It's been awhile since I looked at the gold charts.

I was excited to see gold tested resistance around the 50-Day MA again today, with today’s high reaching 2,665. It looks like we also pulled back to test support around the 20-Day MA, which is currently at 2,639.

Nonetheless, it is on track to end the week at its highest weekly closing price in three weeks. It looks like it will also close above its 50-Week MA after closing below it last week for the first time since it was reclaimed in October 2023. The longer time frame weekly we are seeing strength and a better indicator of strength will be indicated if gold can close this week above that high. Markets have been bearish, but flipped today. The two outcomes are bullish rally Above 2,665 or a bearish breakdown if the price drops 2,625.

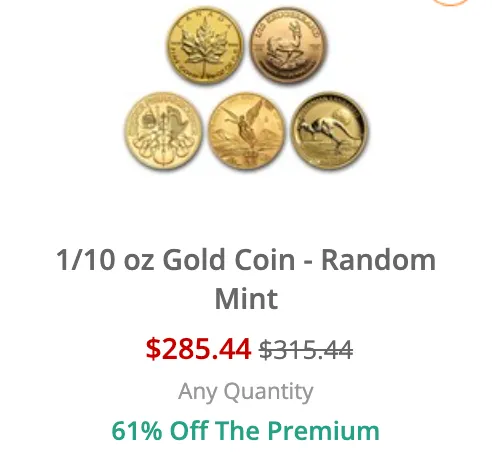

Looks at some deal it looks like there's some decent deals out there. I know I'll catch a bit of grief for using Apmex, but I like the PAMP 1oz and 1/10oz deals they are running. I'm really tempted to get these 1/10 oz!