It was about almost 28 months ago that I realize the possibility of not being able to return to my job. My health had rapidly declined such that I could pose a risk to myself or worse someone else.

“Black birds tend to like shiny things.” ~ The Bloody Raven

Disability benefits will not last and at some point another source of funding albeit markedly less will kick in. That will be beyond my control. Things will have to change. With real inflation, recession and uncertainty early retirement at our current times is less than ideal. Without the security of my job things can easily get difficult. Then again, is anything really secure?

The new calculus is that I am forced to retire well before my intended retirement date. What can I control? What do I need to do? Lets go on a little journey to see if my current finances can allow me to reasonably 'Retire'.

And enjoy the expensive shiny along the way.

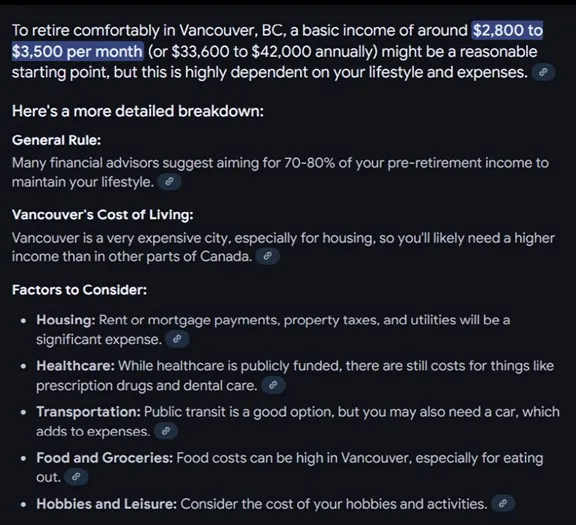

I asked Google AI; What would be a comfortable retirement income living in Vancouver BC?

The Result;

Interesting, then $33,600 to $42,000 shall be the target range, and anything more is a bonus.

Canada Pension Plan;

The maximum base benefit from the CPP ponzi is $760/month. My entitled benefit will be barely above $700/month with an extra $400/month supplementary benefit totaling $1,100/month. The previous years inflation adjustment is laughably 2.5%. This would just cover a little more than my monthly grocery expenses.

Municipal Pension Plan;

A much better run retirement fund compared to the CPP but this MPP fund relies a lot on income from a tepid commercial property market leases rather than on fresh contribution cash as the CPP. My benefit would be about $1,250CAD/month with an annual Cost-of-living adjustment (COLA) and a medical coverage perk.

RRSP/RRIF/IRA;

This is my own Tax sheltered, self contributed and self-directed retirement savings invested mostly in Mutual funds and ETFs of my choice. I am in the process of moving a significant amount from equities into cash equivalents leaving an Income & Dividend fund as my bare bones position. At only a market value $180k CAD I’m sure I could configure a modest supplementary income stream and still build some equity. I will draw only a minimum income $300.00 CAD/month to start.

As you will begin to see, my total revenue flows from multiple income streams. A principle I’ve learned years ago “…that a three legged chair is more stable than a two legged one.”

Rental Income A;

My home has a fully independent legal rental suite currently at an income of $1,050 CAD/month. This is well below the market rate of $3,055CAD/month and I haven’t raised her rental for the last five years since my tenant is another single mother relying on Social assistance and a part time income. Charging any more would take food cash from her family. Besides, we’ve become friends, and this is my way to pay-it-forward the same blessing someone extended to me when I was in a bind.

Rental Income trust B;

The property is a condominium in Trust between me and my siblings generating an indirect passive income. I can withdraw some capital if needed but there are specific rules to doing that but it’s primary purpose is to be financially self-sufficient with some capital growth.

I have a third real property is non-income but can appreciate in value and my foreseeable plan is to be buried in it. Burial plots are a hard asset that goes up with inflation. If necessary I, or my descendant could simply sell it.

Room & Board Income;

My younger adult son offers to pay me $300 CAD/month for the room & board plus pay for half my Car insurance. My elder son is currently unemployed. If I acted like a father I should do the tough love thing and boot them out for their own good, as a mom I’m letting them off cheap and the hugs are well worth it.

Investment Income from Savings;

Sheltered (TFSA) Tax Free Savings account; $20k CAD 50% in rotating 2.5% GICs and 50% Money Market Fund 2.3%, a small interest income of $480 CAD/year. This is my ERF Emergency Reserve Fund that served me well over the years. Meanwhile, my non sheltered checking account yield is negligible.

And finally the off-grid Central Bank of Ravenhill;

Cash on hand; $1,226 USD and $2,520 CAD, in case those credit cards and ATMs stop working just before a long weekend.

Gold Stack, in troy oz; shhh! 🙄

Silver Stack, in troy oz; top secret 🤐

My Crypto portfolio in USD; $28k USD

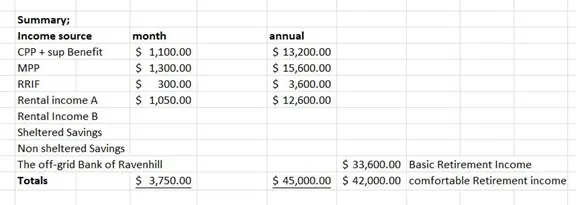

Summary of Retiring Income sources;

Let's add it all up for some totals...

And it looks like I can do this comfortably with a little margin to spare. Retirement looks affordable but that is only half the story. I will follow up with a later post that will deal with the Expenses side of my looming retirement.

It would be sensible to allow my other assets to accumulate as a reserve until needed as we know the effect of real world inflation.

I'm almost ready to join #silverbloggers, isn't that almost poetic?

So, are you ready to retire? 🍹

And thanks @punkysdad for putting me on the road to being Financially responsible.

By the way, it's HPUD. Powering up 111 Hive power!

Stacking Hive, Precious metals and fun for those dark stormy days!

The #piratesunday tag is the scurvy scheme of Captain @stokjockey for #silvergoldstackers pirates to proudly showcase their shiny booty and plunder for all to see. Landlubbers arrrh… welcomed to participate and be a Pirate at heart so open yer treasure chests an’ show us what booty yea got!

References & Sources

RCM Mint.ca 2024 Maplegram25 divisible blister pack.

Photos are my own shot with an aging 2018 Samsung SM-A530W or otherwise indicated.

P. Image under Pixabay

W. Wiki Commons

☠️🎃 Page Dividers by thekittygirl. ❄️🌞

Cameo Raven Brooch from The Black Wardrobe.

The 2024 Hive 0.999 Silver Round.

Physical precious metals bullion stacking is only a part of my personal overall financial strategy. Meanwhile, collecting numismatics are a different set of objectives and strategy. Unless you are a complete nutcase as I am please, do your research before deciding to buy into any bullion or numismatic products.