Dear trading community,

Here is a look at my sample portfolio for Friday September 20th 2019.

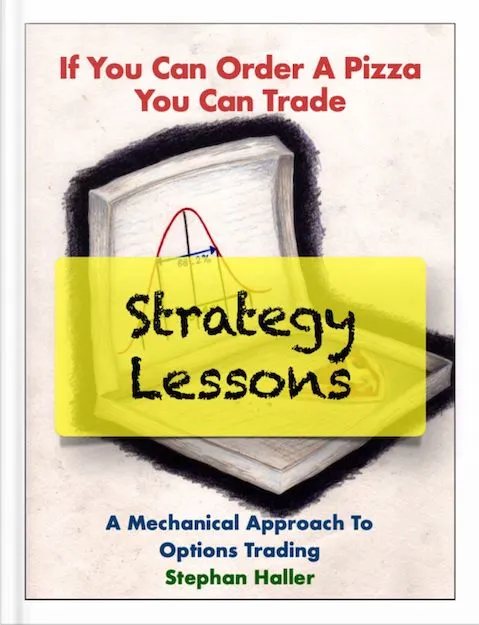

IWM Straddle

On Wednesday, September 4th 2019, I sold an 30 delta strangle in IWM. On Monday, September 9th 2019, I had to roll up my put to defend the position.

My overall credit for this position is $7.03.

My profit target for this position is $2.01, so I'm going to close this position when it trades for $5.02 or at 21 DTE.

At the moment this position is down 31 cents ($31 per one lot).

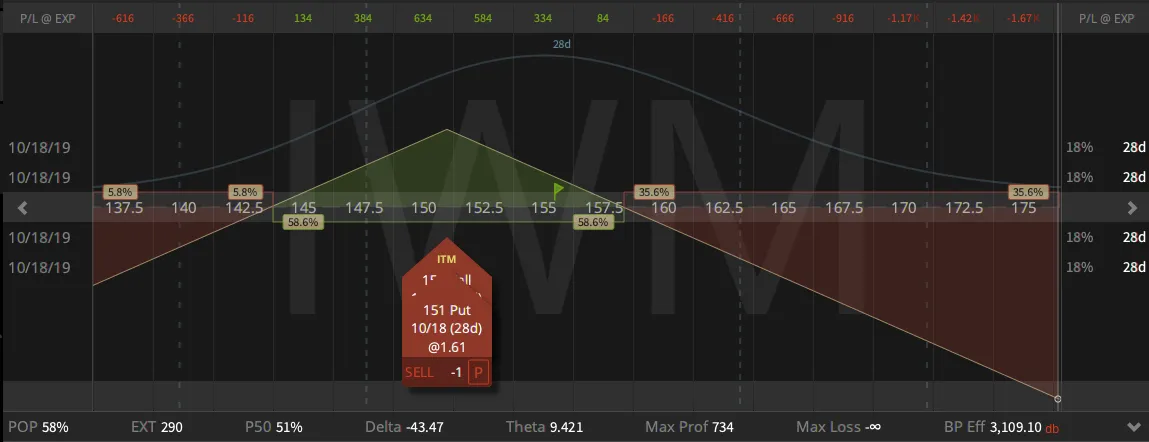

October IWM Short Call

On Friday, August 23rd 2019, I sold this call for a credit of $4.53.

Since this is a very small position and because of my traveling I missed defending this position.

Next week I will have to sell a put against it to defend this position.

At the moment this position is down $5.16 ($516 per one lot).

