Introduction

Governments of different countries have different stands on cryptocurrencies. Accordingly, they have introduced various control mechanisms - fully legal, semi legal, and outright illegal.

These control mechanisms generate arbitrage possibilities and so provide opportunities to risk takers to earn profit by working around the control mechanism. Blockchain enabled cryptocurrencies further reduce overall risk of risk takers.

Hypothesis

The exchange rate of currency for a country, if free of control, will leave no scope for arbitrage between unofficial exchange rate and official exchange rate. On the other hand, if controlled by any means, will generate arbitrage opportunity between unofficial exchange rate and official exchange rate.

Data Collection and Analysis

To study the impact of control mechanisms on exchange rate (one component of monetary policy) - cryptocurrency data can be used as described below:

In India the RBI has banned banking relationship of all crypto exchanges. This step has forced many crypto exchanges to close down and others to move to peer-to-peer (p2p) model. Although p2p model is not illegal, as trading and possessing crypto in India is yet not declared illegal, but due to ban on banking shifts the crypto trading activity from fully transparent to semi-transparent. Therefore, the deals that are executed in p2p model are expected to have a different exchange rate than the official exchange rate of INR-USD.

Official INR-USD exchange rate is quoted on various exchanges and data is easily available. I call it EXR-RBI. To estimate unofficial INR-USD exchange rate from crypto space I did following:

- Take BTC-INR rates from BitcoinRates for different exchanges. This website collects and provides data for BTC-INR rates from Indian p2p exchanges where deals are done in INR only. A total of 13 exchanges data is available on this website. I took data for all the exchanges and averaged separately for buy rates and sell rates.

- Take BTC-USD rates from CoinMarketCap.

- In order to get unofficial INR-USD exchange rate for sell, I divide BTC-INR sell rates with BTC-USD Rates. This I call EXR-CRYPTO-Sell.

- In order to get unofficial INR-USD exchange rate for buy, I divide BTC-INR buy rates with BTC-USD Rates. This I call EXR-CRYPTO-Buy.

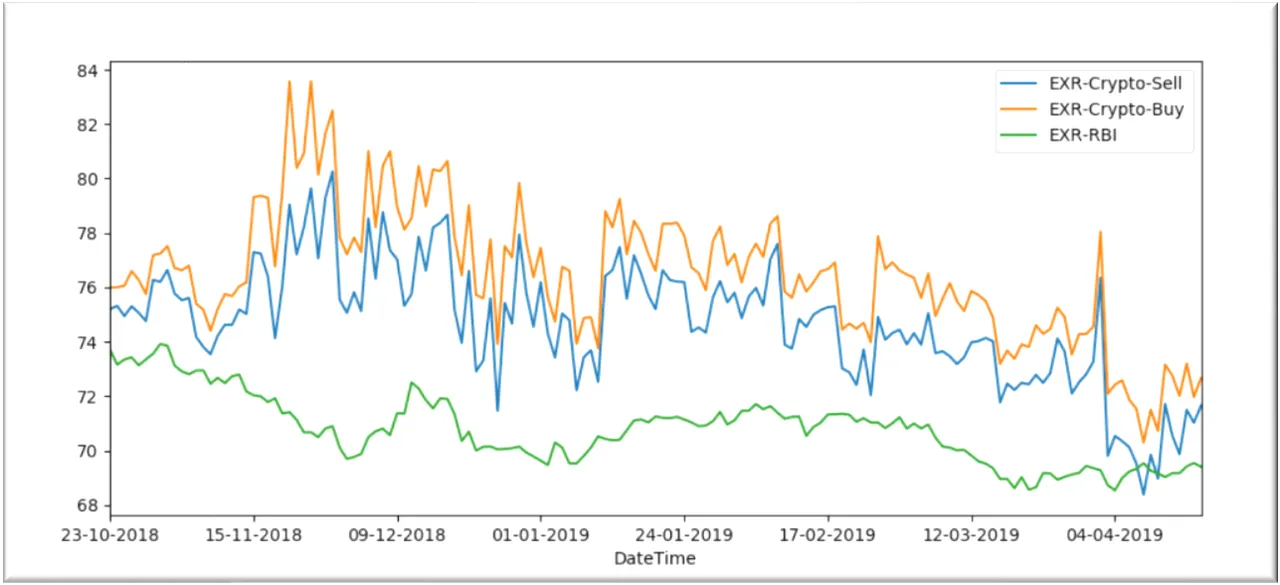

I analyzed the data for last six months and same is displayed in below chart.

Observations and conclusions

- On average the official exchange rate is lower than unofficial exchange rate. Means RBI is using measures to keep pushing up the INR against USD.

- The difference between official and unofficial exchange rate, on average, is 5-15%. This difference is the result of various control mechanisms that RBI uses to control the exchange rates.

- The buy-sell exchange rate difference for crypto is the result of buy/sell rate spread. This is relatively high spread on average between 0.5-2% and as expected for compensation against extra hassle to deal with p2p transactions.

Overall, if ban is removed, then BTC in INR will become cheaper. And buy/sell spread will also reduce.