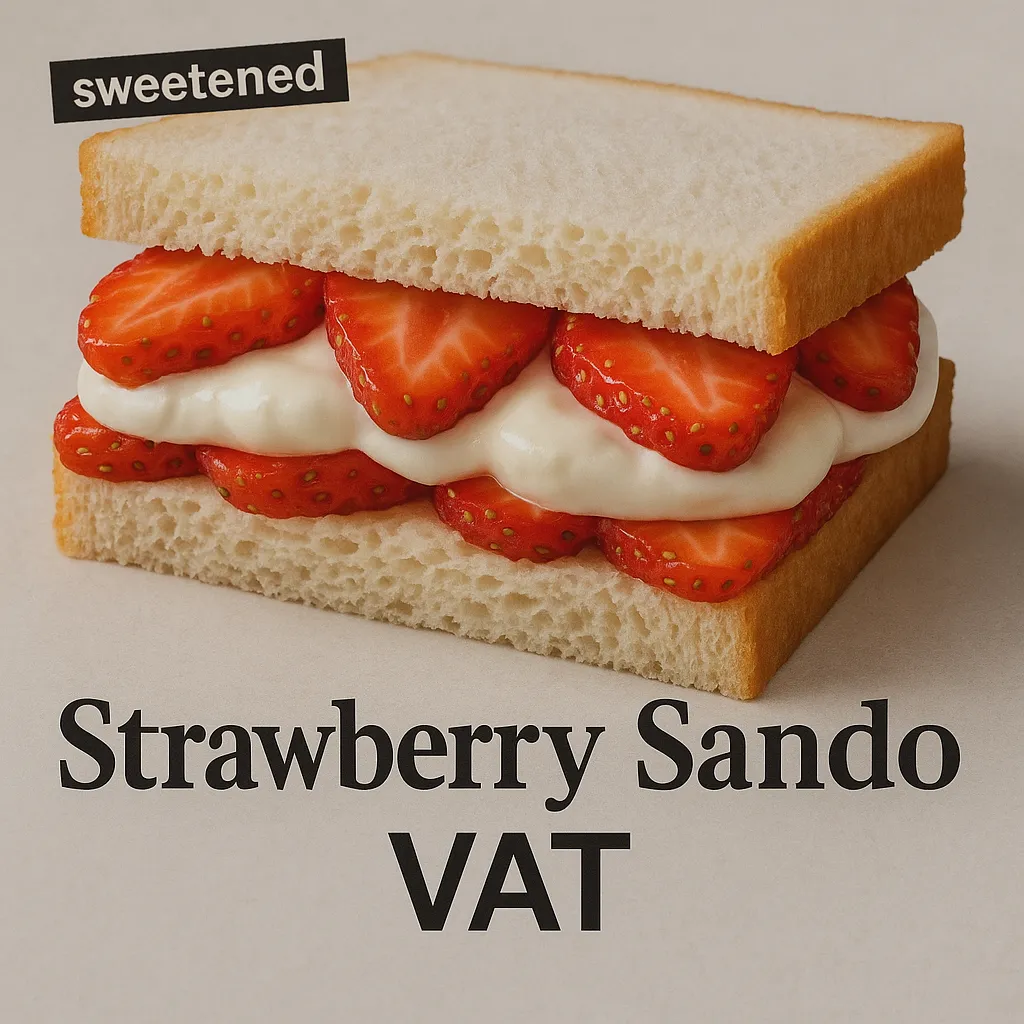

Marks & Spencer recently its own version of the Japanese "sando" – a strawberry cream sandwich that's whetting social media's appetite. While most consumers are focused on the rich taste of this new viral food, a whole different debate is brewing on LinkedIn and among tax authorities: should this sweet sando be taxed with Value Added Tax (VAT)?

This might seem like a trivial affair but it actually touches on a long and complex history of bizarre UK VAT classifications – from the infamous "is a Jaffa Cake a cake or a biscuit?" case to confusion over giant marshmallows. The M&S sando now joins this list of foods that raise tough tax questions...

VAT Law: Where Sandwiches and Semantics Collide

Under UK VAT law, most foodstuffs are zero-rated, i.e., exempt from the 20% rate of VAT. But certain classes – e.g., confectionery, beverages, and hot food – are taxable. The problem is that the Act's definitions are by no means specific.

In the case of the M&S strawberry sando, the tax problem stems from two points: the bread is sweetened, and the sandwich is to be eaten cold, hand-held. In earlier interpretations, these points tend to tip it more in the direction of constituting confectionery, as opposed to a regular sandwich – and thus taxable. As Maria Ward-Brennan observes, what begins as a cutting-edge food launch soon turns into a headache for lawyers.

Tax law experts are quick to point out that this area of law is notoriously obtuse. The rules are "thick, patchy in places, and full of exceptions that have a tendency to appear arbitrary." That obscurity renders it not just difficult for retailers, but also for HMRC itself, to interpret and apply these edicts.

What This Tells Us About Britain's Tax System

The strawberry sando is a symptom of a tax code that must be simplified. Businesses are becoming increasingly hampered by vague rules and capricious choices that rely on minor considerations such as texture or utensils with which to eat them. And a confusing tax code isn't conducive to expanding an entrepreneurial culture!

Generally, this episode serves as a reminder of how easily the popular tax debate can deteriorate into jargon. A viral sandwich is not just a fast meal — it is an exercise in the mechanisms whereby the government's taxation policy interposes itself into mundane business choices and prices.

If the sando takes hold, however, there can be little doubt that HMRC will publish a formal ruling sooner or later.

But perhaps what we really need is less ad hoc policy-making, and more comprehensive reform to ensure that tax law is fair, predictable, and — most of all — less belly-ache inducing!

Too many puns!