Any "stacker" living here in the UK knows the pain of overpriced silver!! So to get around this we sometimes like to buy from overseas.

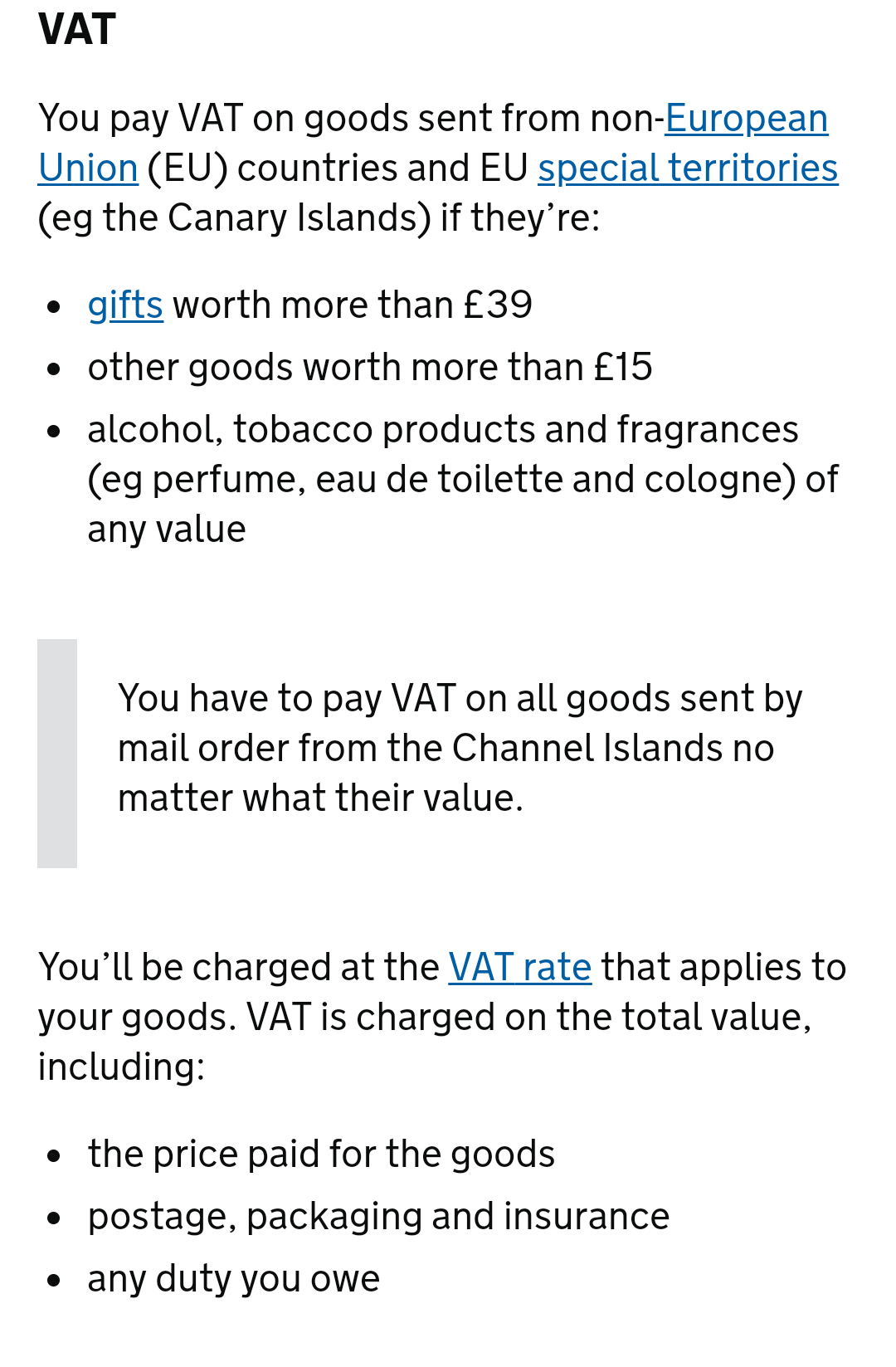

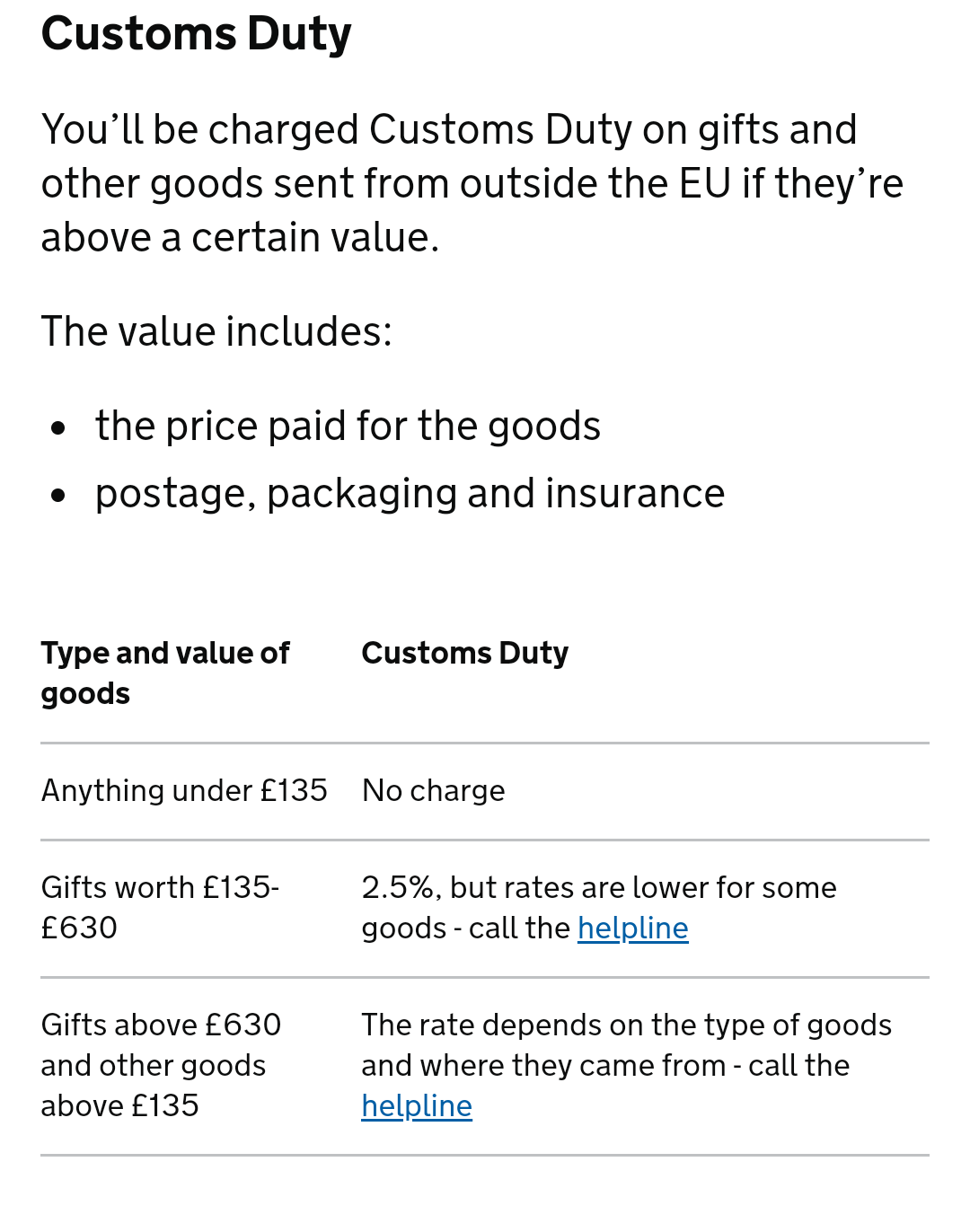

Well when buying from anywhere outside the euro zone, we get stuck with a bill from Her Majesties Revenue & Customs(HMRC) for not only import tax but VAT also.

(screen shotted from hmrc.gov.uk)

Now there are a few loop holes, which I'm not recommending you do as that would be breaking the law, that can reduce the amount you pay to HMRC and I'll list them below:

° ALWAYS get the sender to mark the contents as "GIFT". This gives you a higher threshold before fees are applied.

° You can ask the sender to elaborately describe the silver in a way that makes it sound less valuable; i.e. Instead of "999, 1oz,fine Silver coin" you can call it a "31g metal paper weight"

° You can ask the sender to value them at $1 and not $20, to keep it under the £39 ($50US approx). As long as you understand that insurance may not payout full value if declared value is less.

But I'm not advocating or telling you to do that as that would be dishonest!!!

But sometimes HMRC ignore all of the above and just charge you what ever they want.....

So it's your duty to correct them and point out that they shouldn't have charged you an extortionate amount of money.

