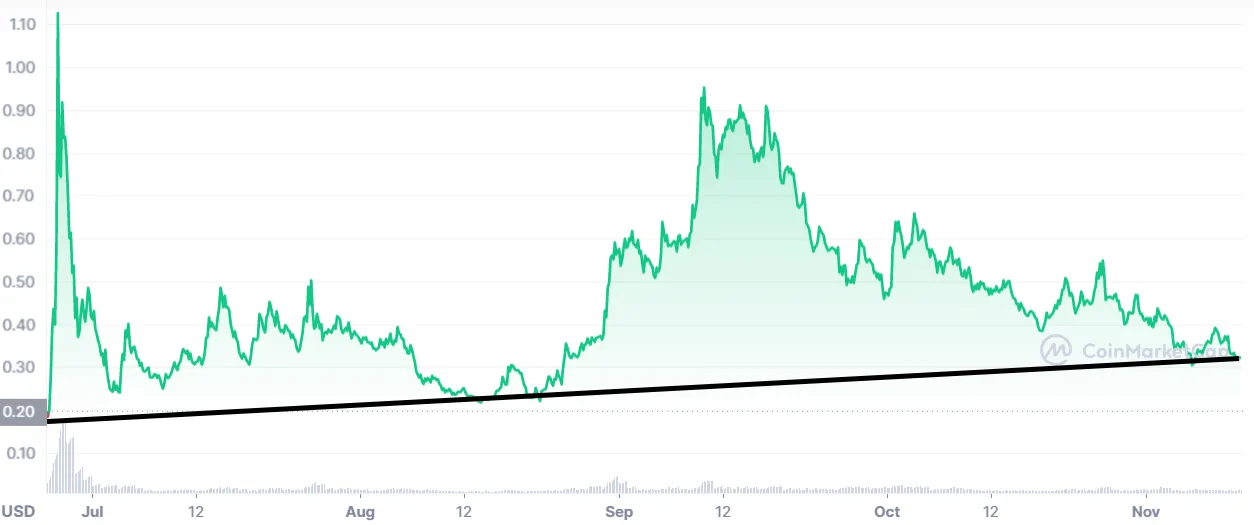

A quick look at SPS's history:

Since it's release it has been volatile, but, what's the bottom line?

It has doubled in price. A 100% return in 4 months is outstanding.

Have you seen the staking APR? Just by having SPS and selecting to stake it you'll be getting a 43.2% return. If you would have secured SPS at .14 and staked it till now you would have absolutely incredible profits. The staking percentage opened at over 500%.

The latest release of their digital product brought with it a voucher system to acquire it dependent on SPS staking. You could compare it to a dividend essentially. The vouchers took on a U.S. dollar value and were distributed to those with sps staked free.

Where it stands right now:

Splinterlands is about to reveal it's 2nd airdrop card. Based off the team's excellent management, it will most likely

be a stimulating, positive factor moving sps price up.

Splinterlands is a gaming economy in which it's participants compete for control over it's assets. It has a positive community that surrounds it, but, as we've noted it's not just fun and games. SPS is the governance token of the community that dictates direction AND awards perks in the game as we've already seen with vouchers.

If you had an appreciating cryptocurrency with a staking APR of 43.2% that pays dividends would it be a yes or no?

How to Login

Video Walk Through of Savings on Splinterlands Card Purchases

Use and Frequently Asked Questions for Cardauctionz

Note I'm not a financial advisor.