Introduction

Even if you have never heard of it you are likely familiar with what is known as the Sunk Cost Effect (SCE) or Sunk Cost Fallacy.

What is it?

According to Arkes and Blumer (1985) it is:

"a greater tendency to continue an endeavor once an investment in money, effort, or time has been made."

It is a form of bias based on past decisions that is based on an irrational economic view.

Common Examples

There are so many ways that the SCE can manifest in every day life that it is impossible to list every potential example.

Some common ones would be:

- Occupational -persisting in a job due to time/effort already invested.

- Relationships - persisting in a relationship due to previous time/emotional/financial investment.

- Investing - continuing to persist in a failing investment due to past money you have put in.

- Maintenance - spending more money on maintining an old car than a better quality used car would cost due the previous "sunk" cost.

A More Detailed Example - Aircraft Research Question

In their 1985 paper "The Psychology of Sunk Cost", Arkes and Blumer use a number of experimental examples where they gave participants various pairs of questions to answer.

Here is one pair:

Question 3A (in the paper)

As the president of an airline company, you have invested 10 million dollars of the company’s money into a research project. The purpose was to build a plane that would not be detected by conventional radar, in other words, a radar-blank plane. When the project is 90% completed, another firm begins marketing a plane that cannot be detected by radar. Also, it is apparent that their plane is much faster and far more economical than the plane your company is building. The question is: should you invest the last 10% of the research funds to finish your radar-blank plane?

Answers: Yes 41 No 7

Question 3B.

As president of an airline company, you have received a suggestion from one of your employees. The suggestion is to use the last 1 million dollars of your research funds to develop a plane that would not be detected by conventional radar, in other words, a radar-blank plane. However, another firm has just begun marketing a plane that cannot be detected by radar. Also, it is apparent that their plane is much faster and far more economical than the plane your company could build. The question is: should you invest the last million dollars of your research funds to build the radar-blank plane proposed by your employee?

Answers: Yes 10 No 50

In question 3A it would appear that people's willingness to invest is affected by the money they have already "sunk" into the research to develop the plane.

Even though the competitor and the chances of success of the plane are identical in both cases the "sunk" cost results in a decision that may otherwise be considered irrational.

N.B. In response to criticism that cost inequality between 3a and 3b might have affected outcomes, they redid the test with a modified version of 3b that had the same total (10 million dollars) cost for both planes.

The results were identical.

Theories For Why the SCE Occurs

Prospect Theory

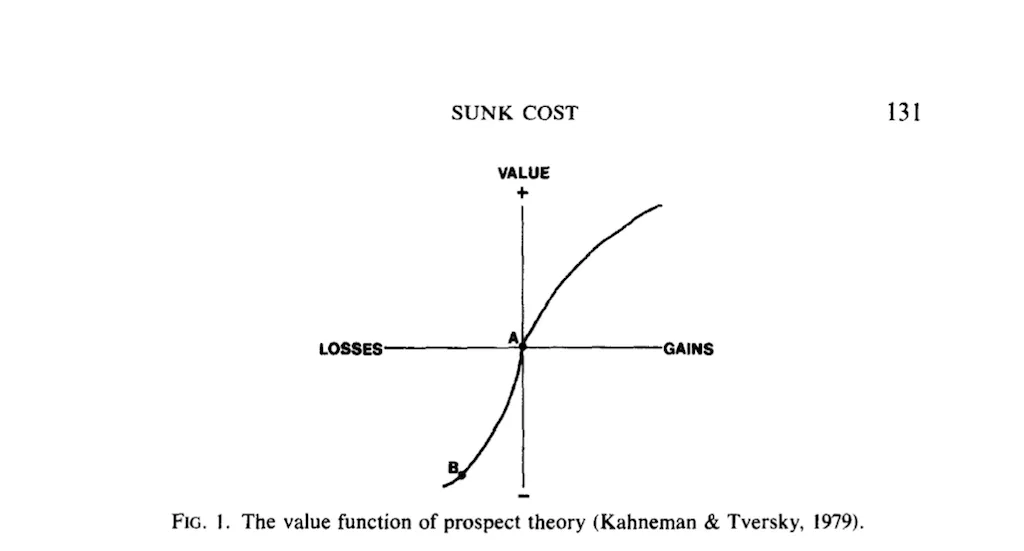

This relates to the subjective value of losses and gains. An illustration of this is provided by the following diagram:

Someone with a "sunk" cost would start at point B, whereas a new investment would start at point A.

According to Arkes and Blumer:

"At point B further losses do not result in large decreases in value; however, comparable gains do result in large increases in value. Therefore an investor at point B in Fig. 1 will risk small losses in order to obtain possible large gains. "

It is therefore at least in part a function of subjective perception.

The Admission of Waste

This is put forward by Arkes and Blumer as equally important.

The reason people keep investing is because failure to do so would imply waste of the previous investment.

This is not only internally problematic for the subject but it may also invoke social stress if it relates to something that others may be aware of.

