Over the last couple of years I have heard quite a lot about an interesting equation, well "law" actually, that has been used to attribute value to certain social communities.

It's been used to attribute appropriate values to Facebook, Google, Amazon, and more recently it has even been used to calculate an appropriate value for bitcoin.

What am I talking about you might ask?

I am talking about none other than Metcalfe's Law.

Metcalfe's Law states that the value of a system is proportional to it's number of users squared.

Specifically it's defined as:

"Metcalfe's Law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system (n^2)"

The "law" was originally presented in 1980 but wasn't formulated in the above way until 1993 by Professor George Gilder.

The intent was to try and explain the network effect. How adding more users to a system doesn't just increase that network's value linearly but instead exponentially.

To illustrate that, the "law" is stating that if you have 100 users and a value of 10,000 and you double your user base to 200, the current value of your users doesn't double and go to 20,000. Instead it goes to 200^2 or 40,000.

Cool, but what's the big deal?

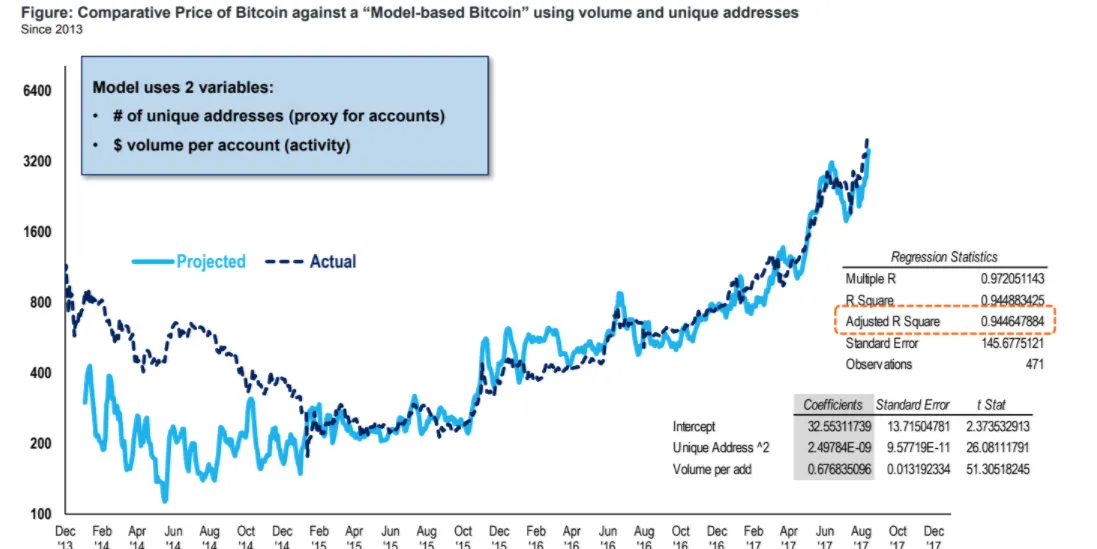

The reason I bring this up is because my favorite Analyst on the Street (Tom Lee) has been using this model for some time now to predict bitcoin prices.

Well perhaps, not so much predict, but to help get an idea of what plugging in certain numbers might do to prices of the coin.

Namely, expanding the number of users in the bitcoin network.

Surprisingly, (or not surprisingly), Lee's modeling has been extremely accurate!

Check it out:

Perhaps better than being a price predictor, this data might be useful indicating whether prices are in "bubble territory" and when prices are undervalued relative to their network usage.

For example, in the above model you can see that when the model was well below the actual line, the price eventually made it's way down to where the model was. Meaning that if you had looked at this at that time you might have guessed prices were a little overheated due to actual network usage.

Basically, this is saying that if you see a big divergence, in one direction or the other, between the number of active users squared and the price, perhaps you can gain some insight as to where prices might go next (if those usage numbers remain constant that is).

More on Tom Lee and his ideas behind using Metcalfe's Law in regards to bitcoin can be read here:

http://www.businessinsider.com/bitcoin-price-how-to-value-fundstrat-tom-lee-2017-10

Cool! How does this relate to steem?

I'm glad you asked!

For one, I would think that steem is probably even a better example of the network effect as its primary users mostly come from the social media site steemit.com.

Knowing that information, is it possible we could come up with a theoretical price of steem?

Maybe!

According to data pulled from @penguinpablo's daily steem stats report we can see that yesterday steemit.com had roughly 24,000 daily active users:

https://steemit.com/steemit/@penguinpablo/daily-steem-stats-report-friday-november-10-2017

(chart courtesy of @penguinpablo)

Applying Metcalfe's Law from above we can take that 24,000 active users number, square it, and come up with roughly 576,000,000 of value. (24,000 x 24,000)

That means with that number of active users, the total value of the system should theoretically be somewhere around $576,000,000.

More than double the current market value of $243,000,000.

To get a theoretical price of steem based on those numbers, we simply divide that 576,000,000 by the number of steem outstanding, which currently is 259,000,000.

(576,000,000/259,000,000)

Performing that calculation would give us a value of $2.22 per unit of steem.

Pretty cool eh?

My thoughts:

I know I know, this isn't really that great of a price predictor and probably not all that accurate as there are many variables that could explain why prices could be well below or well above that Metcalfe value.

Prices are often based on future expectations as well, so perhaps a number well below that might indicate that currently market participants are expecting those daily transaction numbers to not grow as fast as the inflation rate of the currency (steem)? Or it could be because of any other number of future expectations.

However, instead of being a price predictor it might be a valuable tool in deciding whether prices are over heated in terms of actual usage rate or possibly undervalued compared to its network of users.

Basically, this is all just more of something to keep in mind as opposed to something to base your buy or sell decisions on. :)

Also, keep in mind that this kind of comparison only works right now where steemit.com is the primary use case for steem. Once SMTs or any other number of apps start also using steem and the steem blockchain, the data from steemit.com mostly goes out the window as it would only be a small fraction of the coin's overall network usage.

Other than that, I hope you enjoyed my little fun steem price projection project. Feel free to leave me comments with your thoughts below.

Stay informed my friends.

Sources:

https://en.wikipedia.org/wiki/Metcalfe%27s_law

http://www.businessinsider.com/bitcoin-price-movement-explained-by-one-equation-fundstrat-tom-lee-metcalf-law-network-effect-2017-10

Image Sources:

http://www.businessinsider.com/bitcoin-price-movement-explained-by-one-equation-fundstrat-tom-lee-metcalf-law-network-effect-2017-10

Follow me: @jrcornel