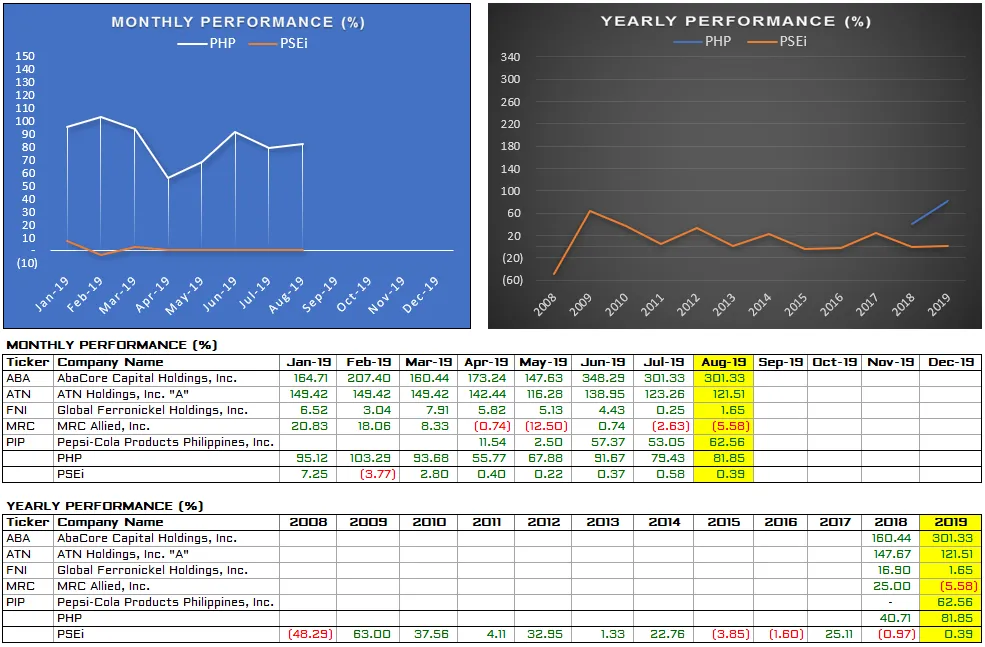

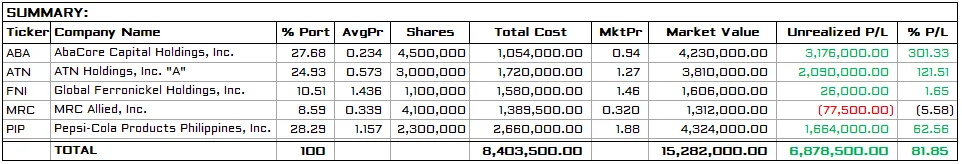

AbaCore Capital Holdings, Inc. (ABA)

It’s an uptrend since my buy signal on 01-Aug-2018. According to the PSE disclosure, ABA ordered to pay a fine of 1 million pesos for the material deficiencies and misstatements in its 2008-2009 financial statements. If this penalization prospers, in my opinion, this has only a petty impact of ABA’s fundamentals and I’m expected ABA in a sideways position in the near-term.

