Like many, I have assisted to the extraordinary rise of XRP's price for the past few days. While some partnership news and a new flux of crypto enthusiasts may explain this surge, I am still looking for a medium or long term rationale in buying such currency.

I visited Ripple's website and challenge my initial thought by going through their saying speech.

I will consider here that XRP is looking to provide a payment network to financial institutions as they are advertising an impressive partnership netowrk with MUFG, Standard Chartered, UBS and many other banks.

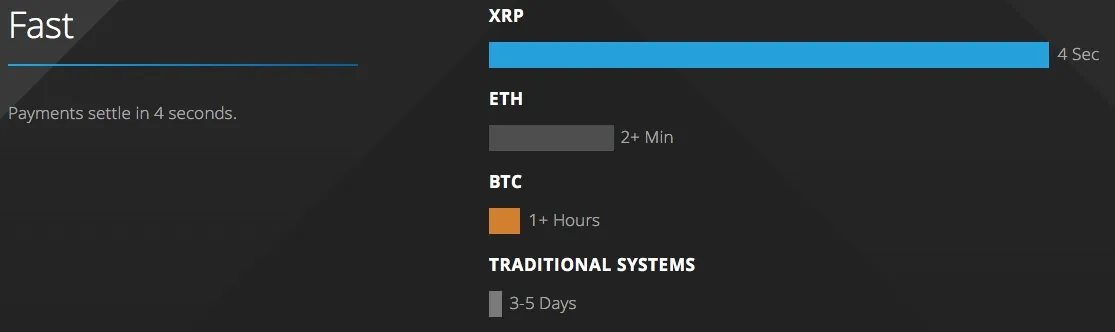

Fast: payments settle in 4 seconds. Such settlement short time is fast, but it is comparable with many other professional payment channels. On settlement date, banks transact with each others huge amounts of cash in matters of seconds. Systems are already able to transfer various assets almost instantly. I don't see anything revolutionary here.

"Traditional systems: 3-5 Days"... probably for the small shop or individual users, but not for banks.

Scalable.These performances are indeed quite good. The main selling point here would be that there is no cut-off set by the system. In traditional cash settlement systems, time limit to settle are imposed. However, they maybe be set by the "users" in order to control and process them later. So until the whole chain is automated on the bank side, companies may not fully benefit from it. Still, it's an enabler to future automation leading to efficiency in operations.

Distributed.Well yes, nothing more innovative than others. This is the definition of a block chain. However Ripple is a private one. Private distribution is nothing creative here. All professional institutions has their servers with ledgers replicated on a network. So they have to prove that they are indeed validating each transactions by various independent actors, in different locations. Given that there is no "minor" or public "validator", it's hard to confirm for the guy on the outside. We have to trust them. Wait, aren't we looking for a trustless network?

Stable.They indeed probably have been able to test their technology with real cases thanks to their XRP public transactions. However does it reflect the professional use? I don't think so. Then, the stability of the Ripple network went through private stress tests with large volume of data. Nothing innovative here, that's pretty standard for the professional world. In finance, banks, clearers, markets are doing that all the time, for any versioning. Just imagine an upgrade of a clearing market for Listed derivatives or FX? I don't think they have nothing to learn from here, however they expect the same standard. Ripple is advertising that their are matching it.

Two use cases are depicted as well.

Is XRP able to absorb a 50mio USD transaction in 1 shot without crossing an order book? I don't think the XRP market is mature enough for that.

And would a bank add XRP as a currency to hedge? If a financial institution needs USD to fund its activities, it will borrow USD, else it's extra cost. Such type of service, while being expensive, exist as banks borrow and lend to each others on a daily basis, with various settlement cycles (T0 is already there).

I find this use case a bit odd to be honest or difficult to implement at little cost in the current financial eco-system. If everyone is not joining in, it's pretty much useless.

Ripple's currency would be used to interface with other Ripple's partners or potentially access the crypto space at large (Bitcoins and others thanks to FX).

I don't think we need the XRP coin to do that but indeed they may have a technology and experience to offer to financial institution in that area. In such case, would Ripple offer some type of market exchange service? I have heard that banks area already working on that, by themselves though.

Conclusions

I don't think XRP (the coin) is of any use for financial institutions. It doesn't provide any service by itself and is far to be big enough to provide any liquidity unless it become a digital fiat thanks to a partnership with a central bank.

I believe the current investors in Ripple are seeking for technology advisory or to have their own private Ripple network, far from the public, so no involving any XRP. They would definitely benefit from such block chain to cut their external and internal operational costs, however the professionals activity can't be put at risk through a public coin (price volatility, market manipulation, etc.).

If you're a private investor in XRP, you're not buying into this partnership or any future profits made by Ripple. You're just helping to test their network and gambling with individuals.