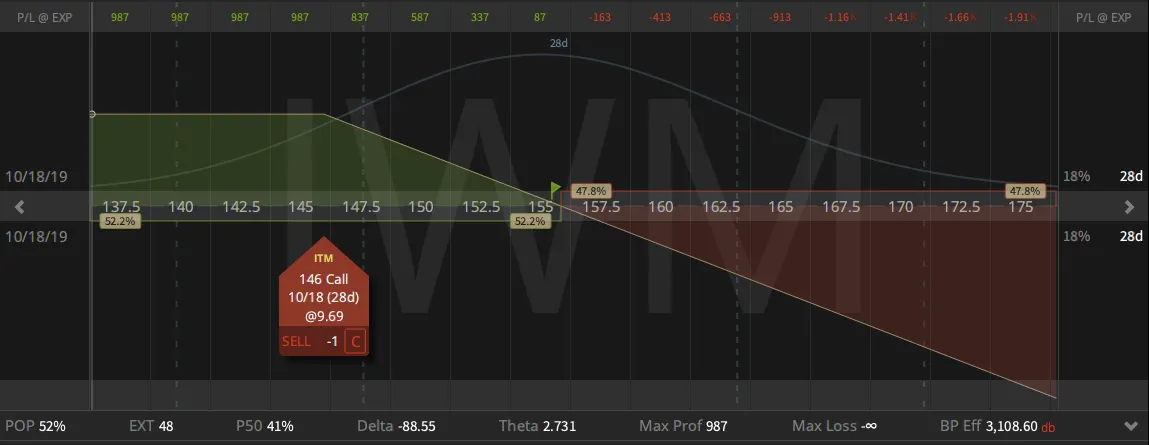

TLT October Inverted Short Straddle

On Wednesday, September 4th 2019, I sold an 30 delta strangle in IWM.

On Monday, September 9th 2019, I had to roll up my put to defend the position.

On Friday, September 13th 2019, I had to roll down my call and go inverted.

My overall credit for this position is now $7.29.

Since the most I can make on this position is 29 cents, I'm looking for a scratch, so I'm going to close this position when it trades for $7.00 or at 21 DTE.

At the moment this position is down $1.88 ($188 per one lot).

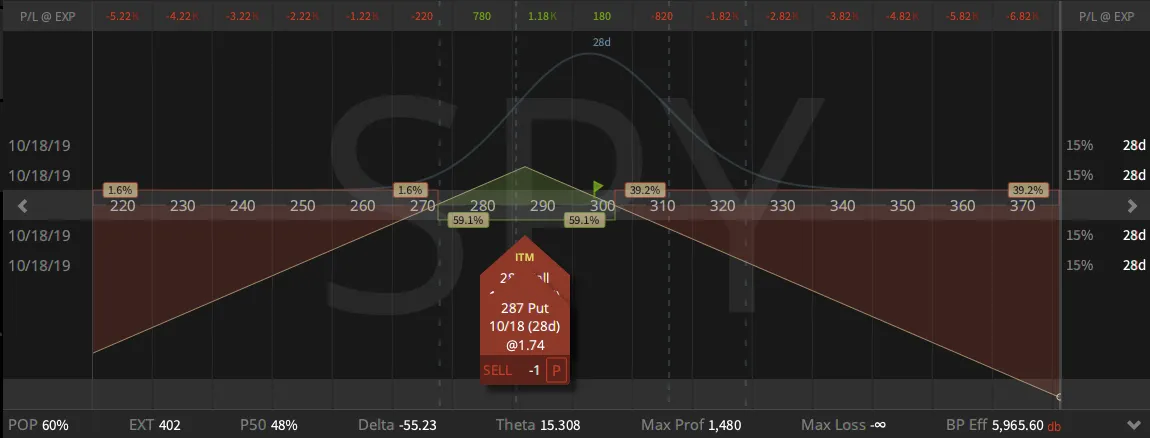

Rolled October SPY Aggressive Short Delta Strangle into a Straddle

On Friday, August 23rd 2019, I sold the aggressive short delta strangle for a credit of $10.03.

On Monday, September 16th 2019, I rolled up my put into a straddle for a credit of $1.43.

My overall credit for this position is now $11.46.

My profit target for this position is $3.56, so I'm going to close this straddle when it trades for $7.90 or at 21 DTE.

At the moment this position is down $3.34 ($334 per one lot).

QQQ Synthetic Covered Put

I also had to roll up my put in this position for a credit of $1.

My synthetic basis on the covered put is now $179.97, so I have to collect $1.91 more in credit on this position, until I can break even.

Closing QQQ October Short Straddle

The overall credit on this position was $11.54.

On Friday, September 20th 2019, I closed it for a profit of 89 cents ($89 per one lot).

