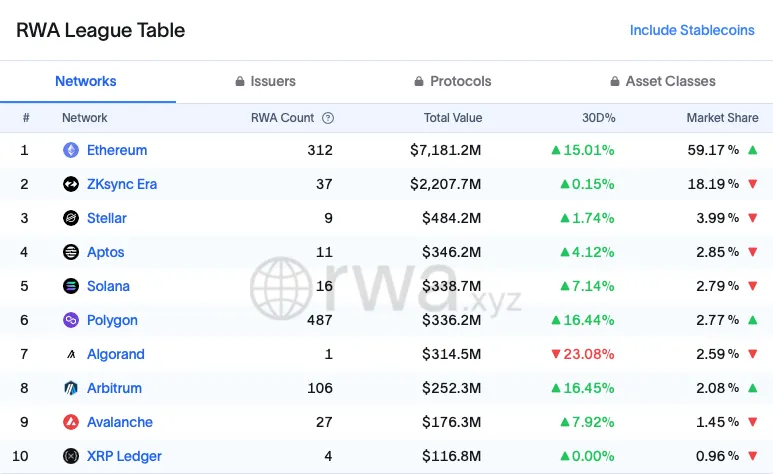

I recently discovered in a roundabout way that Ethereum is far from becoming a dead blockchain. It all happened when I was exploring the Stellar blockchain. Somewhere I saw that Stellar is in second place in terms of holding real world assets (RWA). I thought, well, that's quite interesting. That means that Stellar has a future if it's in second place. I wonder who was in first place. So then I stopped by a website. You can visit rwa.xyz where they track the total value locked of real assets (RWA) The top blockchain with RWA is Ethereum!

But in the claim about Stellar being in second place, what they fail to mention is that actually in second place is ZK Sync Era. ZK Sync, in a lot of ways, does what Cosmos does in terms of blockchain interoperability. That is, it allows blockchains to transfer in between. So you can build on one blockchain and then your assets aren't locked into that blockchain. You can transfer them over to another within Cosmos, or in this case ZK Sync, without having to use a bridge.

That actually answered another question as to why the Cronos blockchain created a third chain. They started off with a proof-of-stake chain that was built on Cosmos. Then they built a second one, Cronos, which was supposed to be EVM compatible. But then that wasn't enough. They built a third one that is a zk-sync compatible blockchain. Now, all of these three blockchains on the Cronos blockchain ecosystem will bridge together. But the question was, why did Cronos build a zk-sync version?

So this answers the question: zk-sync is perfectly built for real-world assets. ZK Sync, and ZK Sync Era are not very old; they are very recent developments. In that time, ZK Sync Era has taken up second place—actual second place to Ethereum. ZK Sync depends on Ethereum's security. So, you can say that, in some regards, it's on Ethereum. ZK Sync is ideal for RWA because institutions can build on private chains using ZK Sync without getting locked in.

