How SBD could replace BTC: an Unconventional yet Possible Scenario

While (almost) the entire Steemit community is mostly focused on theorizing potential pricing and market capitalization of the Steem token, and the SBD (Steem Backed Dollar) is mostly seen as an "IOU" (I owe You) and "frowned upon" by some as an reasonable investment option, I hereby want to present to you a scenario that, while being unconventional, might be plausible due to -a- a high-implication Steem blockchain rewards mechanism, -b- outsider market valuation perception, -c- technical & commercial innovations expanding the E-Commerce possibilities of the Steem Ecosystem.

SBD background

SBD intended to be a stable currency and fiat replacement

Initially the Steem Backed Dollar (SBD) was meant to provide the "CryptoSphere" with a stable currency. While crypto volatility is very interesting for active crypto traders, - for it enables them to grow their crypto capital's worth by "hopping" from one crypto asset to another -, the volatility is negatively affecting the widespread adoption of retailer crypto acceptation as a means to pay for regular goods and services. After all, suppose you're a smartphone retailer and you purchase "smartphone X" for an amount of $300,- USD, if you're selling it for 0.05 BTC as a retailer you can make a big loss when BTC price drops heavily, and in case BTC goes up to $15,000.- then nobody will buy the phone at 0.05 BTC.

So as a consequence, the retailers that do accept crypto as a payment option constantly change their crypto pricing, because they are still "accounting" in terms of fiat instead of crypto.

So, as an attempt to change that "fiat-minded perspective" the SBD was intended to be worth 1 USD worth of Steem, for being backed by Steem. Maybe the idea was also to get that retailer to price its "smartphone X" at 500 SBD, being the equivalent of $500,- USD, enabling a more "crypto-minded accounting perception" among both retailers and consumers.

Steem/SBD conversions as a mechanism to burn SBD and keep its circulating supply under control

As an implementation mechanism, there was (is!) an "SBD to Steem" conversion option: 1 SBD would then get "burned" to a $1,- USD value worth of Steem, and that 1 SBD would literally disappear from existance after the conversion. To make that conversion and "SBD-burning" work, the blockchain needs to produce as much Steem as needed for that conversion to happen. If Steem is priced at exactly $1,00 USD then 1 Steem is needed to burn 1 SBD. If Steem is worth $10.00 USD, then only 0.1 Steem is needed for that conversion. But in case 1 Steem is worth $0.10 then 10 Steems are needed for the same conversion.

But, the higher the price of Steem, the more SBDs are rewarded ("printed"), meaning that if (for example) Steem is priced at $5.- USD and the blockchain in a certain amount of time rewards 100,000 SBD, and then Steem falls to $1.- USD then the blockchain needs to repay 5 times that amount in terms of Steem, which causes a fluctuating rate of inflation in terms of generated / circulation Steem token supply.

Having said this, in case due to (external) market demands SBD price goes up (a lot) above a $1.- USD value,- which is and has been the case since November / December 2017, then why should anybody holding SBD want to use that Steem/SBD conversion option? A few Steemit rookies made the mistake before to unintentionally convert SBD for Steem at a $1.00 USD price worth of Steem when SBD was worth a lot more. So, as a protective measure, Steemit Inc. decided to (temporarily) remove that conversion option from the Steemit.com user interface. (You can still convert and burn SBDs via the CLI wallet though.) So as a consequence, (almost?) nobody converts anymore, zero SBDs are getting burned at the moment, and the SBD circulating token supply is growing, and growing and growing: while writing this, there are 12,901,785 SBDs in circulation.

