Script is here.

This is a simple R script to keep track of crypto investment. The script enables user to record and track investments with two functions:

add_trade()

with which user can record transactions, e.g., deposit, withdraw or exchange. And

portfolio_value()

which evaluates real time portfolio value in user specified crypto or fiat currency. We'll create a function to make naive price prediction as well as the two functions mentioned.

First, check if required packages are installed. If not, install them:

if (!require("jsonlite")) install.packages("jsonlite")

if (!require("dplyr")) install.packages("dplyr")

if (!require("ggplot2")) install.packages("ggplot2")

if (!require("forecast")) install.packages("forecast")

if (!require("plotrix")) install.packages("plotrix")

It's a good practice save trade history in disk. We'll save it as .csv file which allows analysis using other software as well. The below code chunk checks if there's a file named trade_histoy.csv in user's working directory. If not, the code will create one. Issue getwd() to see current working directory and setwd(<directory path>) to set working directory.

if(!file.exists("trade_history.csv")){

trade_history <- data.frame(type=factor(levels = c("deposit", "wtihdraw", "exchange")),

deposit_amount=double(),

deposit_currency=factor(),

withdraw_amount=double(),

withdraw_currency=factor(),

exchange_name=character(),

remark=character(),

date=character(), # year-month-day format eg 2017-07-18

stringsAsFactors=FALSE)

write.csv(x = trade_history, file = "trade_history.csv", sep = ",", row.names = FALSE)

}

We inspect what our old or newly created trade_history.csv contains. First load the data with read.csv() function, store that data in an R variable named trade_history and see top few rows of that R variable with head(trade_history:

trade_history <- read.csv(file = "trade_history.csv", header = TRUE, sep = ",")

head(trade_history)

Output of head(trade_history) is:

[1] type deposit_amount deposit_currency withdraw_amount withdraw_currency exchange_name remark date

<0 rows> (or 0-length row.names)

Since we haven't yet entered any trade/transaction, it's a dataset with 0 rows. Lets create the function named add_trade() so we can add transactions easier:

add_trade <- function(type, deposit_amount = 0, deposit_currency = NA,

withdraw_amount = 0, withdraw_currency = NA, exchange_name = NA,

remark = NA, date = NA) {

new_trade <- data.frame(type, deposit_amount, deposit_currency,

withdraw_amount, withdraw_currency, exchange_name, remark, date)

read.csv(file = "trade_history.csv", header = TRUE, sep = ",") %>%

rbind(new_trade) -> "trade_history"

write.csv(x = trade_history, file = "trade_history.csv", sep = ",", row.names = FALSE)

assign(x = "trade_history", trade_history, envir = globalenv())

}

Now add a few transactions with the function add_trade() we just created:

add_trade(type = "deposit", deposit_amount = 0.2, deposit_currency = "BTC", remark = "gift from brother", date = "2017-07-01")

add_trade(type = "deposit", deposit_amount = 5, deposit_currency = "XMR", remark = "purchased", exchange_name = "poloniex", date = "2017-07-02")

add_trade(type = "deposit", deposit_amount = 1, deposit_currency = "ETH", remark = "mining reward", date = "2017-07-05")

add_trade(type = "deposit", deposit_amount = 200, deposit_currency = "STEEM", remark = "Steemit rewarrd", date = "2017-07-06")

add_trade(type = "trade", deposit_amount = 1.1, deposit_currency = "ZEC", withdraw_amount = 0.1, withdraw_currency = "BTC", remark = "Exchanged BTC for ZEC", date = "2017-07-09")

add_trade(type = "trade", deposit_amount = 4.6, deposit_currency = "ETC", withdraw_amount = 2, withdraw_currency = "XMR", remark = "Exchanged XMR ETC", date = "2017-07-10")

add_trade(type = "trade", deposit_amount = 65, deposit_currency = "EOS", withdraw_amount = 0.5, withdraw_currency = "ETH", date = "2017-07-14")

add_trade(type = "withdraw", withdraw_amount = 0.5, withdraw_currency = "XMR", remark = "lost wallet key")

See our first 5 transactions (rows) of trade history by running head(trade_history, 8)

type deposit_amount deposit_currency withdraw_amount withdraw_currency exchange_name remark date