A while back I received a shipment of silver that was elaborately described, completely under valued and sent as a GIFT but I still received a hefty ransom, sorry I mean tax bill. Well of course I questioned this....

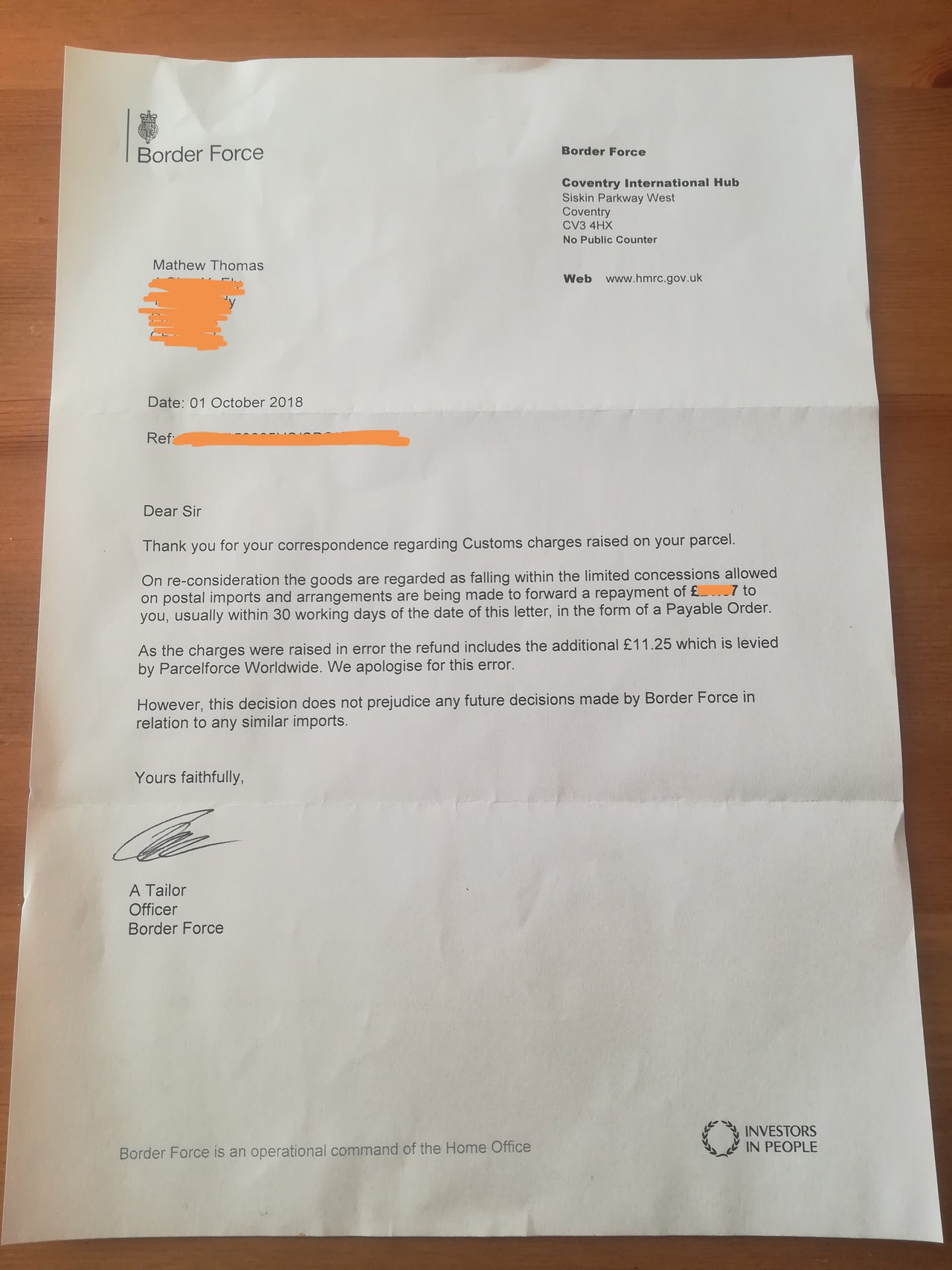

I sent all the details they requested even pointing out thier own laws and then waiting for me when I got in today was a letter.

It's taken about 3 months to reach this point, yet when they believed I owed them, I had 7days to pay up or my items would be confiscated.

Ohh yeah and did you notice the £11.25 ($14.50US) they charge to tell you that you owe them money, I will be getting that back too!!

Hopefully this means the end to my bad luck of having silver sent to me from USA/CANADA.....

How do I test this?? I know, let's order some more 😉