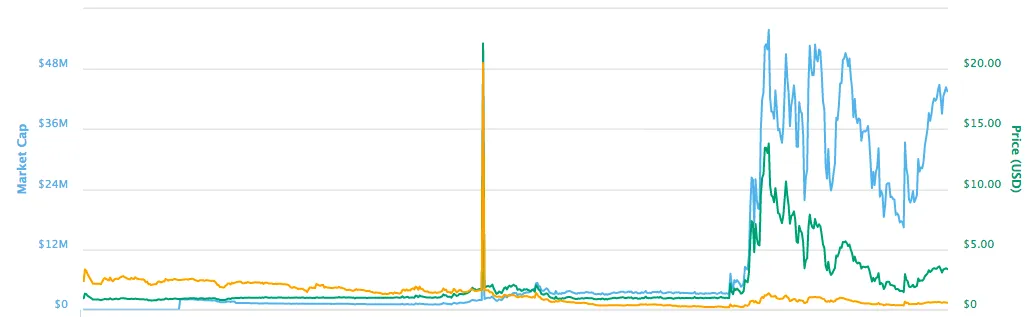

If you take a brief look at https://coinmarketcap.com/currencies/steem-dollars/ you can see that on December 21, 2017, the SBD market cap was around ~$ 55 million USD being priced at $13.81 USD per SBD, while at January 21, 2018 the SBD market cap was above $52 million USD but SBD price at $7.90: in the same period Steem price was relatively high as well, causing the printing of lots of SBDs, which caused a relatively stable SBD market capitalization where prices almost halved. And at April 29, 2018, SBD market cap was still just under $45 million USD while being priced at $3.59 USD.

We can clearly see, that because (almost) nobody is nowadays using the Steem/SBD conversion option, more and more SBDs are being printed, causing a relatively stable SBD market cap in a 3-month (Jan-Mar 2018) SBD price downtrend (which has now been reversed) causing a bigger "debt position" for Steem.

A complicating blockchain debt safety measure

As we have experienced last month when Steem price was relatively low and the circulating supply of SBDs was (and still is) relatively high, something interesting happened, which is caused by a blockchain mechanism which is intended as a debt safety measure. Because, in order to keep the debt-equity ratio of SBD/Steem from getting disproportional, there exists a mechanism built into the Steem blockchain. Regard the following formula:

Steem Debt Ratio = SBD Circulating Supply / Steem Market Cap

This formula does take into account the Steem Market Cap, but it does not take into account the SBD price or its market cap; only the amount of circulating SBDs.

And there exist the following rules:

- when the Steem Debt Ratio is below 2%, blockchain rewards (50-50 setting) are being paid as SP and liquid SBD;

- when the Steem Debt Ratio is between 2% and 5%, rewards are paid as a mixture of SP, liquid Steem and liquid SBD (the higher the Steem Debt Ratio, the less SBDs will be rewarded);

- in case the Steem Debt Ratio goes above 5%, rewards will be paid as SP and liquid Steem only, meaning no more SBDs will be printed!;

- and when the Steem Debt Ratio goes above 10% then the rule "1 SBD is worth 1 USD worth of Steem" won't be honored anymore.

SBD: inflationary or extremely scarce????

The 2-5% Steem Debt Ratio rule did already get applied, briefly and very recently: for example, on April 1st 2018, the Steem market cap was about $378 million USD, and at the same date the SBD market cap was at about $17.5 million USD while priced at $1.56, meaning there was an SBD circulating supply of about 11.2 million tokens. 11.2 / 378 = ~3%, and as we've experienced parts of the rewards were then paid out as a combination of SP, liquid Steem and liquid SBD. Since then Steem price has gone up considerably, leading to more SBDs being printed in a short span of time, and since today there are 12,901,785 SBDs in circulation already that's a 15% increase of the amount of SBDs circulating (+ 1.7M / 11.2M) in just one month!

Also, regarding that last rule (>10% debt ratio)... that's all good and well IF SBD price is <= $1.00 USD, but in situations SBD is (way) above $1.00 USD absolutely nobody wants to use the conversion option: not at a $1.00 USD rate let alone at a lower rate than $1.00 USD.

So these debt-limiting mechanisms have an unforeseen effect. And that effect is:

SBDs will be scarce as gold.

First more SBDs will be printed, up until the point the Steem Debt Ratio is above 5%, and then suddenly zero new SBDs will be printed meaning the circulating supply of SBDs is scarce, and fixed even, at a zero inflation rate or even deflationary.

Scarcity as a key value driver

And what usually happens, in terms of valuation, to any asset that's become scarce?

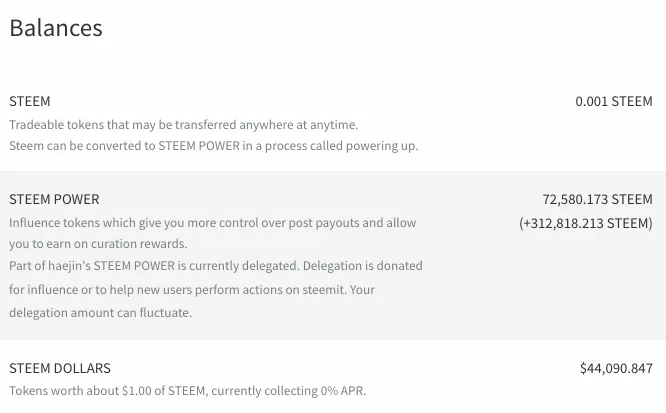

Some believe in @haejin being a "crypto oracle", while others are of the opinion he's a scammer, a self-centered egoist, and a reward pool thief (to avoid a different wording). Anybody is entitled to form his or her opinion regarding @haejin, as far as I'm concerned, but have a look at this SBD price prediction post of his, which was presented from a price-technical point of view (as always), and now regard it from the perspective that I just presented. And ask yourself, no matter what you think about him personally: "Is that SBD price projection unrealistic, or might it be under-valued even?"

