Yesterday we learned that Ripple has finished a second round of funding (Series B) incorporating $55 millon, bringing its total capital to about $93 millon. @steempower wrote about this news and since his wording seemed a bit confusing by stating this:

this is good news for ripple with 55 Million accounting for 20-25% of their market cap before today's rally

I had to reply:

Wait a moment. Ripple the company raised 55 millon for actual shares on the company (Series B).

XRP is just a the cryptotoken. The "market cap" you are referencing is just the "market cap" of XRP (the token) and NOT the market cap of Ripple the company, which is a private held one and could one day be listed on a traditional market.

The amount of XRP that Ripple as a company holds is certainly quite significative. It is an important asset of Ripple (the company). But it is not the only asset. Actually this rounds of funding makes Ripple LESS dependant on XRP the asset.

Ripple is engaged in the ILP (Inter Ledger Protocol), a protocol that doesn't require any kind of token to transfer value. So ILP and XRP are both assets of Ripple the company, therefore nor the "market cap" of XRP (the asset) or the XRP that Ripple holds are the actual value of Ripple the company.

The value of Ripple (the company) is greater than the XRP holdings of Ripple. And each round of funding makes Ripple less dependant on XRP.

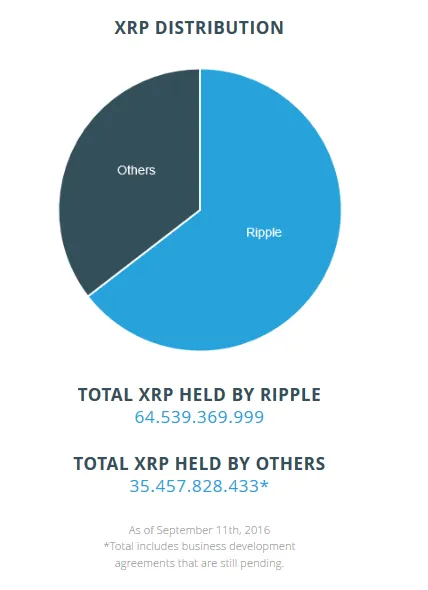

According to Ripple's XRP Portal:

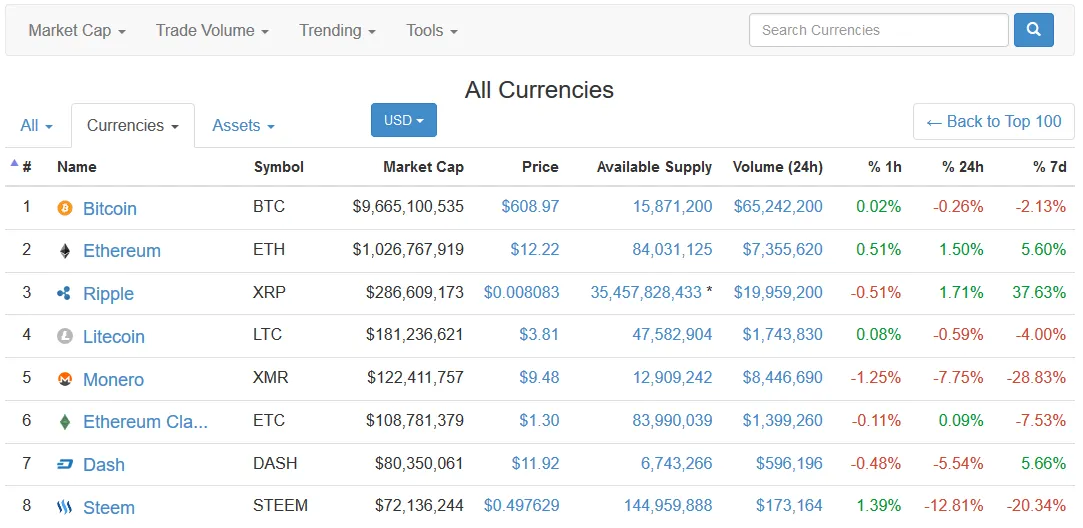

The total amount of XRP held by Ripple is 64,539,369,999 XRP (as of September 11th, 2016) , the "free float" (XRP not held by Ripple) is 35,457,828,433 XRP. The "market cap" referenced by @steempower is the free float market cap reported by coinmarketcap.com. That "market cap" is the free float ("available supply") multiplied by the XRP market price (currently $0.008048). That "market cap" of currently about $285,348,293 is "capital" outside of Ripple as a company. Is the combined XRP "wealth" held "by others" (than Ripple, the company).

But Ripple holds 64,539,369,999 XRP. Those XRP have a value too! In "steemit language" you can think of those 64 B XRP in terms of "XRP Power" (equivalent of Steem Power). According to Ripple:

we currently plan to distribute XRP primarily through business development deals, incentives to liquidity providers who offer tighter spreads for payments, and selling XRP to institutional buyers interested in investing in XRP. If market conditions permit, we expect our company to hold approximately 50 billion XRP by the end of 2021. This schedule is indicative and discretionary.

Se they plan to "Power Down" about 15 B XRP in 5 years. And 5 years from now, they will still hold 50 B of "XRP Power".

That's the way to distribute XRP into the market without actually destroying the price (and consequently destroying the value of XRP as an asset). We as Steemians are into the same logic. We hold Steem in the form of "Steem Power" because that long term commitment prevents the value of Steem to evaporate.

So there is no real "market cap" for Ripple's XRP holdings. We know the free float XRP is currently valued at

$0.008, so that's just one way to indirectly determine the value of that 64 B share of XRP's.

On the other hand, Ripple as a company has raised $55 million this time and the total capital raised is $93 million. That capital is "backed" by the value of Ripple as a company. And the value of Ripple as a company is determined by its assets. Those 64 B XRP's are just one of Ripple's assets. Some argue is the main asset, while others consider that Ripple's implementation of the Interledger Protocol is another equaly relevant "asset" from the company.

Interledger Protocol

So this is the deal: Investors on Ripple (the company) invested about $93 million. That capital is incorporated on a company that possess "assets" such as 64 B XRP, Interledger Protocol services, etc. There is no "Ripple marketcap" as Ripple the company is private held, not traded on the market.

Steemit's current state of affairs

According to coinmarketcap.com, there is a free float of 144,959,888 STEEM:

Steemit depends 100% on the capitalization of this free float. This blockchain social network costs money, servers aint free, etc. etc. etc.

But there is also Steemit Inc.. As a company, Steemit Inc. is no different than Ripple (the company). The STEEM holdings of Steemit Inc. could also be seen as assets. Steemit.com the social platform is also an asset in itself.

It is my opinion that Steemit Inc. could benefit from a "Series A" round of capitalization because it already has a proper social network working to show to investors as well as liquid crypto "assets" (STEEM) as collateral to back the incorporation of capital.

A capitalization round from Steemit Inc. (in the form of traditional shares) would enormously contribute to compensate sell pressure of STEEM.

That's the lesson Steemit Inc. could learn from Ripple, the company.