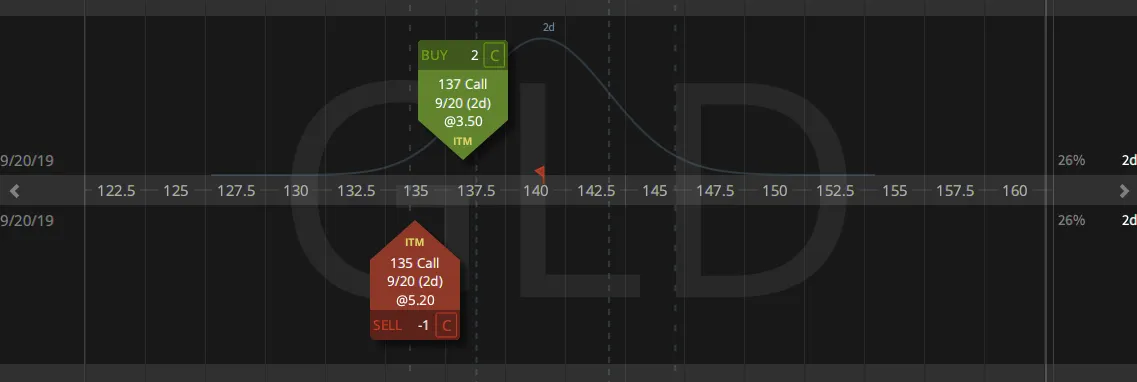

Closing GLD September Call Ratio Spread

I sold this one for a net credit of $1.26 on Thursday, August 1st 2019.

On Wednesday, September 18th 2019, I closed it for a loss of 23 cents ($23 per one lot).

Closing October GLD 30 Delta Strangle

On Friday, August 23rd 2019, I sold this position for a credit of $3.33.

On Wednesday, September 18th 2019, I closed it for a profit of $1.50 ($150 per one lot).

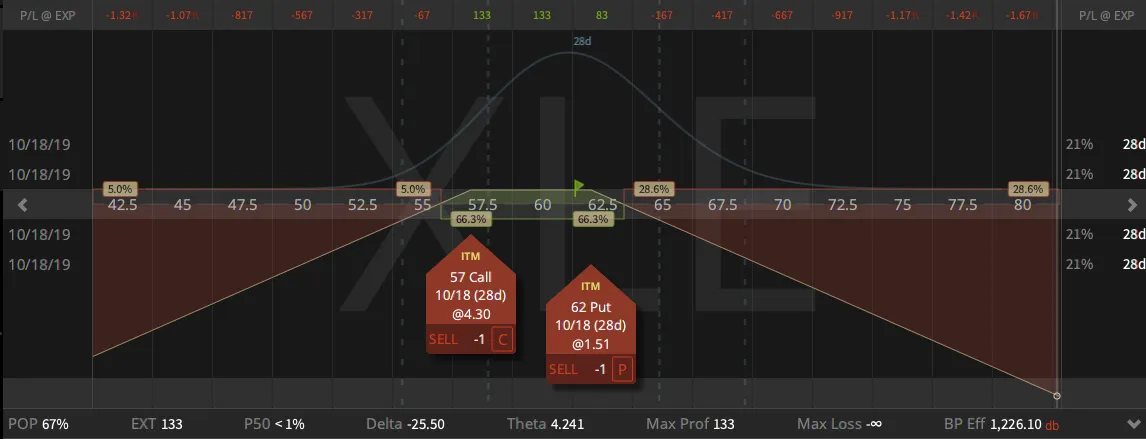

XLE Inverted Strangle

This position started out as an October 57 short straddle.

The price of XLE kept going up, so I had to go inverted.

The overall credit on this position is $5.25.

At the moment this position is down $1.08 ($108 per one lot).

Books Update

With the completion of my latest book, I have now a trilogy.

The first book is still available for a huge discount on Google Play, so buy as long as it is still cheap.

You can also buy it for $19.99 on iTunes, Amazon or Barnes and Nobel.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My second book is available for $5.99 on Amazon, Google and on Apple.

Thanks to all my readers for buying it.

If you like it, you would do me a great favor by writing a short review on amazon.

My third book is available on Amazon, Google and iTunes.

Have a great weekend,

Stephan Haller

P.S. Probably no update for the next two weeks.

Legal disclaimer: These are not trade recommendations. Options involve risk and are not suitable for all investors. The trades shown above are for educational purpose only.