If you take a sneak peak at https://steemit.com/@haejin/transfers/ and take a look at his liquid positions... then surely you cannot deny that @haejin is practising what he preaches, at least in this case, for he's clearly preparing himself for an SBD mooning very soon.

Let's say at some point Steemit Inc. wants to put a stop to the ever-expanding increase of SBD supply, therewith controlling the debt-equity ratio, by "burning" a bunch of SBDs with their self-owned Steem. While being very costly on the one hand, such an operation would be pointless on the other as well. What happened in December 2017 when SBD price had mooned causing a 0.2 SBD/Steem price ratio? On the internal market everybody quickly converted their hard-earned SBDs for Steem: trade 1 SBD in exchange for 5 Steem, that was a pretty good deal! So as an effect, SBD price slowly fell, but Steem price got driven up: high-SBD lead the way to a higher price of Steem. So in case Steemit Inc. would choose to mass-convert SBDs to Steem by burning them, then at first the amount of SBDs will be even more scarce, causing the price of SBD to moon once again, which will again lead to a price increase of Steem, which leads to more SBDs being printed, until the same high debt/equity ratio is a reality once again.

Also ask yourself: who else than Steemit Inc. could or even want to burn SBDs just in order to sanitize the debt-equity ratio?

Concluding on this, and as I've reasoned about that has nothing to do with technical but with fundamental financial analysis, and please feel free to share with me aspects I didn't consider that might prove me wrong, if things continue unchanged in the way they do now, I see no other possibility than that SBD price and market capitalization will go up by several factors in a few weeks or months.

SBD vs Steem vs BTC: which one could or should be more valuable?

Circulating supply SBD vs BTC: same ballpark

What drives market capitalization of any asset? I'd say it's "utility" (what can it be used for?) and "popularity", or "volume" (how many people want to use it?). BTC is of course the first mover in the crypto sphere and because of that, since 2009, it has steadily acquired a powerful market position in terms of market awareness, and price per token and market capitalization as an asset class of its own. Out of the maximum supply of 21 million BTC tokens, currently a little over 17 million tokens are circulating.

When looking at SBD, with a current circulating supply shy under 13 million tokens, wouldn't you say that both BTC and SBD are in the same ballpark, in terms of circulating tokens? Suppose we're at a point where 100 million SBD tokens are circulating, then they're still in the same ballpark, but in order to let the ">5 % Steem Debt Ratio" take effect, then the market cap of Steem needs to remain under $2 billion USD (that's double the value it has today).

However, the current market cap of SBD (~$ 44 million USD) isn't in the same ballpark as BTC's market cap currently is (~ $ 165 billion USD) at all.

SBD vs Steem vs BTC Comparison SWOT

Apart from it's first mover advantage, which strong points does BTC have? Its underlying blockchain technology isn't very fast in terms of transaction speed, especially when being compared to the Steem blockchain which dances circles around BTC's blockchain tech. BTC's mining mechanics are very inefficient, yet lots of hardware capital (ASICs that can only be used for one specific task) is involved in the mining of BTC meaning the miners have their hardware investment at stake as an incentive to keep on backing BTC. But there's one very strong plus in favor of BTC, namely it being the current gateway between fiat and crypto: if somebody wants to invest in crypto or cash out to fiat, BTC is the gateway. And if somebody wants to exchange altcoins X for Y on crypto markets, then they're obliged to do so via BTC (and/or ETH) mostly as direct exchange pairs.

By design, anybody can follow and inspect transactions of a certain BTC wallet, where the wallet's address is anonymous (well, to a certain extent at least it is). People mostly prefer not to talk to others about the amount of BTC they own, for various reasons, meaning a scenario where BTC-users would "interconnect socially", like is being done on Steemit, is highly unlikely. And as such, I don't see any potential for BTC to be more than a storage facility and exchange mechanism for holding and exchanging crypto value.

