Community Proposal #15

We have been presented with an opportunity to participate in the launch of SushiSwap's new Bonding Protocol. It's a bit of a complex concept and a reframing on how liquidity pools should work overall, so I'm going to do my best to breakdown what a DeFi Bond is and we'll discuss the terms of the proposal at the end.

Currently we are offering LP incentives to rent liquidity in our liquidity pools. When the incentives stop, the liquidity providers will likely remove those funds and put them elsewhere seeking higher returns. It's a net negative form of token emissions as we're spending and in the end will likely be left with nothing to show for it.

Enter an alternative liquidity pool funding structure: DeFi Bonds! A DeFi bond is different from a traditional "liquidity mining" set up like the ones we are currently using on all of our pools. In a DeFi bond, the DAO would sell tokens for the creation/funding of a pool and then the DAO would own the funds forever.

Here's how it works: First a smart contract for the bond market is created. The terms can vary, but in the example we'll be using today, let's assume we offer a 5% discount and there's a 5% backend service fee for successful funding that goes to the host of our pool, in this case SushiSwap.

We then allocate a set amount of tokens that we want to sell on the bond market. The amount of tokens allocated for bond sales goes into a wallet to be offered for sale under specific terms. The tokens will be locked for a set amount of time, only a set amount can be purchased per day so they don't all unlock at once, and the bonded tokens can only be purchased with LP tokens. This means that the people buying our tokens are building DAO owned liquidity pools that the DAO will earn the fees on going forward. The DAO is also free to take that liquidity out of the pools and move it elsewhere or use as it sees fit.

The difference in this approach is pretty substantial to what we have been doing. Instead of paying to essentially borrow liquidity, the DAO could use that inflation to permanently own liquidity. There's a lot of opportunity to explore this further if things go well and then potentially scale back our LP inflation spending and turn that expense into Revenue for the DAO. To put it simply, would we rather own liquidity or continue to rent it for the next 3 years or so with token inflation?

That's a discussion for a later time once we see how this proposal goes and if it passes, we'll have to evaluate the effectiveness and demand for the bonds. For now, let's look at the terms on offer and decide if we want to proceed:

If this proposal passes, the SPS DAO will allocate $100,000 worth of its SPS reserves to be sold in a SushiSwap Bond Market. This is a new offering and we will be a launch partner, which means that SushiSwap will be promoting our bond market as well as hosting Twitter (X) Spaces in which we can participate to help market our pool.

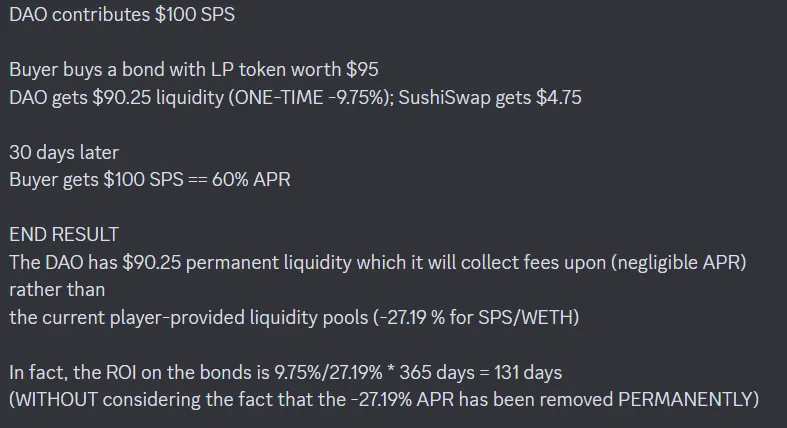

The funds that are allocated will be used to build a v3 SPS:ETH pool on SushiSwap. We will offer a 5% discount on the bonded tokens with a 30 day lockup. Sushiswap will earn 5% of any sales generated. If there are no sales, this cost us nothing and we get free promotion.

Total expenses from this would be less than $10,000. We get a new LP in which the DAO will own the liquidity, we get to promote SPS and our new bond market with SushiSwap, and if things go well we can look into this as a sustainable approach to building LPs that are not a constant expense on the DAO. Thanks for your time and consideration.

Partner's Notes

How does the community benefit?

As we see it, the goal of the community is to earn rewards for contributing, to hold an appreciating, liquid token, and to decentralize the distribution of the token.

Token incentives

WHY- Loyal users who hold $SPS token or $SPS liquidity should be rewarded

HOW- This is simple, there are a million programs to facilitate rewarding users with tokens. Bonds allow users to contribute to the DAO in a permanent and meaningful way while still earning a yield for their contribution. Because the liquidity used to purchase the bonds will be held by the DAO, Users can confidently hold or sell their tokens avoiding large price impact and a race to the bottom as seen at the end most other liquidity incentive programs.

Token appreciation

WHY- Token Holders want to be rewarded for holding by having their held tokens appreciated in value.

HOW- We would never claim that we can cause the token price to appreciate as we believe anybody claiming that they can assure token appreciation in price is either lying or manipulating the price of the token artificially. What we can do is relieve the inflationary pressures that are opposing price appreciation. Bonds are a means to end the need for farming incentives permanently. This relieves the pressure of inflation, allowing demand to have a stronger effect on token price.

Token Liquidity

WHY- If holders see their tokens appreciated but they cannot sell them then they have no value to the holder.

HOW- As I’m sure you all know, the function of most incentive programs is to deepen liquidity. The problem with many of these methods is that they provide temporary deep liquidity while they run but this liquidity evacuates when the program ends, forcing a game of selling your rewards before there is no liquidity to do so. If the liquidity is instead built permanently and held and locked by the DAO, Traders can trade freely and aren't at odds with each other.

Decentralized distribution

WHY- Having more holders with less tokens each empowers the individual token holder.

HOW- One thing that we agree on in DeFi is that there is power in decentralization. We prefer tokens with more smaller holders over tokens with fewer large holders. With most current distribution methods, we see “Mercenary Miners” holding the overwhelming majority of staked tokens. These users strategically farm tokens for profit to make a living. Because of this, if rewards decrease, their position is no longer profitable and they will move their funds to a more profitable token. These large shifts can cause huge price depreciation as tokens are being sold while liquidity is unpaired, causing a magnifying effect on the selling.

Why should you vote yes?

You want to end the need for emissions permanently

You want to earn a return for investing in $SPS

You want more decentralization of holders

You want the token to be liquid for trading

You believe in sustainable DeFI

Edit: Adding an example to help illustrate the bond costs and return: