Disclaimer

GOPAX Insights or listing decisions should not be considered as endorsements or solicitations to purchase the featured assets on our platform.

Overview

Steem is the backend of the social platform Steemit, which seeks to incentivize content creation, curation and discussion. The financial building blocks of the Steem blockchain are Steem (STEEM), Steem Power (SP), and Steem Blockchain Dollars (SBD), which interact with each other to discourage speculation and foster long-term engagement. The Steem Foundation also plans on launching a platform for Smart Media Tokens (SMT) analogous to the ERC-20 platform for Ethereum tokens.

Business Landscape

Current Challenge

Many social media platforms incentivize users to upload quality content with the expectation of up-votes or re-posts to drive traffic to their content. This is often coupled with the interests of advertisers who are offered the chance to expose their products to the traffic. While this model has proven to be profitable for publishers and some content creators, it is not without its drawbacks.

The first drawback is that there is no guarantee that a content creator will find a suitable advertising partner. This is especially true for new content creators who have not already established a reputation for themselves. Since quality content may require a sizeable investment in time and resources to create, it is very unlikely a new content creator will be able to reliably find a partner to reward their effort.

The second drawback is that the reward path for content creators is not direct. Advertisers can choose to pay content creators an upfront sum, or pay later according to the amount of traffic and effectiveness of the advertisement. This often means that content creators must cater their content to suit the needs of advertisers, rather than those of the target audience.

Finally, the advertising model is often seen as intrusive and unpleasant to much of the general public, and has sparked a technological arms race between ad-blockers and the ad-tech industry. These problems all detract from the value created by content creators, curators, and readers as a whole.

Proposed Solution

Steem introduces a new model to reward and incentivize social media engagement. Instead of encouraging content creators to cater to advertisers, Steem directly rewards content creators based on decisions by the community through the use of a blockchain. While many aspects of Steem should be considered experimental, it leverages proven economic incentives present in Proof of Work (PoW) consensus mechanisms and uses them to encourage work toward creating and evaluating content instead of difficult mathematical functions.

Current Major Players

Steem is competing directly with more traditional forms of social media, such as Reddit and Medium. The prospect of earning directly on those platforms is small, and the economic reward system of Steem may give it the edge necessary to draw users away from those platforms.

Technical Specification

Steem consists of an underlying blockchain with three native digital assets: STEEM, Steem Power, and Steem Blockchain Dollars.

STEEM, the Unit of Account

The first asset on Steem is STEEM, the unit of account. Steem accounts require a minimum amount of STEEM to be created. This STEEM is transformed into Steem Power upon creation of the account. This system helps prevent someone from creating a large number of Steem accounts and manipulating the vote system. STEEM can be transferred between accounts.

Steem Power, the Measure of Influence

STEEM can be converted to Steem Power (SP) in a process known as “powering up,” which is instantaneous. Likewise, Steem Power can be “powered down” and converted back into STEEM; the powering down process takes place over a 13-week vesting period.

Steem Power holders are entitled to a share of the block rewards, and the amount of Steem Power a user holds determines the strength of their upvotes. For example, a post that receives an upvote from a user with 100 SP will receive more rewards than an upvote from a user with 10 SP.

When a user upvotes a post or comment from another user, it does not cost them SP to do so. Instead, the effect of each successive upvote will diminish; this also holds true for downvotes. Users with small amounts of SP will not have the option to toggle how much strength each upvote gives, and can only give the maximum strength. Users with more SP have the ability to toggle how much weight their action gives to the receiving post.

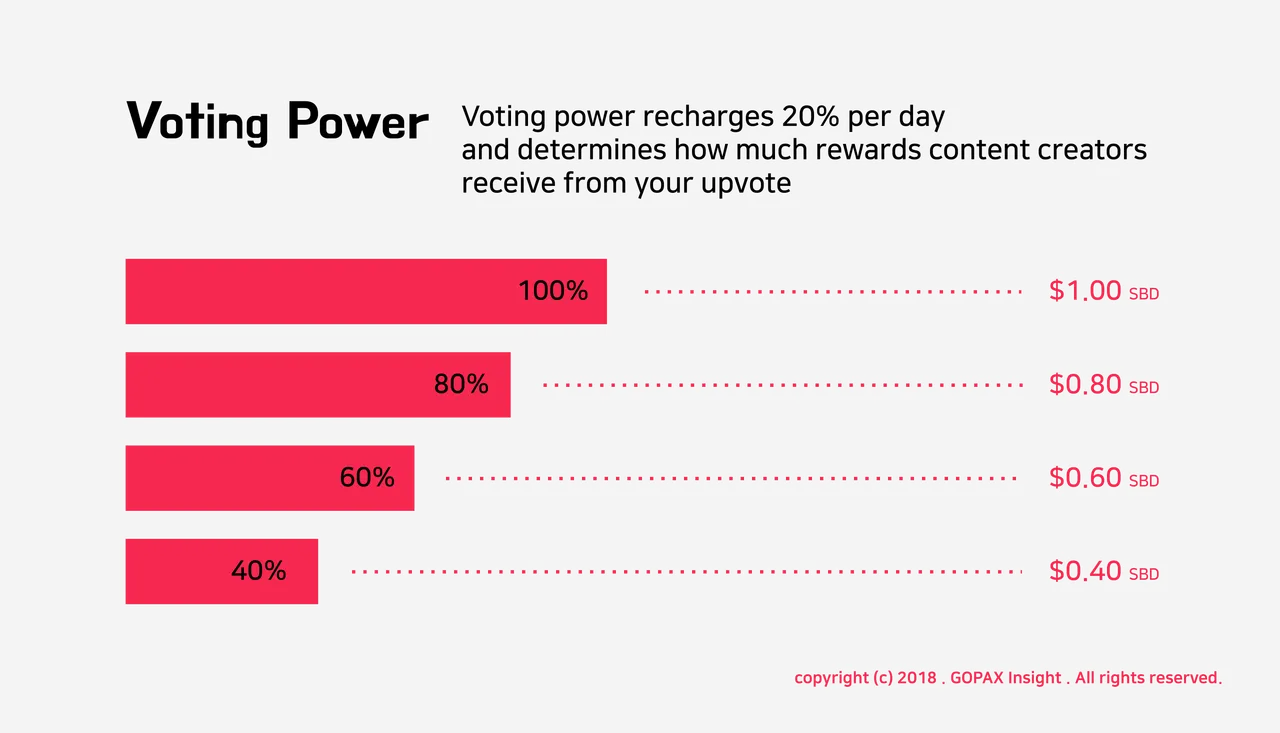

The influence from SP “recharges” linearly at a rate of 20% per day. This has the effect of rate limiting users with lots of SP and prevents them from dominating what is promoted on Steem.

Steem Power can also be “delegated” to another user. In this case the user gains all the benefits of holding the delegated SP, but cannot convert the delegated SP into STEEM. This allows a user to promote a poster for a limited period of time without permanently losing any of their own influence.

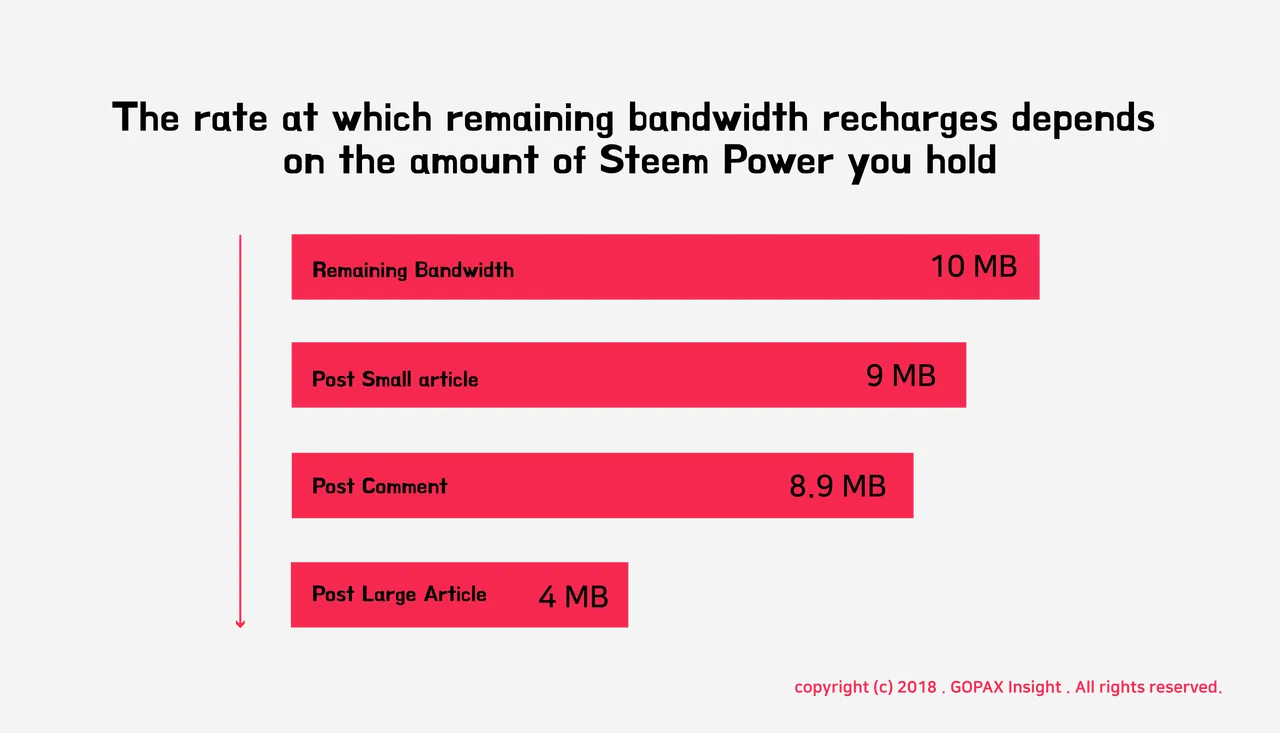

Actions that post to the blockchain do not require a fee. Instead, actions are rate limited according to the amount of SP held by the account. A user who wants to post many more articles, comments, and upvotes in a short time will need to hold more SP to ensure they are all completed. Otherwise, the actions may be delayed to accommodate usage from other users.

Steem Dollars, the Medium of Exchange

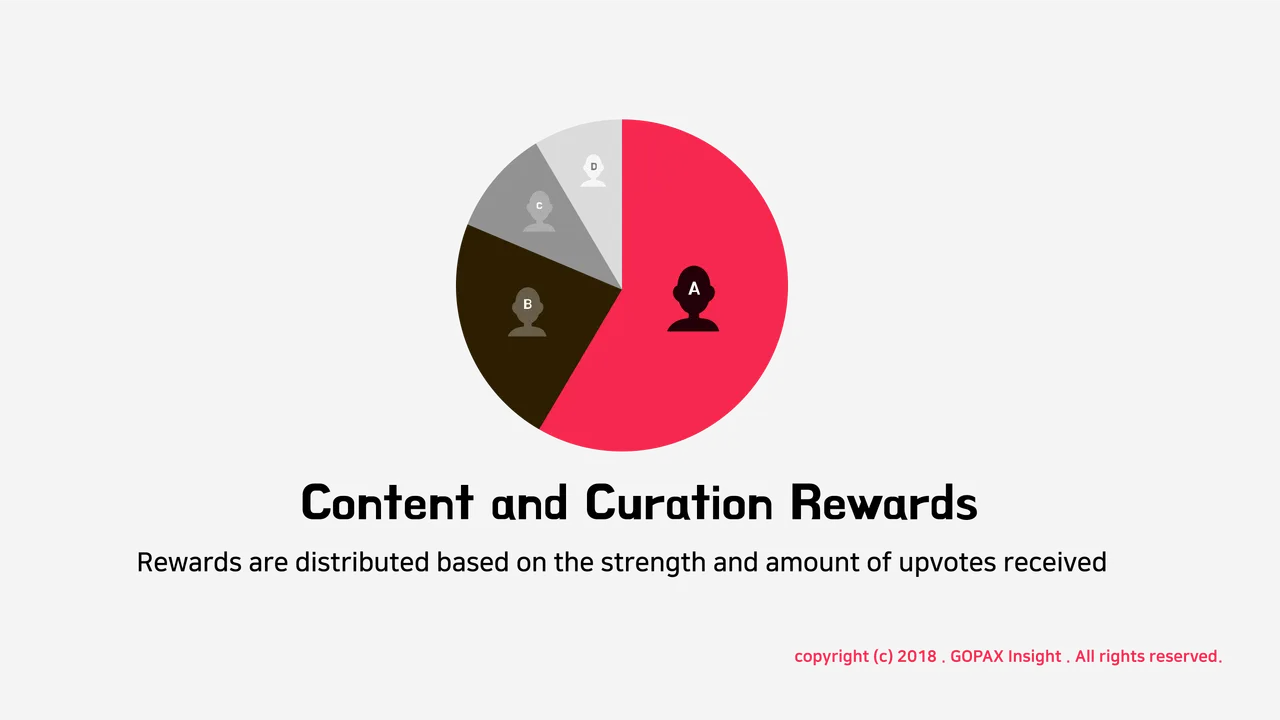

In addition to STEEM and Steem Power, Steem also introduces Steem Blockchain Dollars (SBD). SBD is designed to hold a stable value, roughly at parity with the US Dollar. SBD are distributed as block rewards to content creators proportional to the strength of the upvotes received, or to curators proportional to the popularity of an article after it was upvoted. When the value of SBD is under $1 USD, an interest rate is given to SBD holders to encourage them not to spend SBD to increase its value. If the value rises above $1, the interest rate of holding SBD is zero.

To help maintain a stable value, SBD requires a reliable price feed from exchanges that trade it. The price feeds are selected with SP and the median value of all the price feeds is used. This mitigates the effect of a malicious price feed. The median is calculated over a three and a half day period.

SBD can be converted into STEEM through a process that requires 3.5 days. This is to prevent price changes from the price feed from causing abuse. Once converted, STEEM cannot be converted back into SBD.

Consensus Mechanism

Steem is a platform that uses a modified Delegated Proof of Stake (DPoS) algorithm based on Graphene, the technology that powers BitShares. In Steem there are a total of 21 “witnesses” which create blocks storing information such as up-votes, content uploads, comments, and re-steems. 20 witnesses are selected by approval voting; the final witness is timeshared by every witness that didn’t make it into the top 20 proportional to their total votes.

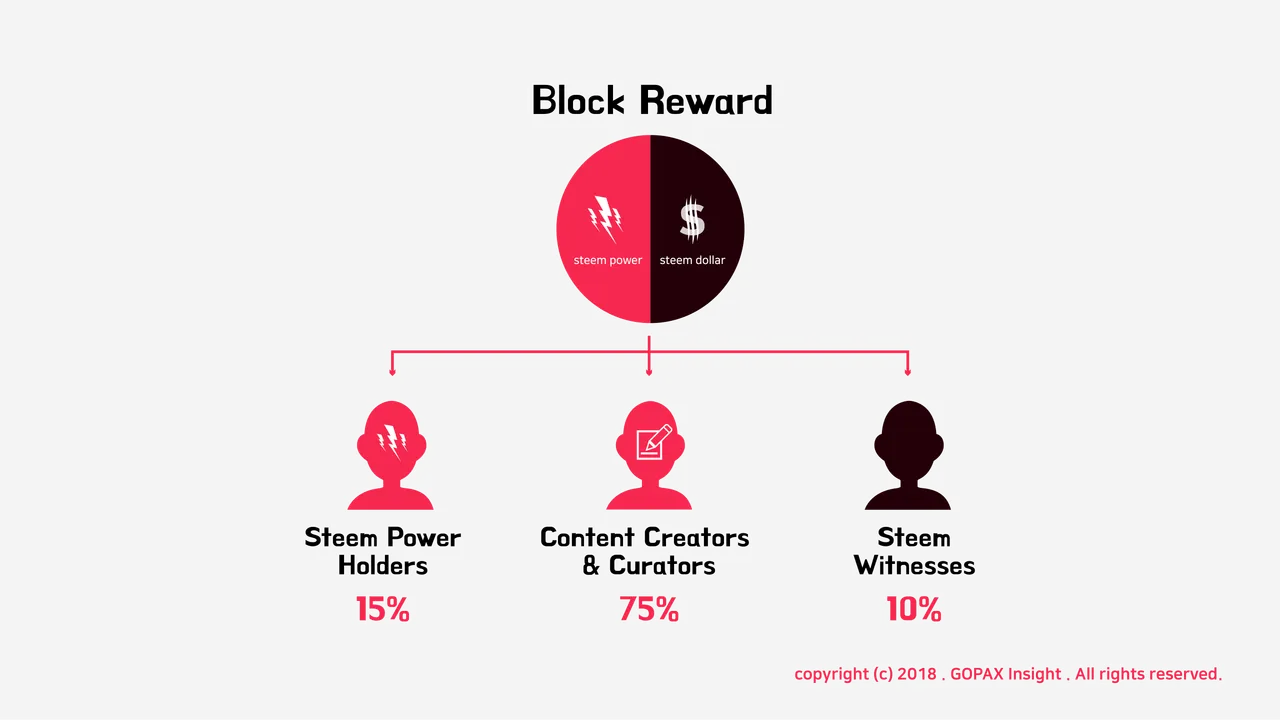

Block rewards are split between content producers (75%), block witnesses (10%), and SP holders (15%).

Smart Media Tokens

Smart Media Tokens (SMT) are similar in function to the ERC-20 standard on Ethereum. They represent a way of specializing rewards to certain communities, and are intended to function in a manner similar to that of STEEM tokens. Token creators can define the behavior of reward pools and inflation to incentivize actions on their platform or community.

Token Market Structure

Pre-mine / Inflation

Steem currently has a yearly inflation rate of approximately 9.5% per year, decreasing at a rate of 0.5% per year.

Initial Coin Offering: Sales Model

Steem did not hold an ICO. Instead, the network was launched and the Steem Foundation completed a premine prior to listing STEEM and SBD on exchanges.

Steem Team

| Name | Credentials and Experience |

|---|---|

| Ned Scott | CEO and Cofounder |

| David Jeffreys | Business Development, Master Data Coordinator at New Era Cap |

| Nate Brune | Blockchain Developer, Junior Programmer and Kernel Developer at Embedded Devices and Web Applications |

| Valentine Zavgorodnev | Software/UX Engineer, Software/UX Engineer and Cofounder at Cryptonomex Inc. |

| Dan Larimer | Former Cofounder at Steemit, Creator of BitShares and EOS |

Secondary Market

Market Capitalization

Source: CoinMarketCap 2018/03/09

| Token | Market Capitalization | Price Per Token | Circulating Supply | Volume (24hr) |

|---|---|---|---|---|

| STEEM | $568,463,597 USD | $2.26 USD | 251,629,431 STEEM | $4,638,560 USD |

| SBD | $24,876,067 USD | $2.40 USD | 10,370,170 SBD | $2,963,590 USD |

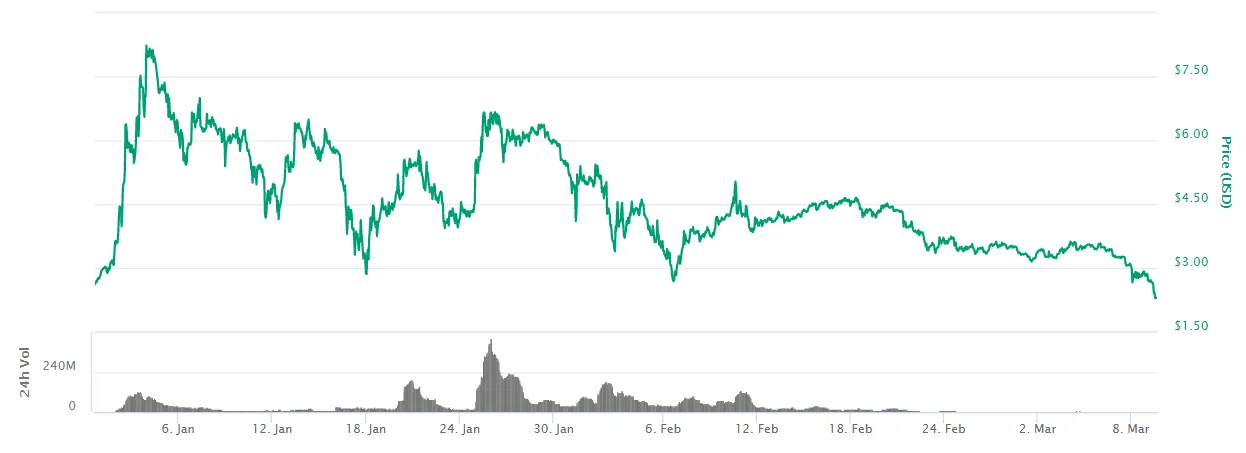

Market Price Volatility

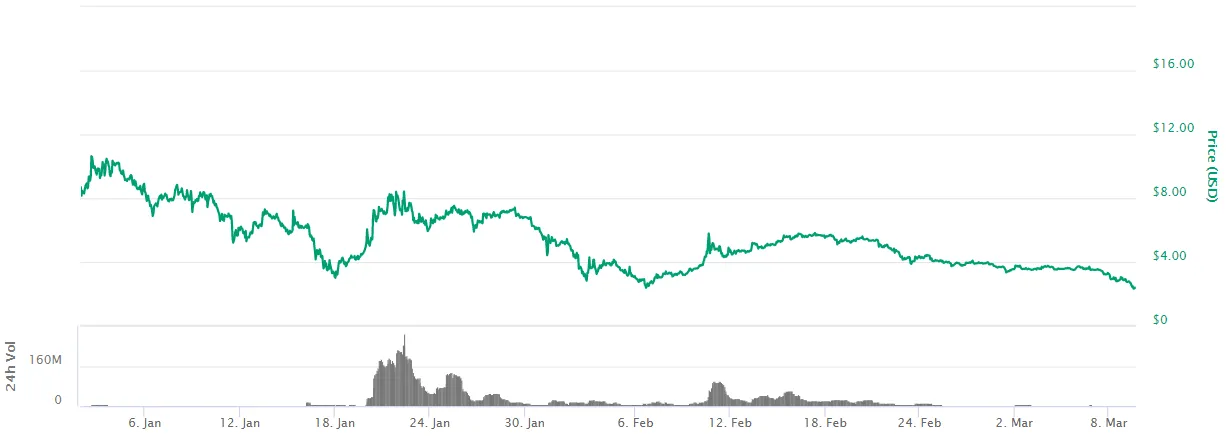

Source: CoinMarketCap 2018/03/09

STEEM YTD

Source: CoinMarketCap 2018/03/09

SBD YTD

Risks and Limitations

Steem remains a highly experimental project and many of the design choices are subject to revision. The profile and experience of posting on Steem and receiving rewards should not be considered final at the time of this report.

It should be noted that despite the goal of SBD to maintain price parity to the US Dollar, from November 2017 to the present date it has been unsuccessful in doing so. The price of SBD rose from rough parity to the dollar to a high of near $15 USD. The volatility of SBD as evidenced in December 2017 raises serious questions about how viable the “stable coin” goal of SBD is.

Another risk is that actors with access to large resources may easily promote their posts at the expense of other users. One way this is achieved is by waiting to upvote a post until 12 hours before the payout is given, thus making it difficult for people to apply negative voting pressure to the content in question. This decreases the rewards that would have been given to more meaningful posts.

Additional Resouces

- Steem: An incentivized, blockchain-based, public content platform

- Smart Media Tokens (SMTs)

- Steemit FAQ

- Steem Blockchain Explorer

Edit: The overview section has been edited to include the Steem logo instead of the Steemit logo.