1 deposit 0.2 BTC 0.0 <NA> <NA> gift from brother 2017-07-01

2 deposit 5.0 XMR 0.0 <NA> poloniex purchased 2017-07-02

3 deposit 1.0 ETH 0.0 <NA> <NA> mining reward 2017-07-05

4 deposit 200.0 STEEM 0.0 <NA> <NA> Steemit rewarrd 2017-07-06

5 trade 1.1 ZEC 0.1 BTC <NA> Exchanged BTC for ZEC 2017-07-09

Note that we don't need to supply values for all the arguments. Empty argument values default to NA. This, however, doesn't provide compact info about our portfolio. Let's create a function and name it portfolio() that will:

portfolio <- function() {

deposit <- aggregate(trade_history[c("deposit_amount")],

by = trade_history[c("deposit_currency")], FUN=sum)

names(deposit) <- c("currency", "deposit_amount")

withdraw <- aggregate(trade_history[c("withdraw_amount")],

by = trade_history[c("withdraw_currency")], FUN=sum)

names(withdraw) <- c("currency", "withdraw_amount")

portfolio <- full_join(x = deposit, y = withdraw, by = "currency")

portfolio[is.na(portfolio)] <- 0

portfolio$available <- portfolio$deposit_amount - portfolio$withdraw_amount

assign(x = "portfolio", portfolio, envir = globalenv())

print(portfolio)

}

Unlike add_trade(), this portfolio() function doesn't take any argument. Just issue portfolio() which in our case returns a compact table:

currency deposit_amount withdraw_amount available

1 BTC 0.2 0.1 0.1

2 EOS 65.0 0.0 65.0

3 ETC 4.6 0.0 4.6

4 ETH 1.0 0.5 0.5

5 STEEM 200.0 0.0 200.0

6 XMR 5.0 2.5 2.5

7 ZEC 1.1 0.0 1.1

If were to know how much the portfolio is worth in, say, USD, EUR, CNY or BTC? Let's create a function portfolio_value() that will do our job:

portfolio_value <- function(priced_in) {

for(i in 1:nrow(portfolio)) {

url <- paste0("https://min-api.cryptocompare.com/data/price?fsym=", portfolio[i, 1], "&tsyms=", priced_in, collapse = "")

unit_price <- fromJSON(url)[[1]]

portfolio$value[i] <- unit_price * portfolio$available[i]

}

assign(x = "portfolio_value", portfolio, envir = globalenv())

print(portfolio_value)

print(paste("Total portfolio value in", priced_in, sum(portfolio_value$value)))

lbls <- paste0(portfolio$currency, " : ", # Create labels for plot

sprintf("%.2f", (portfolio$value / sum (portfolio$value))*100), "%")

pie3D(portfolio$value, labels = lbls,

explode=0.1, main="Portfolio value")

}

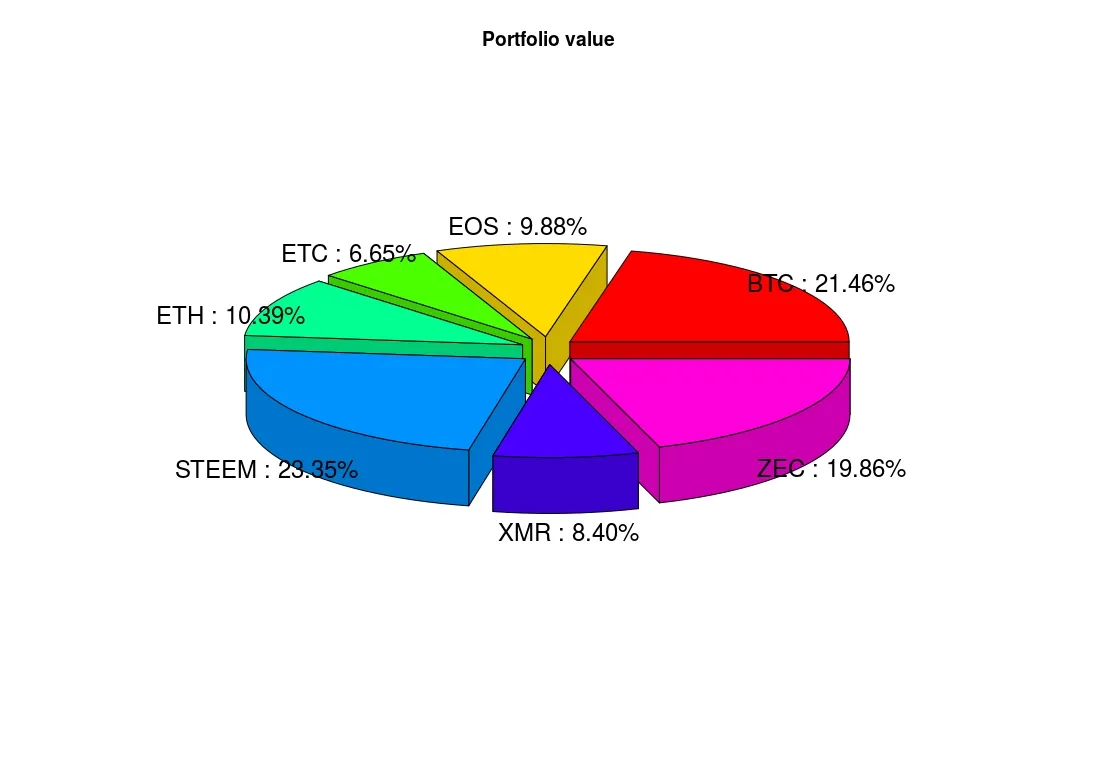

The portfolio_value() function takes one argument - the currency in which we want to evaluate our portfolio. Standard symbols are accepted like, USD, EUR, BTC, ETH. I would like to know how much it's worth in Chinese Yuan symbled CNY:

So I execute portfolio_value("CNY") which returns the below table as well as the pie chart:

currency deposit_amount withdraw_amount available value

1 BTC 0.2 0.1 0.1 1585.070

2 EOS 65.0 0.0 65.0 729.950

3 ETC 4.6 0.0 4.6 491.418

4 ETH 1.0 0.5 0.5 767.625

5 STEEM 200.0 0.0 200.0 1724.000

6 XMR 5.0 2.5 2.5 620.150

7 ZEC 1.1 0.0 1.1 1466.366

[1] "Total portfolio value in CNY 7384.579"

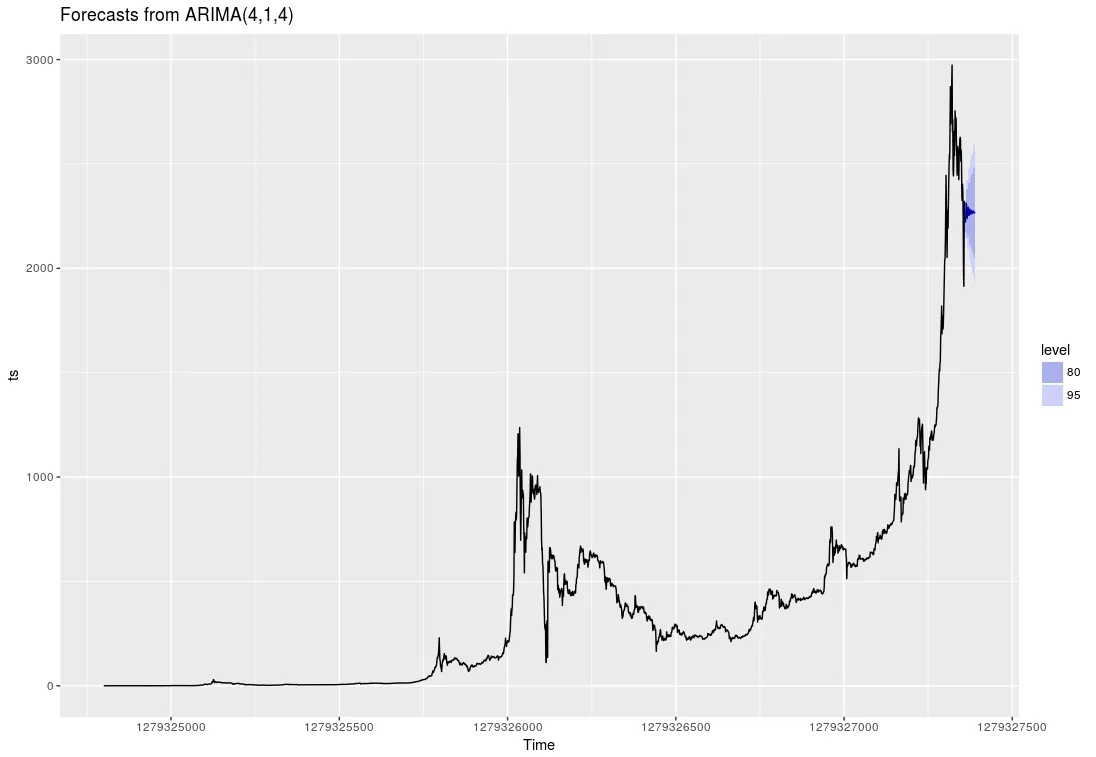

We might be interested in some predictive analysis of portfolio performance. Let's see how we can make prediction using simple method. I would like to know how BTC is going to perform in the next 30 days against USD. Let's create a function so we can do same thing for all currencies:

predict_currency <- function(currency, priced_in, period) {

url <- paste0("https://min-api.cryptocompare.com/data/histoday?fsym=", currency, "&tsym=", priced_in, "&allData=true", collapse = "")

histoday <- fromJSON(url)

ts <- ts(histoday$Data$close, start = histoday$Data$time[1])

fit_arima <- auto.arima(ts)

autoplot(forecast(fit_arima, period))

}

Now run predict_currency("BTC", "USD", 30). It generates the below graph in which colored region indicates the likely price of BTC in USD in the next 30 days:

Run for, example, predict currency("ETH", "BTC", 7) to get estimated ETH price in BTC for the next 7 days. It would be nice to create a predictive function for our portfolio like:

predict_portfolio <- fuction (period) {

# do things

}

We'll do this in the next post.

I just uploaded the script in my git repo. Feel free to contribute and provide suggestion to improve code so it can be actually be used by others. Thanks!