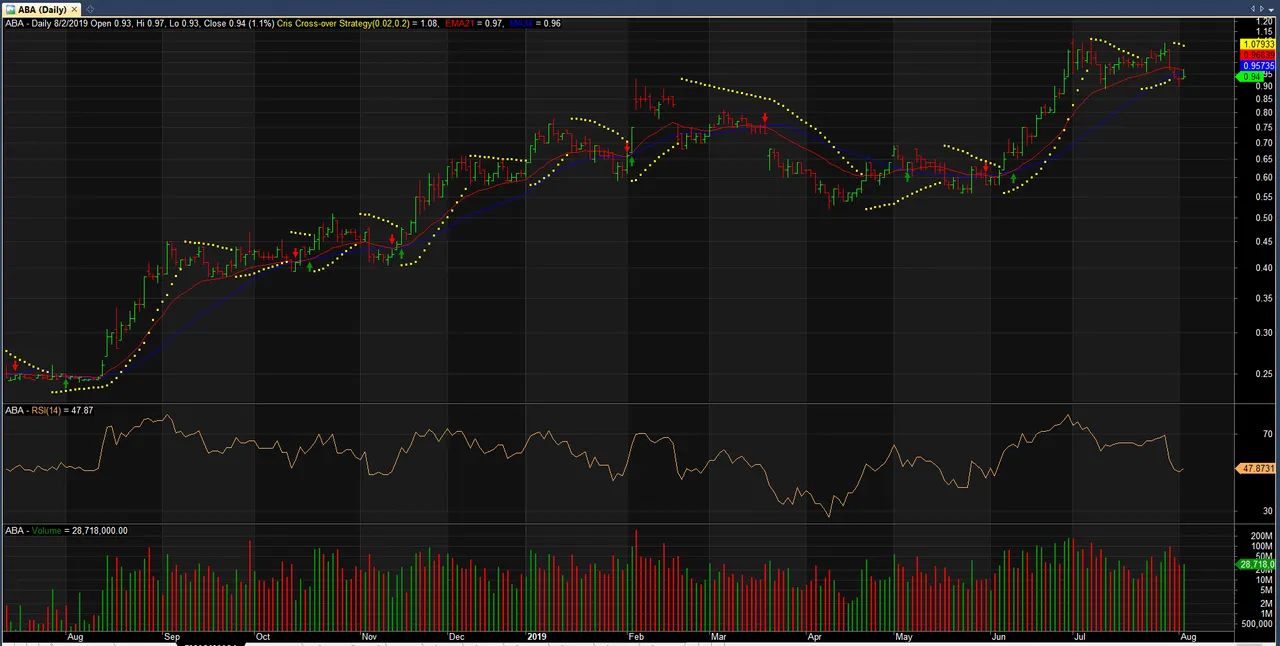

ATN Holdings, Inc. "A" (ATN)

Since an enormous parabolic moved up of its price a year ago (06-Aug-2018), it is in a sideways trend and a noticeable declined thin volume from then on. I may be in a sideline as this ticker is lacking catalyst. The annual report published at PSE on 26-Jul-2019 has incurred a net loss of Eleven (11) million compared to a net profit of Three Hundred Eight (308) million last year. Despite an increase in revenue to 42% is beyond compare to a net loss of -103.81%. If this trend will persist shortly soon is not a healthy sign and investors should look forward to a steadfast value-added investment somewhere else. I’m constantly watching ATN and if the losses will not fade away in the forthcoming quarters, I maybe cut this short in my portfolio even though the piled-up retained earnings of 1.6 billion and the fundamental catalyst still intact.

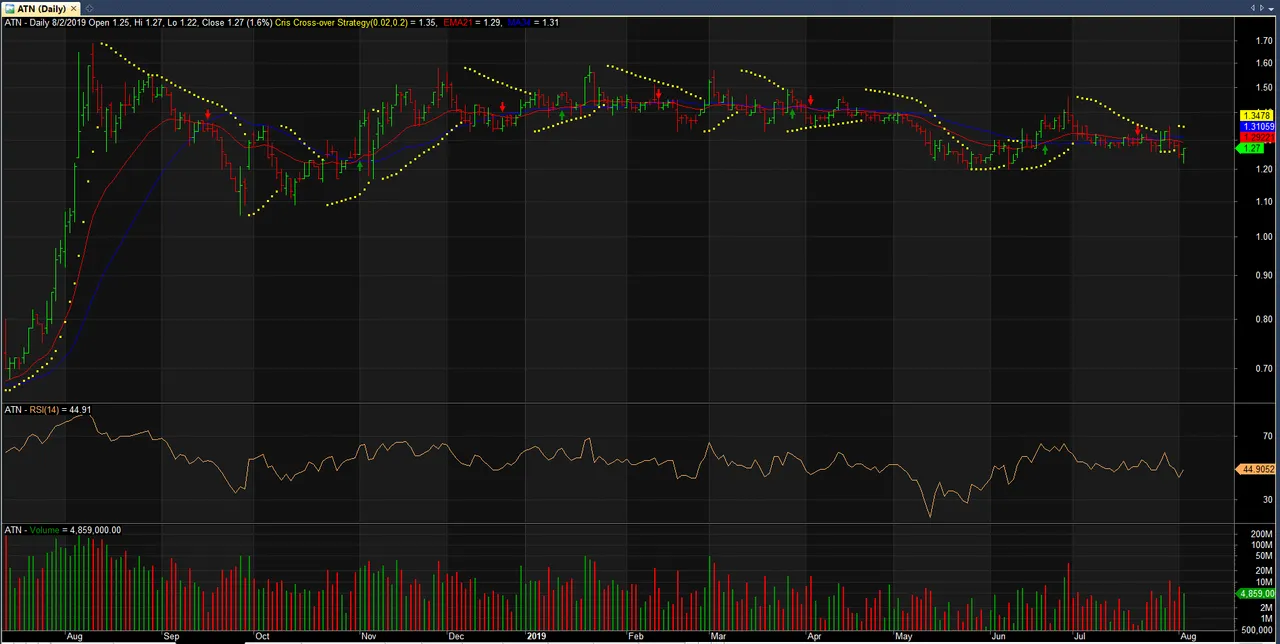

Global Ferronickel Holdings, Inc. (FNI)

