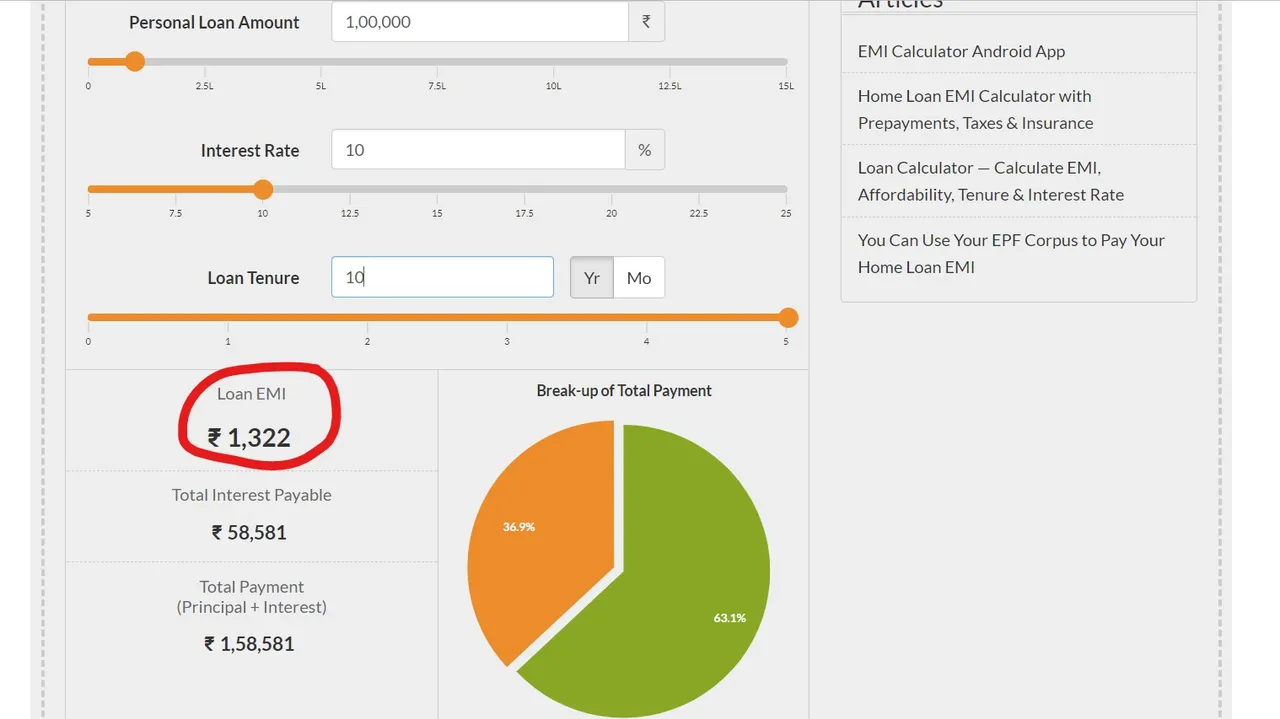

I had recently applied for a personal loan of inr 100,000($1500) and i am glad to say that my loan has been sanctioned . i am planning to buy steem power with this amount . so lets see if i will be able to pay my emi and also make some profits every month.

So here are some calculations.

Steem price now is $1.55 so approximately 1000 steem power can be bought

I have to pay inr 1300(approx $20) as emi.

I will use 50% power to upvote my own comments and posts and will use the other 50% for curation of content that i like.

Currently i get 25-22 cents per upvote for the first 5 votes and 20-17 cents for the next 5 and i have a total of 520 power now.

So on an average for the first 10 votes i get 20 cents and my voting power bar stays around the 80% mark.

When i buy 1000 steem power with my loan money i can get 40 cents on an average for the first 10 votes per day.

I will use 5 votes for self upvoting so i will be making $2 per day on that.

So monthly i will make $60(3900 inr).

From that $20 (1300 inr)will be paid as emi.

Steem price now is $1.55 so approximately 1000 steem power can be bought

I have to pay inr 1300(approx $20) as emi.

I will use 50% power to upvote my own comments and posts and will use the other 50% for curation of content that i like.

Currently i get 25-22 cents per upvote for the first 5 votes and 20-17 cents for the next 5 and i have a total of 520 power now.

So on an average for the first 10 votes i get 20 cents and my voting power bar stays around the 80% mark.

When i buy 1000 steem power with my loan money i can get 40 cents on an average for the first 10 votes per day.

I will use 5 votes for self upvoting so i will be making $2 per day on that.

So monthly i will make $60(3900 inr).

From that $20 (1300 inr)will be paid as emi.

10 . So at the end of the month i can make upto $40(2600 inr after paying off the emi).

On the plus side

If steem price increases than my rewards would increase but my emi will remain the same.

My principle amount will remain intact .

As dollar value increases as compared to inr (indian rupees ) lesser dollar value would be needed to pay up the emi.

There are the curation rewards and upvotes from fellow steemians.

After the term end of the loan ill own the bought Steem Power without putting my own money and also having no debt.

What can go wrong??

Steem prices plummet drastically but it is highly unlikely.Even if it drops by 1/3rd still i can make enough to pay off the emi.

If too many members join steemit than weekly rewards will reduce.But wouldn't that drive the price up thereby increasing your account value and also your upvotes??

Why i opted to take a loan instead of borrowing from friends and family?

It will improve my credit score and hence help me to take larger loans in the future.

I will finish my undergraduate degree by next year and will be eligible for larger loan if i am able to pay my emi for 1 year.

So i feel that this investment has lot of promises and is a risk worth taking . If you found my plan useful please upvote and resteem and feel free to leave your thoughts and opinions below .

If steem price increases than my rewards would increase but my emi will remain the same.

My principle amount will remain intact .

As dollar value increases as compared to inr (indian rupees ) lesser dollar value would be needed to pay up the emi.

There are the curation rewards and upvotes from fellow steemians.

After the term end of the loan ill own the bought Steem Power without putting my own money and also having no debt.

What can go wrong??

Steem prices plummet drastically but it is highly unlikely.Even if it drops by 1/3rd still i can make enough to pay off the emi.

If too many members join steemit than weekly rewards will reduce.But wouldn't that drive the price up thereby increasing your account value and also your upvotes??

Why i opted to take a loan instead of borrowing from friends and family?

It will improve my credit score and hence help me to take larger loans in the future.

I will finish my undergraduate degree by next year and will be eligible for larger loan if i am able to pay my emi for 1 year.

So i feel that this investment has lot of promises and is a risk worth taking . If you found my plan useful please upvote and resteem and feel free to leave your thoughts and opinions below .

It will improve my credit score and hence help me to take larger loans in the future.

I will finish my undergraduate degree by next year and will be eligible for larger loan if i am able to pay my emi for 1 year.