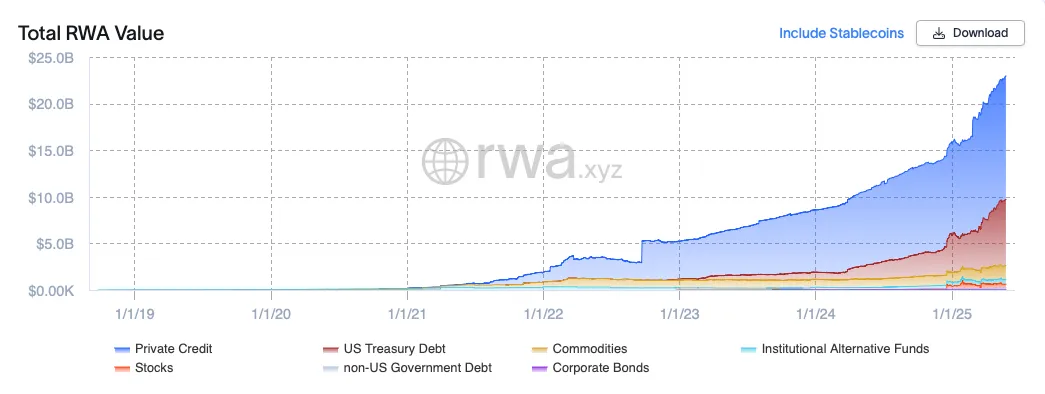

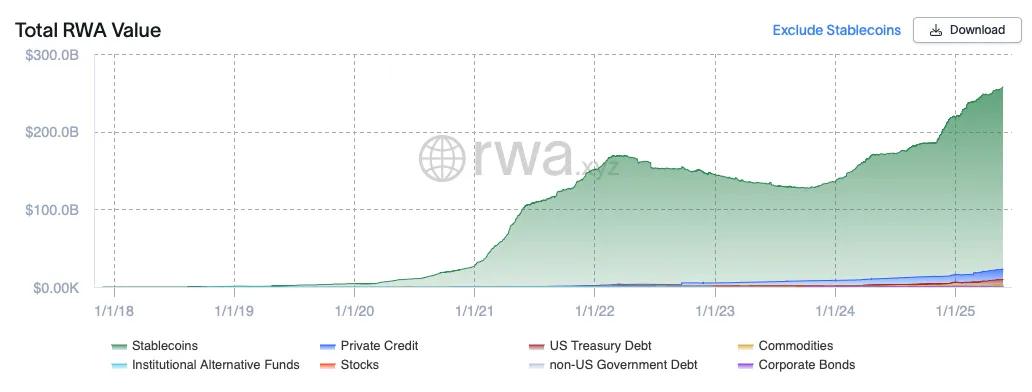

Real-world assets are rolled up into Ethereum and zk-sync in one lump sum, leaving Stellar as the second place location for storing real-world assets. Now, on the website rwa.xyz, you can find that a lot of the total value locked is in stablecoins, but it also includes other things such as lines of credit, commodities, securities, and things like that. The demand seems to be growing. It's not something that has been stagnant.

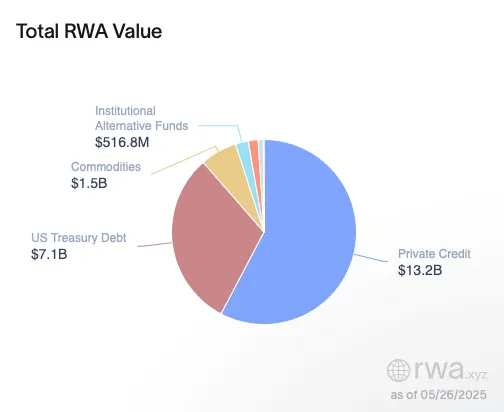

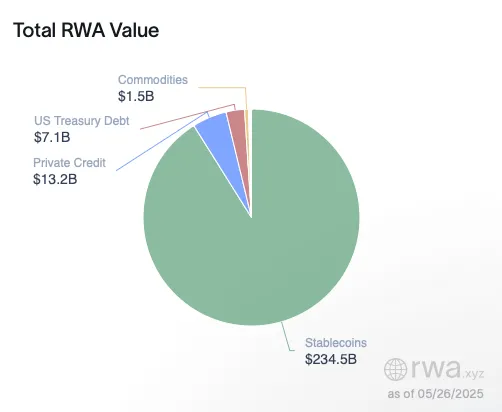

In fact, as of today, on May 26, 2025, the value is largely private credit, about $13.2 billion in private credit, $7.1 billion in U.S. Treasury debt, $1.5 billion in commodities, $516.8 million in institutional alternative funds, and $393 million in public equity. Then there's $216 million in non-U.S. government debt. As far as issuance, the large majority of issuance on these blockchains is mostly stablecoin. Competing for second place are U.S. Treasuries and private credit.

Now, in terms of market share, Ethereum has 59% of real-world assets, ZK Sync Era has 18%, and Stellar comes in at 4%, so it is hardly taking over the world in terms of real-world assets being locked on Stellar. Other blockchains that have real-world assets are Aptos, Solana, Polygon, Algorand, Arbitrum, Avalanche, and XRP. XRP comes in dead last with almost 1% of market share.

The largest market cap for real-world assets is the BlackRock USD Institutional Digital Liquidity Fund by Securitize. Tether Gold, Paxos Gold, Franklin On-Chain U.S. Government Money Fund, and so on are also large parts of TVL. So this tells us that Ethereum is far from being a dead blockchain. There is a lot going on; it just isn't reflected in the price.

Something we should remember is that Ethereum has been around for a relatively long time. Just like banks still use systems running on COBOL, they will continue to use Ethereum until the wheels fall off. I am particularly surprised that ZK Sync Era has jumped in to the mix as a powerhouse for RWA. It makes sense as developing on ZK Sync carries over the same talent that has developed on Ethereum. There is no need to relearn a new programming language.

Prior to this discovery, I was hesitant to buy Ethereum or stake it. After all, the price has been relatively dormant until recently. Now I see that Ethereum is far from dead. All the Ethereum killer blockchains have the wrong target. ZK Sync Era is eating their lunch in terms of actual use. I'm also pleased with Stellar, even if it comes in a distant third in terms of RWA. And despite making great headway into the banking system, Ripple's share of RWA is rather insignificant. Obviously, time will tell.

Images are screenshots from rwa.xyz