This ticker is in continuum bearish trend. If the company’s plan to put up a $20-million steel plant in Luzon alongside partner, Hong Kong-based Huarong Asia Limited, which jump-start operations by 2021 will push through, then it’s a significant value-added to company’s fundamentals in the long-term as well as to investor. It’s only high speculation at this stage.

MRC Allied, Inc. (MRC)

Since the parabolic reversal on 07-Nov-2018, it is in a sideways trend but overall in downtrend territory. Due to the lack of catalyst that continuous drag the price down. The second-quarter report still laggard though a bit improved from a year ago. I’m not expected MRC to wipeout deficit in the mid-term although I’m bullish on their renewable energy portfolio that gives investor intrinsic value in the long run.

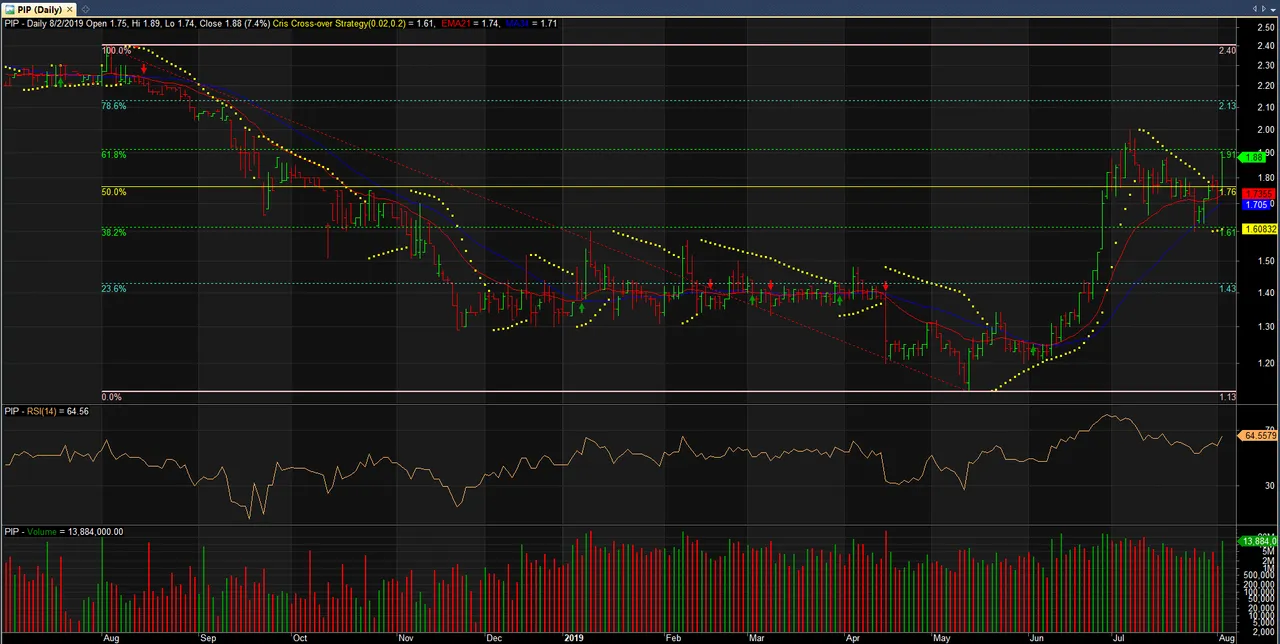

Pepsi-Cola Products Philippines, Inc. (PIP)

If this failed to revisit my 2nd resistance at 2.40, this may continue in a sideline trend. It seems that yesterday’s price tried to climb in my 1st resistance level at 2.00. If the price will breakout at this level, then a sideways trend range at 2.00 to 2.40 is expected in the coming months.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of these securities.

Please upvote and follow me on https://steemit.com/@php-ph.