at price points, does not want to buy as much as before...

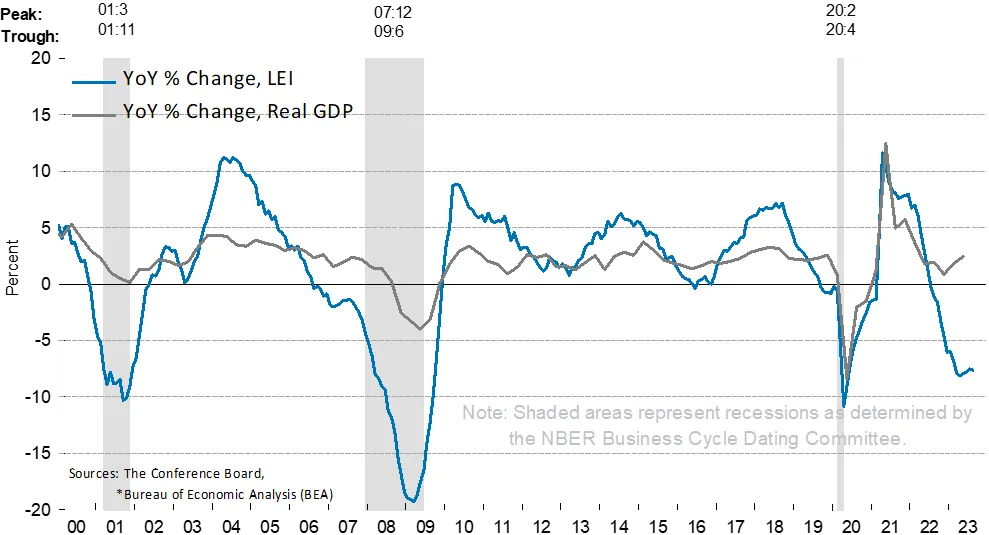

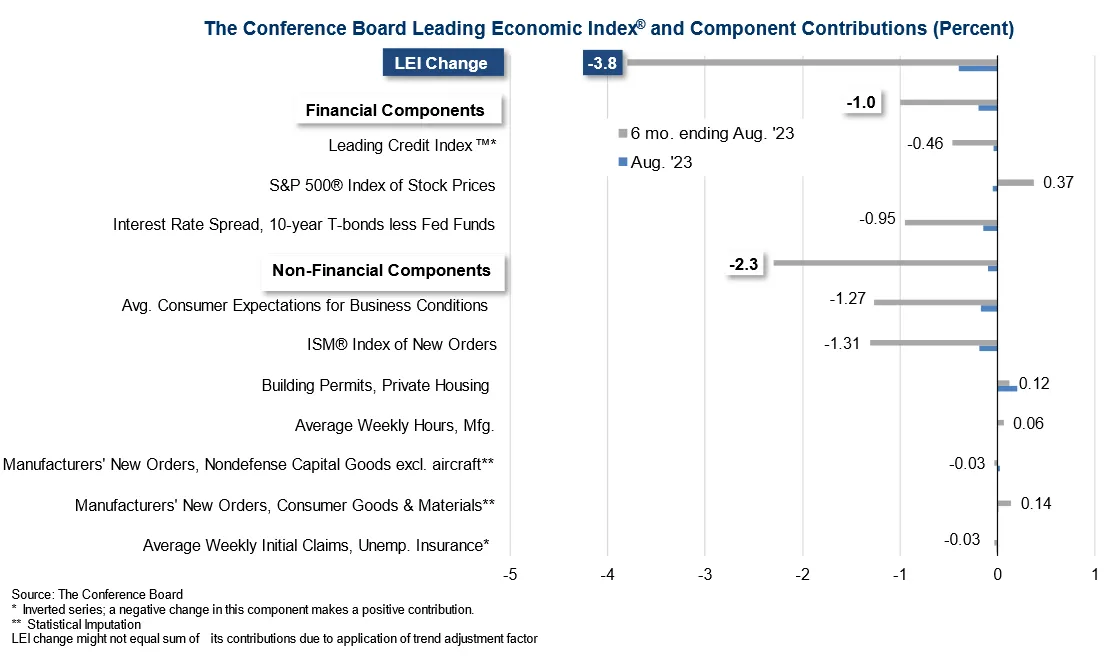

Conference Board Leading Indicators

This is something I really value and some top notch data followed by the finance world. They do not publish often new data points but when they do, you better watch out. This is calculated using a lot of different metrics weighted by order of importance.

I think the graph is pretty easy to understand.

We should soon have the September data point.

Stay safe,