Hello, @empoderat!!!

Thank you so much for another report of the project and its progress. We truly appreciate you keeping us informed.

My understanding is that the 15% APR inflation is our cost to attract capital, based on the thesis that the portfolios performance will outperform by far that cost. With that in mind, I thought it would be an interesting exercise to analyze the efficiency of this growth engine.

The "Cost": Based on the calculations, with 160k HP delegated and a 15% APR, the project is paying the equivalent of ~65.75 HIVE daily (or ~1,972 HIVE per month) in rewards via PWR tokens. This would be the cost to incentivize and maintain the delegated capital (our growth engine).

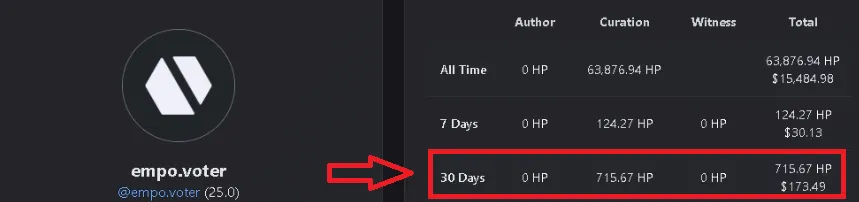

The "Return": To analyze the return on that investment, I checked the curation rewards for the @empo.voter account over the last 30 days, where approximately 715 HP were generated. This would be the return obtained directly from using those delegations.

This leads me to think that the current cost of the delegations is (~1,972 HIVE/month) which is significantly higher than the direct return they generate Us (~715 HIVE/month).

I know and understand that the ultimate goal is not the profitability of curation itself, but rather the AUM growth of the main portfolio, which these funds act like fuel. The question that arises after all this wall of text is: is this "cost of capital acquisition" (a deficit of ~1,250 HIVE/month from this operation) factored into the project's strategy?

I believe this operational efficiency metric would further strengthen investor confidence by providing a deeper understanding of how the project's growth engine works.

Again, thank you so much for all your work and for creating this project!

Pp.

RE: [#20 & #21] - Monthly PWR Holdings Report