I personally believe that Ripple is a very useful coin with spectacular technology behind it. The company also has lots of trustable people working for it. From transaction speed, scalability, transaction fee and in many other ways, Ripple actually beats Bitcoin and Ethereum at the moment. And lots of more banks are joining Ripple to work together. This has led lot of people to think that Ripple can one day pass other coins to be the number one coin. But at the end of the day, Ripple remains as a banker coin. And most of us know that it's quite centralized. The company holds more than 60% of the total 100 billion coins while little over 30% are circulating around in the market.

Ripple has had lots of price ups and downs past few months. This has been written fairly detailed by @olyup and the post can be found on below link. Although I do not hold everything he wrote as 100% accountable, I find lots of info useful and worthwhile reading.

https://steemit.com/ripple/@olyup/fck-you-money-the-rise-and-fall-of-xrp

Anyway, today, I would like to talk about how Korean markets have been involved in Ripple market.

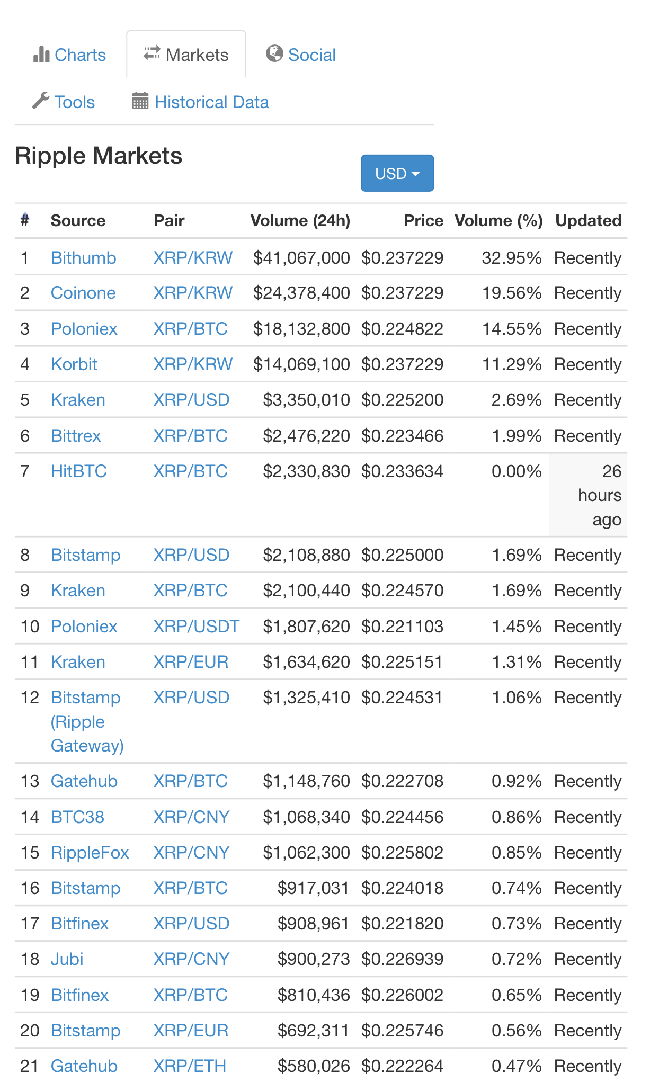

As you can see from coinmarketcap, more than 60% of total exchange volume of Ripple is from Korean exchanges.

(Top 1, 2, and 4 are Korean exchanges)

So... a token that is supposed to be global, consists 60% of trading volume occurring in one small country. When Koreans brought the price of Ethereum up starting in March as we all know, Korean market had about 40% of whole trading volume. So maybe... maybe expect price of Ripple skyrocketing sometime near future! Anyway, I somewhat believe that Ripple took the advantage of Korean power in manipulating the price.

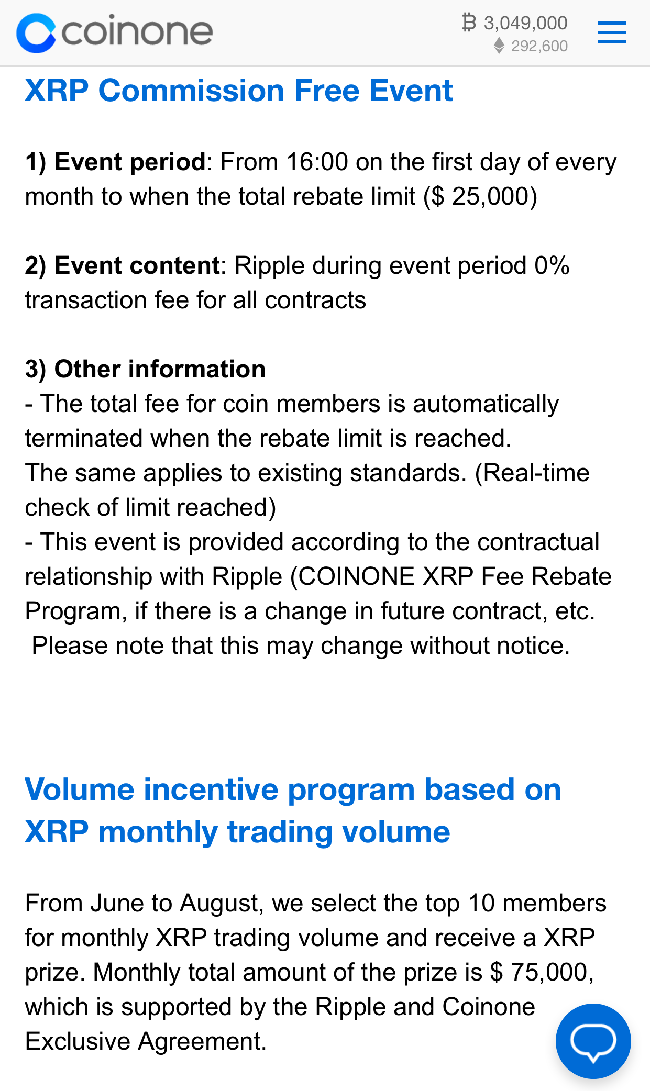

In the month of June, Coinone, second biggest Korean exchange, held an event after launching Ripple on their exchange in end of May.

Original details can be found HERE

There were actually two specific events. One was waiving trading fees. (English version says transaction fee but it is written as trading fee in Korean and indeed it was trading fee as I checked back then) The other event was to reward top 10 highest traders in volume from June 1st to June 30th in cash! Yup those top 10 traders will be rewarded with cash soon. Basically these two events triggered so many more Koreans buying in on Ripple. And there are lots of Koreans who bought in on Ripple at 50-60 cents when there was Korean premium most of them ended up losing money. Sure, this event did not directly drove up the price of XRP as majority of cryptocurrencies faced dips past month, but we cannot deny the fact that this has helped XRP to have less dips past month while other cryptocurrencies had trouble holding positions.

Even though Ripple is a great coin and it will probably go up a lot in price, I believe that a cryptocurrency is not supposed to be manipulated by the creators. More than that, I believe a cryptocurrency is supposed to be as decentralized as possible. It's also true that neither bitcoin nor ethereum is completely decentralized as well. But I mean at least.. at least trading volume should not be manipulated just like how Ripple encouraged more Koreans to join trading Ripple.

So, what do you guys think?