As we are hovering near the 20 cents range for STEEM, everyone is wondering what will it take to stop this? How is this going to reverse?

I think the answer to this comes from stripping it down to the basics.

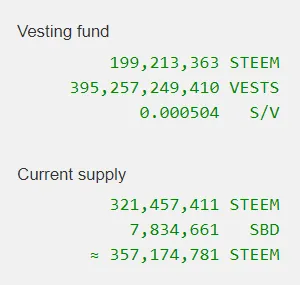

According to Steemd.com, there are roughly 120M STEEM in liquid form out of the total of 320M. Almost 200M is vested, removing it from the liquid market via powering up.

I am not quite sure how much needs to be soaked up to stop this but let us look at a few ways this could happen.

User Base Grows

This is the reason many of us are optimistic about the long term potential of STEEM. It is very simple: STEEM is required to operate on the Steem blockchain, hence more users equates to more STEEM needed. This has to be powered up to provide the Resource Credits which quantify every activity on Steem.

Here we have an option that is long-term. We are not going to see the user base add a couple million overnight. However, doing some basic math, if we add 2M people, each requiring 10 SP to have minimal interaction on Steem, that is 20M soaked up. This along removes 16% of the total on the open market.

Businesses Start Buying STEEM

Here is another alternative that is highly attractive, most likely very effective, and long term.

Businesses tend to have simple goals. They typically want to sell more of their products and services. Steem could be an attractive venue since there is a user base that is becoming categorized. This is very helpful for businesses seeking to reach a targeted audience.

Companies looking to interact with Steem would have to buy the currency as part of the package to operate. @oracle-d is already working on a couple projects along these lines. Businesses have the ability to buy hundreds of thousands of dollars worth of STEEM.

The question is will they? I guess we can say this option is tied to the first one. Businesses go where the users are. The attractiveness of a platform grows as the amount of people using it expands. Here, we kind of see the chicken or the egg scenario.

The Present People On Steem Buy In Quantity

The other day I wrote a post about there being a floor in the price of STEEM. At some point, I feel there is a level where people on here will add to their stake in massive quantities.

https://staging.busy.org/@taskmaster4450/there-is-a-floor-to-the-price-of-steem

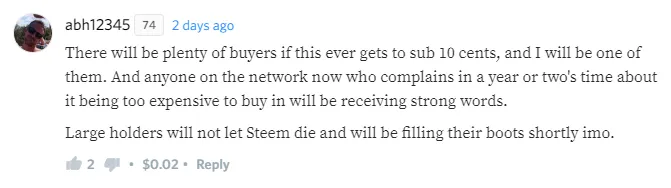

Looking at the comments, there are a number of people who posted they are watching closely. There is a price point, which differs for everyone, that is going to trigger some buying. We might not be there yet but it was summed up in this comment by @abh12345.

Ideally, we would see across the board buying with smaller accounts taking the opportunity to add to their stake. At present, $100 creates a Minnow which is much different than 18 months ago when it took $1,000 (I know because I bought some STEEM at $2 in the fall of 2017). The same $1K will make one a Dolphin.

Unfortunately, the total accounts in each of these categories has not seen much of a shift out of the normal trend the last few months. People entering those levels are doing so through normal earning activities. Don't get me wrong, I am elated to see that since it shows people can grow their accounts and are committed to powering up.

However, my sense is that when buying takes off, it will be larger accounts adding to their stake in a disproportionate manner (on a collective scale). It looks like the larger Dolphins and the Orcas are going to be the ones adding.

Applications Start Making Money

It is hard to pinpoint where the selling pressure is coming from. There are always a variety of reasons for people to sell and the crypto bear probably has a large part to do with it.

There is another factor that I think is overlooked. We know that Steemit Inc had been dumping somewhere between 500K-800K per month. Many feel this is stopping with the addition of advertising to Steemit.com plus the cost cutting. Doing some quick calculations in my head, that does not add up.

To start, Steemit.com does not have the traffic that is going to garner a ton in advertising. Even if we give them 2.5M clicks on the ads posted, at a penny a click (which is probably high), that is only $25,000 a month. Add up the cost for a couple blockchain developers, a handful of other employees, Eli, possibly Ned, the AWS bill, legal fees, benefits, and all the other everyday costs businesses have to see if this matches.

Thus, I expect Steemit Inc to keep selling.

But they are not the only ones. There are other applications on here that are selling each month too. Unfortunately for them, even though they had success in the blockchain world, overall it is not that much of an impact. Since most of the apps are still dependent upon the STEEM earned, they are having to sell some regularly to pay their bills.

Obviously, this is not the preferred method of these businesses but it where they are. Again, this is not something likely to change instantly. They are working on pulling other revenues in yet that takes time. I believe many of them will succeed and have business models that are starting to address it. Nevertheless, in the short-term, it is most likely status quo.

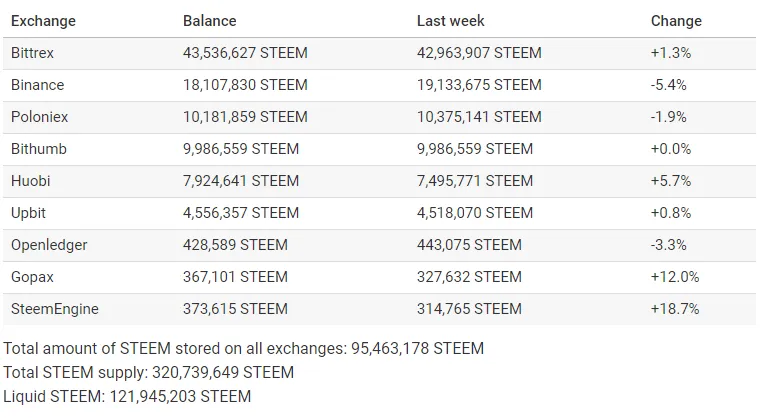

I did find something interesting. @penguinpablo put together a weekly report on the liquid STEEM out there. He took a look at the amount on the exchanges which actually makes the situation a bit better.

Of the 120M liquid STEEM, 95M of it is on exchanges. That means about 25M is on Steem in liquid form. This is a combination of those who put STEEM in savings or are just holding it in their wallets. A decent percentage of this could actually be large number of small accounts holding a few STEEM apiece that was never powered up.

Regardless of how it occurred, that removes some of the amount that people are looking to dump (I presume). However, what I find interesting is the STEEM held on exchanges.

Notice the last one on the list.

Steem-Engine has roughly 375,000 STEEM held. It is listed as an exchange since that is what it is and is not, technically, on the Steem blockchain. Hence, all STEEM moved there is leaving the blockchain.

Yet, most importantly, it did not leave the ecosystem. We know Steem-Engine is using STEEM as the pair for the tokens created via the STEEM peg. This means the STEEM is not going to be dumped in a fire sale since it is backing the peg.

Obviously, we could see people starting to dump the SE tokens, convert to STEEM, and then sell that on the open market. However, at least in this post, the amount of STEEM increased by 16%. Since token creation on this exchange is only a few months old, 375K amassed in such a short period is encouraging.

To me, STEEM's biggest sink is the fact that it is required to operate on the blockchain. Activity is what STEEM buys in the form of SP (RC). The ability to interact is the main use case, long-term, for STEEM. There is simply no way around this.

This is why I feel so optimistic about what is going on here. The development we see, tied to the overall growth of the crypto/blockchain world, will see our user base increase over time. Actually, we are already seeing that according to the number, it is just at a pace which is a trickle.

In the meantime, we are dealing with a number of forces that are putting selling pressure on. One can view this as either a curse or an opportunity. Obviously, if one feels Steem is going away and will fail, then there is nothing left to say about that. However, for those who do not believe this, the falling price does provide an opporuntiy.

For me, I have been buying on the way down. I do not view this as "catching a falling knife" because the STEEM I buy and power up is not passively sitting in an account. On Steem, with the compounding mechanism, we can use it in a variety of ways to further our stake. The increase in the voting power is the most obvious benefit.

Time will tell what turns the confidence in the STEEM token around. Which of these factors comes into play, and when, will be determined.

For now, we just either endure, or enjoy, the ride.

If you found this article informative, please give an upvote and resteem.