We're on the eve of a Federal Election where it is widely expected that we will have a change of government to usher in one of the most leftist governments this country has ever seen. It does make you wonder about what our new economic policies might look like when they inevitably take power in a few weeks.

Source

Against a backdrop of an imploding housing bubble market and a potentially slowing global economy it does cast the mind back to the last time this mob were in power and we had a financial crisis – what did they do? Well, the first thing they did was dip into our budget surplus to give Australian citizens some free money via a massive Stimulus Package - estimated by some to be in the vicinity of $100 billion dollars.

Source

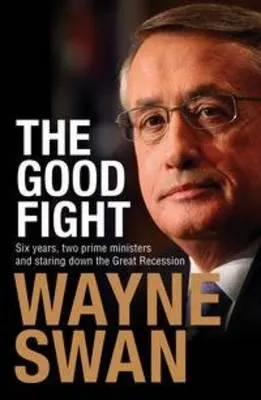

Everyone likes free money, right? Why wouldn’t they do it again? After all, the treasurer at the time Wayne Swan was awarded as the Worlds Best Treasurer and while it all seemed like a good idea at the time, to many with the benefit of hindsight….it still seems like a good idea. So what does that mean for investors?

Source

Well, you can say it with me…..CURRENCY DEVALUATION. More debt and more deficit spending eventually leads to more money printing to support it. We already have record low interest rates in this country at 1.50%, so let’s take them even lower! Why do I care? Well, to be honest I don’t much any more. Stupid is what stupid does and the leftist fiscal policy playbook is the same all around the world. They don’t much care about Sound Money – but I do. So let me sum it up for you - The Australian Dollar (Fiat Currency) is just not sound.

Source

So what do I do about it? Well quite simply I don’t hold Australian Dollars and I don’t hold assets that are tied to Australian Dollars. Of course I like Precious Metals for wealth preservation and one of the best (and easiest) ways to invest in Gold is to buy Australian Gold Mining Shares. Not only is that a good Export Commodity play that is relatively immune to the impacts of a falling Australian Dollar, but it is also an Alternative Currency play and it is ALSO effectively leveraged on the Gold Price.

Source

Australia has a good number of Gold Mining companies, but you do need to watch out for those speculators. For the safest plays I’d recommend looking at the big producers. The Big 4 that I like to talk about are Newcrest (NCM), Northern Star (NST), Evolution (EVN) and Regis Resources (RRL). Of course there is some risk with all these companies but for me these shares are safer than the Big 4 Banks and possibly the best place to be parking funds right now if you’re an Aussie who is concerned about the looming political landscape.

Source

DISCLAIMER #1 – This information is for general information only and should not be taken as financial advice. I am not a financial adviser and I encourage all readers to seek independent financial advice before investing in any of the above Shares.

DISCLAIMER #2 – I am not a Liberal Party voter either. In my opinion they are a bunch of idiot and morally bankrupt scumbags also. This post is not a How-To-Vote guide.