Waste is generally seen as being very negative in societal terms.

By continuing the investment the subject continues the prospect that the investment may eventually pay out (no matter how small that possibility is).

The previous money is therefore not wasted as it may still pay out in the long term - at least in the mind of the subject.

This can also be seen to bear some relation to cognitive dissonance theory in that a behaviour which may be considered maladaptive is continued in order to reduce potential dissonance.

Related Theories

Cognitive Dissonance (CD)

This article has a useful summary of CD:

a powerful motive to maintain cognitive consistency can give rise to irrational and sometimes maladaptive behavior.

As mentioned earlier this bears some similarities to SCE, however, according to Arkes and Blumer (in reference to CD research):

Numerous studies have shown that once a subject is induced to expend effort on an onerous task, the task is revalued upward

This does not really seem to apply to Sunk Cost Effects:

There are differences...in dissonance research subjects who have no sufficient justification for performing an onerous task improve their attitude toward the task. In the sunk cost situation, on the other hand, it is unlikely that investors begin to enjoy their floundering investments.

Some aspects of dissonance may apply but it is not really a complete fit or explanation.

Entrapment Theory

Subjects in entrapment situations typically incur small, continuous losses as they seek or wait for an eventual goal. Brockner et al. cite the example of waiting for a bus. After a very long wait, should you decide to take a cab, thereby nullifying all the time you have spent waiting for the bus?

This is similar to the SCE in that the time you have already waited could be seen as being "sunk".

Continued investment could be an analogue to small continuous losses.

There are differences too.

Continuing to wait is not as irrational from an economic standpoint as most sunk cost examples.

If you wait long enough a bus will eventually arrive.

If you keep investing in the plane from the earlier example there is no guarantee that it will be a success.

Foot in the Door (FITD)/Low Ball (LB) Techniques

These are both versions of an old sales technique.

Getting someone to comply with an initial small request increases the likelihood that they will comply with a larger request later:

An example would be first having people sign a petition to encourage legislators to support safe driving laws. Later, the petition signers are asked to display on their lawn a large sign that reads, “Drive safely.”

The Low Ball technique is similar:

When the small and large requests are for the Same target behavior, the technique is called the “low-ball” procedure (Cialdini, Cacioppo, Bassett, & Miller, 1978). An example would be getting someone to agree to buy a car at a discounted price and then removing the discount. The initial decision to buy heightens willingness to buy later when the car is no longer a good deal.

This bears some superficial relation to Sunk Cost.

An investment which would be less likely to be made on it's own becomes more likely in the face of a previous investment.

There are differences though as Arkes and Blumer point out:

A major difference between the sunk cost effect and the two techniques is that compliance is the dependent variable with the two techniques. Compliance typically plays no role in the sunk cost effect.

Put simply compliance is responding to a request from another person.

This is different from what occurs in the SCE, as in that case the person is responding to their own internal request and an outside agency does not come into it.

It is believed that FITD/LB work on the basis of "self-perception" theory:

A person observes himself or herself complying with a request to support good driving or a charitable organization. The person then concludes, “I’m the sort of person who supports that cause.” This conclusion based on self-observation then results in a high level of compliance when the larger request is made later (Snyder & Cunningham, 1975).

This is not really consistent with the SCE.

Using the plane analogy it is unlikely that you would continue to invest in developing the plane merely because you are "the kind of person who invests in developing planes".

Conclusion

I hope you have found this summary of the Sunk Cost Effect useful.

If you are familiar with investing or trading then it is likely you have encountered it in it's more obvious financial guises but it applies just as much to other domains.

Many of us may have found ourselves in relationships or jobs where we felt our prior investment of time or effort meant that we had to persist.

The type of investment is not important, merely that there is some kind of investment which affects our current or future decisions.

What examples have you encountered? Let me know in the comments.

References

- Arkes, Hal R., and Catherine Blumer. 1985/2. “The Psychology of Sunk Cost.” Organizational Behavior and Human Decision Processes 35 (1): 124–40.

- Thaler, Richard. 1980/3. “Toward a Positive Theory of Consumer Choice.” Journal of Economic Behavior & Organization 1 (1): 39–60.

- McLeod, Saul. 2017. “Cognitive Dissonance Theory | Simply Psychology.” Accessed January 19. http://www.simplypsychology.org/cognitive-dissonance.html.

Thank you for reading

Before you go have you filled in the Coinbase form to list STEEM? It only takes a few seconds. THIS POST shows you how.

If you like my work please follow me and check out my blog - @thecryptofiend

All uncredited photos are taken from my personal Thinkstock Photography account. More information can be provided on request.

Are you new to Steemit and Looking for Answers? - Try:

Before you go have you filled in the Coinbase form to list STEEM? It only takes a few seconds. THIS POST shows you how.

If you like my work please follow me and check out my blog - @thecryptofiend

All uncredited photos are taken from my personal Thinkstock Photography account. More information can be provided on request.