Now as I've argued above, Steem and SBD behave like Siamese Twins (intended originally, or not, doesn't matter: the correlation is happening regardless). A mechanism where high-Steem leads to a faster creation rate of SBDs, and low-Steem leads to a zero creation rate of SBDs, eventually an equilibrium state will occur where the circulating supply of SBD is finite and fixed by market demand, not by design. Therefore I foresee a situation where Steem will be mostly occur, and be used dominantly, in the form of Steem Power as a means to have a say over the distribution of newly rewarded Steem. The (then) liquid Steem rewards will either be powered up to SP or traded for SBD for its scarcity and value.

Practically speaking, you can do the same with SBD as you can with liquid Steem: they both use the very fast Steem blockchain technology allowing for very fast transaction times at a high volume. This means both Steem and SBD can be both used as a transaction mechanism / currency for the exchange of goods and services in a far more practical way as BTC current technology allows for.

Utility-wise, both SBD and Steem have far more possibilities than BTC does. Because of the underlying social interactions (by design!) of the Steem Ecosystem, both SBD and Steem encourage social interaction between users and therefore also "wallets". While BTC wallet owners behave rather "shy" about showing what they've got, the Steem Ecosystem encourages "showing off" your wealth: there's a strong correlation between "amount of SP owned" and "amount of followers". The more SP influence you have, the more eyes following you as well (e.g. people hoping for an upvote from a high-SP account). The Steemit ecosystem encourages people to interact, form alliances, develop and use new things and services, together. None of those things are happening in the BTC Sphere: in there, the "retailer fiat mindset" is still dominantly present.

Steem & SBD E-Commerce Initiatives => SteemCommerce

Currently, the Steem ecosystem is still mostly about "blogging" and "upvoting content". But so much more can be done with both the underlying technology and community! Just imagine what will happen if we create an E-Commerce layer on top of the current Steem ecosystem... The zero-transaction costs of Steem & SBD are very appealing, allowing for micro-payments. And it's possible already to do so in ways currently unseen. Let's give a few examples:

You know hosting company https://www.privex.io/ ? It's founded by my friend Chris (@someguy123), and as a hosting company Privex allows you to use its hosting services paid for in USD but also as Steem and/or SBD. Many Steemians use Privex.io because of that: the acceptance of SBD & Steem allows you to actually spend your Steem & SBD, in fact circumventing the fiat markets with it. Now imagine how useful it would be if Privex.io would deploy a subscription-based payment system: auto-payments I mean, subscription-based, right from your wallet on a predefined date and time. It's possible already technically, using SteemConnect!

@utopian-io already uses a weekly comment-creation and upvoting mechanism for moderators and Community Managers, as a means of payment for being active in those Utopian roles. Again, using SteemConnect authorization, Utopian auto-comments on behalf of moderators / Community Managers, and auto-upvotes each comment based on the value provided by that person in the past week. The interesting tech aspect here lies in the 'auto-commenting on behalf of'. That's another form of a subscription, I argue.

And then there's Steem Dunk, allowing you to pay, via subscriptions, for setting up and deploying an advanced curation trail. While that's still a similar service to "blogging & upvoting", the subscription-based payment mechanism is extremely interesting.

Please consider @neoxian 's financial services. Another very interesting approach to provide new and exciting services, using the Steem blockchain, apart from "blogging". @neoxian is single-handedly taking the Steem blockchain to an entire new level, providing immense value to the entire ever-expanding community.

Many developers are already accepting Steem and SBD as payment for their development services. The same goes for designers providing their services. Another form of "SteemCommerce".

Or how about web shops allowing you to pay with Steem & SBD, right out of your account's wallet, via SteemConnect?

If we only think "Out of the Box" about the Steem Ecosystem, instead of "blogging & upvoting content"-only, and develop new services and infrastructures around it, then we have collectively circumvented the need for a "fiat gateway", which is to my perception the most dominant enabler of BTC's market cap.

Concluding...

I think:

SBD market cap and price has a realistic potential to multiply by a number of factors, because of the debt-equity counter measures built into the blockchain, leading to irreversible SBD scarcity (don't take this as financial advice but don't ignore what I've explained either);

Since I've argued that Steem and SBD are behaving as "Siamese Twins" I don't see why their both market caps couldn't be in the same ballpark;

If we collectively develop a technical infrastructure of SteemCommerce with new and exciting products and services, and take care of growing the Steem user base (which needn't be about blogging-only!) in a healthy way, then we have combined all factors that are needed to make way for a very, very, very bright future of the Steem Ecosystem.