tl;dr: Using Steem is not really free. Steem Power holders are being charged a negative inflation-adjusted interest rate. Only witnesses and top contributors earn enough to offset it with rewards. Other contributors lose more than they earn, to the profit of witnesses and top contributors.

If the market cap grows fast enough, everybody using Steem can make some profit. However, if the market cap stabilizes, Steem becomes a zero-sum game, where some lose and some win.

That is because the only way to increase the value of your Steem holdings becomes increasing your share of the market cap. Conversely, this means somebody else will see their share of the market cap - and the value of their holdings - shrink.

Who loses?

Steem Power holders. When more than 90% of Steem is powered up, the inflation-adjusted interest rate becomes negative [1] (i.e.: your share of the market cap shrinks).

Steem holders. They don't even get any interest at all, so their inflation-adjusted interest rate is very negative in all cases. Therefore it is doubtful that much of the available Steem will be powered down at any given time, which in turn makes it unlikely that any Steem Power holder will ever see a positive real interest rate.

Who wins?

Witnesses, of course. Each of the 19 permanent witnesses earns at least 1371 STEEM per day (658 USD at the time of writing), for producing 1371 blocks a day [2, 3].

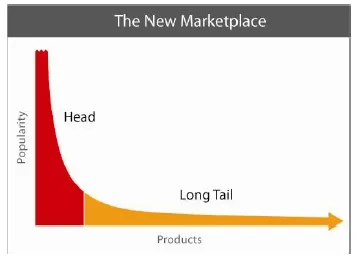

Top contributors (posters and curators). Even though all contributors are rewarded, top contributors get most of the rewards. This is because the reward distribution is heavily skewed in favor of the top contributors (rewards grow exponentially with popularity) [4]. Other contributors will only earn nominal rewards.

Conclusions

When you are holding Steem Power, you are being charged a negative real interest rate. When you vote for yourself, you recoup some of it. When you vote for someone else, you give them some of it. In all cases, you give some to the witnesses for securing the blockchain. All of this is paid with the devaluation of your holdings.

So if you decide to invest into Steem Power, remember that using Steem is not really free: you are actually taking part in a STEEM redistribution from Steem Power holders (you) to witnesses and top contributors.

It might still be profitable for you if the market cap increases fast enough, but be aware of what you are betting on: other people having reasons to buy STEEM, thereby driving the market cap up.

There ain't no such thing as a free lunch

[1] White paper, "Allocation & Supply". For every 1 STEEM created to reward contributions, 9 STEEM are distributed to Steem Power holders. If more than 90% of the existing STEEM receives 90% of the new STEEM, the inflation-adjusted rate is negative.

[2] 63 seconds per round, 1 block per round per witness

[3] White paper, "Allocation & Supply". "1 STEEM per block or 0.750% per year, whichever is greater"

[4] White paper, "Payout distribution". Units are arbitrary, but the idea is that people in the red will make enough to offset the negative interest rate, people in the orange (the majority) will not.