Yeah great naming convention europe, props for that!

It was interesting to see apps like revolut jump straight into the fanfare about it, because it's obvious it’s going to impact that fintech market straight away. They are already ahead no doubt and they are recruiting people like crazy — I’m expecting that service to have a shelf life of a few years before they sell out to a bank so basically back to square one.

I don’t bring any technical information to the mix in this post, if you want to read up on it this piece from dw.com I think is pretty solid — PSD2: New EU rules to make credit card transactions cheaper, faster and safer | News | DW | 13.01.2018

Loving the fact that ‘extra charges’ will fall away (not without a fight I’m sure, expect account charges in 3-2-1) and I do like that we have this third party sharing thing. Especially if we end up with some blockchain fintech companies jumping into that space with AI or neural networks being ‘suggestive’ of ways to invest our resources in projects both local and global.

That could bring about a new ‘all boats’ rise situation and approach to the way we look at value itself, instead of this race to the lambo bullshit i often see with people desperate to be millionaires like it matters.

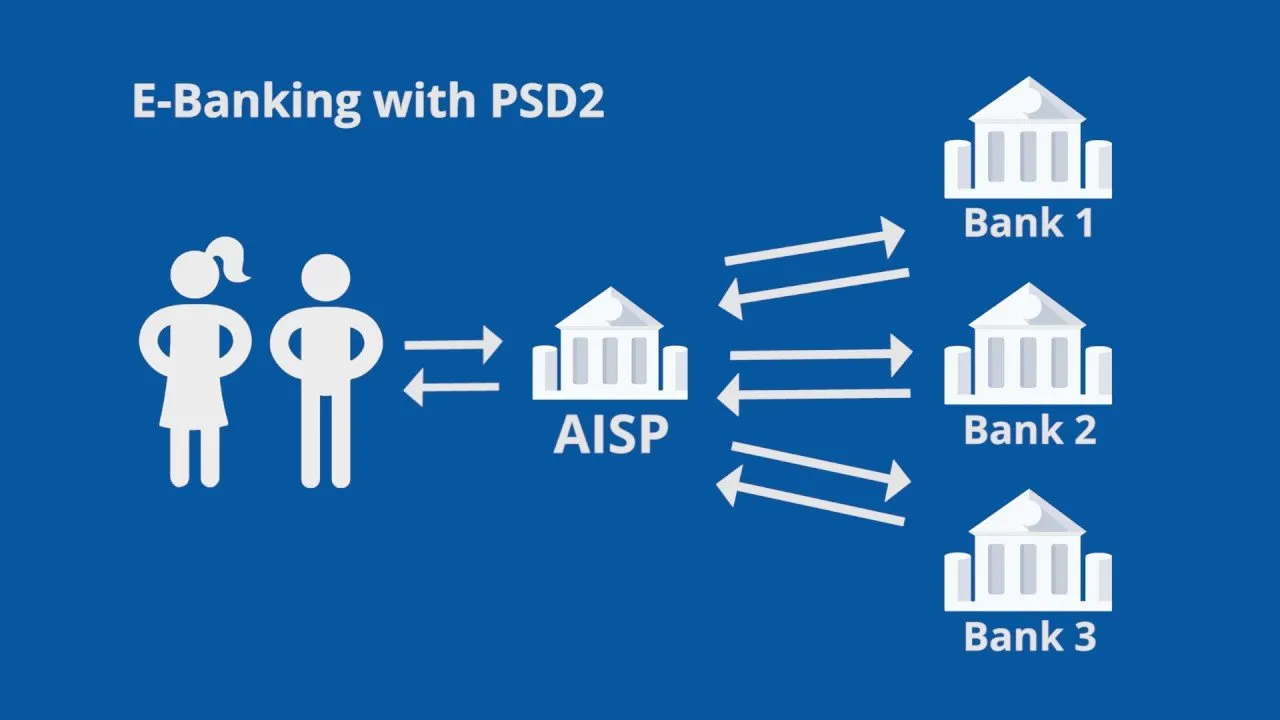

Also feels like this is the EU ‘catching up’ I mean take Estonia with their @eresidency program x-road that they have had for years which does exactly this, one app - many data silo points to bring information in. It’s not like it’s something new really it’s just about tearing down some of those privacy walls of access to locked away silos.

You only have to look at the data of 86% of under 30’s being ‘ok’ with giving access after all banking should be an app on a phone in the digital age, this is 2018 for god sake. Do we really need the high street full of banks with humans in when a huge chunk of the work that banks supposedly do for us can be automated anyway?

My own interactions with banks over the years has left me frustrated, annoyed, felt like it was just an upsell and they have weird ways of looking at overdrafts (like, surely a limit is a limit that you can’t go over?! -- I say bring on the mobile, local, global, connected blockchain economy of digital assets banking. Let me money work for me, let it contributes to the global good of my fellow humans and let me invest in projects like kiva.org with the flick of a switch — maybe this way would be better to teach our children a better way to manage money than the way you see in school.

Of course on the flip side, I do have privacy and data paranoia but that’s the world we live in, data and silos are bought and sold, cross-referenced by ‘agencies’ and ‘services’ from all nations to the act of data mining and algorithm analyse. In a world rapidly marching into quantum communications the more routes into cross-referencing that’s possible the more it’s going to be suggested — money to me has always been this multi-headed hydra no matter what head you cut off ;)

I guess in some ways it’s why visa is so damn scared of allowing companies like wave crest to issue credit cards to crypto currency needing fiat customers. Maybe they didn’t like not being the people to do it, maybe they cut of a head so that they could grow another and be seen as the company to ‘innovate’ on the back of someone else’s idea — you can’t change the middleman without changing the greed and the behaviour of the people at the wheel and you can be damn sure they wanna hold onto the wheel as long as possible for the journey outcome they have.

In a world that won’t stop for any middleman and that has access to information and choices, with communities popping up localised mesh networks and people getting back to speaking to other people face to face about their wants and needs, skills and services we are seeing the utopian vision of what arpanet did for defense networks — from war to porn, to social media to social blockchains, you just can’t stop this SS t’internet ;)

p.s - The Government must comply with EU directives until Britain leaves the bloc, although these changes will become part of UK law so will remain after Brexit