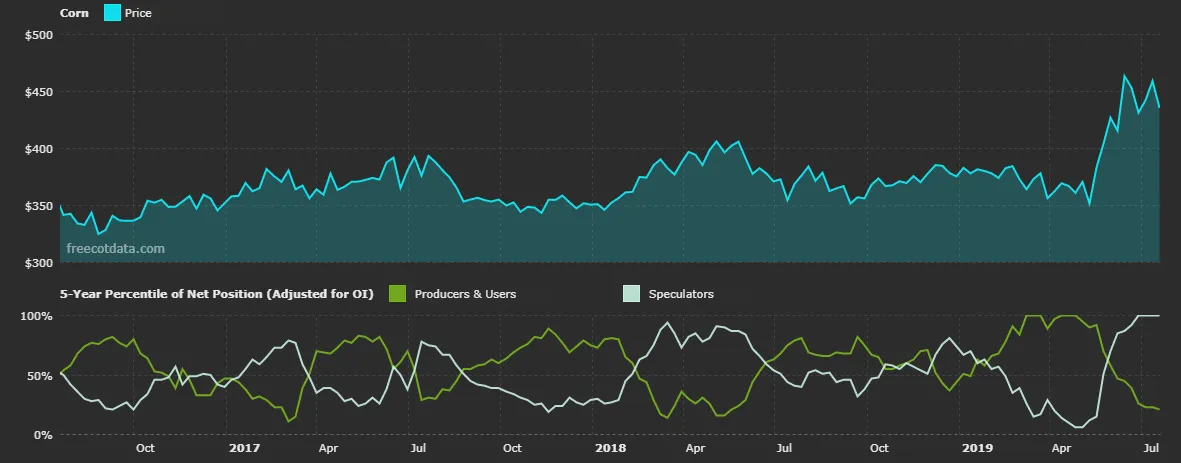

COT report measures positions of all commercials and speculators who usually take the opposite side. If either is on

1-3 year historical top or bottom and the other on the opposite side, it usually harbingers a good opportunity for midterm investment.

Reports:

Technicals:

Both markets are closing on their key structures. I want to see them bounce and create a higher low in case of cotton and lower high in case of corn. If success, I will be looking for an entry point within or around the circles. As they bounce, I want to see candles decreasing over the duration of bounce. Perhaps, some rejection candles (long tail for cotton, long wick for corn). Then, I will open my position on one of these.

Corn's downward move is also strongly supported by seasonality, so I would favour taking it more.

Remember that my analysis is just my opinion and it is only your decision to either invest or not invest.

Thanks for reading! Have a nice day!