So, the trade between SBD and Steem in the internal market is free in the internal market. What stop you from trading like no tomorrow other than lack of confident? What can give you confident? Knowledge it is. We're going to dive into the trade market and try to understand more about the virtual reading in the internal market.

Market strength

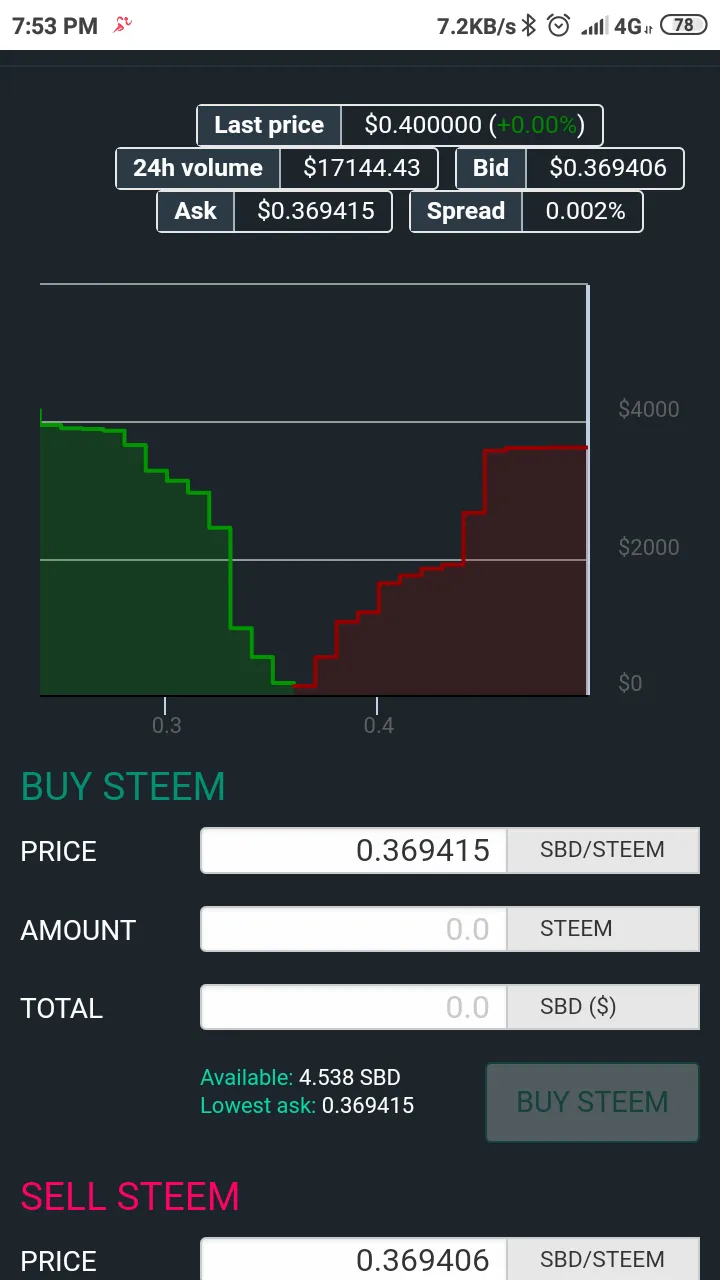

Here's what you see in any and every exchange. Does any of you know how to use this graph? This is a volume chart. Well, basically this chart said there's how much is in the red zone selling Steem and how much in the green is buying Steem. In a way, if you see green is lower than red, meaning more people are selling their Steems for SBD. Vice versa, when red is lower than green, meaning more volume is on the buy side.

Market info

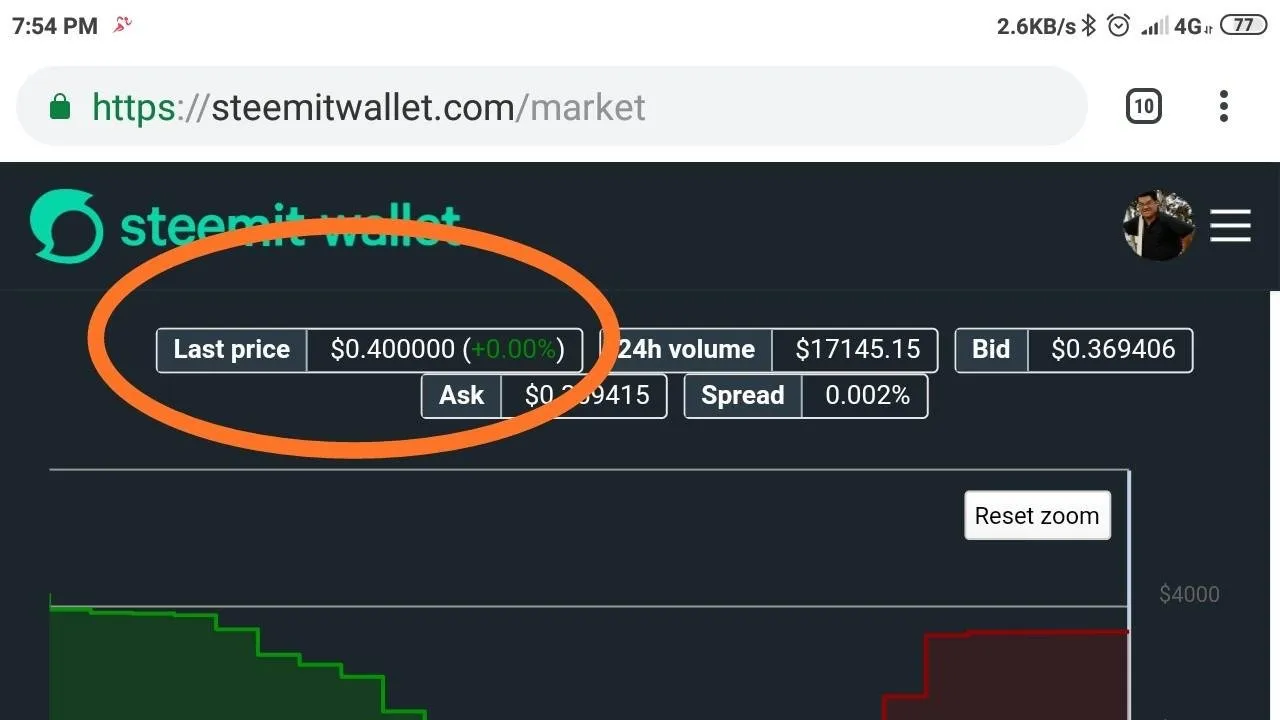

Now, what does it show us when there are green and red on the chart? Here's a useful indicator, numbers. You can find the most recent deal at the top middle part of the internal market. Over here, you can see the latest transaction said there's someone took a trade of 0.400. I'd guess someone managed to sell their Steem for SBD at a higher rate. Because you can see the bid and ask price is way below the last transaction. Also, noticed there's a 24 hours volume, comparing to several weeks before, a day transaction was only few thousands, and today already exceeded 17thousand so far. When there is volume, good chance is you can strike a bargain by changing the bid and ask value. How to do so? We will come back to that again later. Let's stick to information sharing for now.

Supply and demand

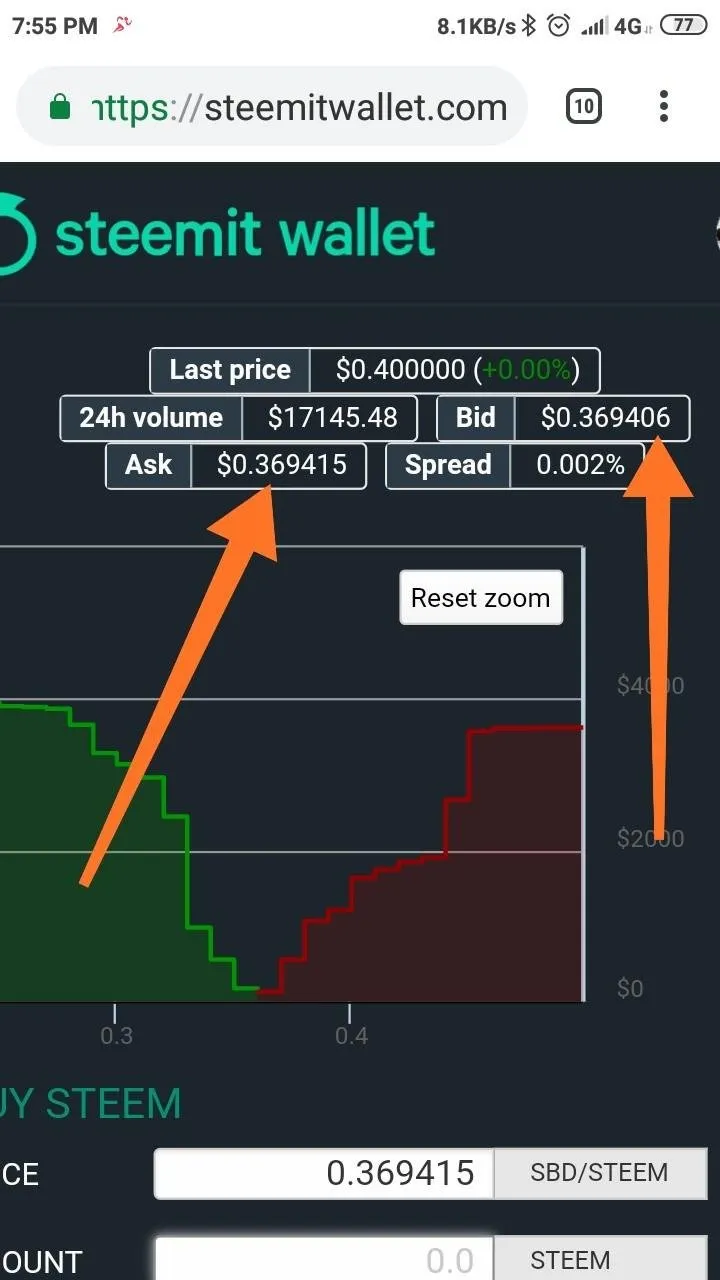

Here is the important part. Since this is an internal market, which means it only involved with two different type of cryptos, which is Steem and SBD. We can see the Bid and Ask price different apart 0.002%. We call it spread. Aren't we talking about FREE brokerage? Yes indeed its still free. But why is there difference? Trust me, there's no middleman in internal market. Theonly middleman is the virtual contract that setup the deal, which will cost you RC(resource credit, which can be regenerate very quickly). The spread is actually the supply and demand, by nature they're split regardless. For one simply reason, seller wanted to sell at higher price; buyer wanted to buy at lower price. Which causes the buy Steem price is always higher than the sell price. In order to execute a trade soonest possible, you're highly recommended to follow the latest ASK price to buy Steem, and follow the latest BID price to sell Steem.