Summary

- There is a common mistake most investors make: they study the dividend discount model with great caution and then use it as a valuation tool.

- What the DDM really gives you is the value of a money printing machine.

- The DDM or the Discounted Cash Flow Model are simply giving you a theoretical value for future dividend (or free cash flow for the DCF).

- Focus on finding great companies increasing their dividend year after year and let the share price be a secondary element in your decision.

- This idea was discussed in more depth with members of my private investing community, Dividend Growth Rocks.

The Dividend Monk contains a multitude of articles about the dividend discount model (aka the DDM) and how to use the famous Gordon Growth Model. Most articles I read (from this blog or elsewhere) focus on the calculations, how to put the numbers in the DDM formula. Those articles are lengthy and include academic references to the Capital Asset Pricing Model (CAPM), the beta and risk-free returns. After a couple of reads, you become academically educated in explaining the DDM formula and its components. But do you really know how to use the dividend discount model to make smart investing decisions? This article will tell you how I interpret the results of my calculations and how I use it in real life.

First, forget about valuation, the DDM is not about the price you pay

There is a common mistake most investors make: they study the dividend discount model with great caution and then use it as a valuation tool. After all, this is what the formula is about, right? Determining the fair value of a stock considering future dividend payments to be received. This is very good for financial theory fans who spend their lives studying the market but rarely invest a dollar in a single stock.

What the DDM really gives you is the value of a money printing machine. Imagine you wish to make 9% return on your investment (read discounted rate of return). You select a dividend stock. You get its dividend payment from any free financial websites and you guess to the best of your knowledge how the company will increase it in the upcoming years.

Let's run some numbers in the Dividend Discount Model

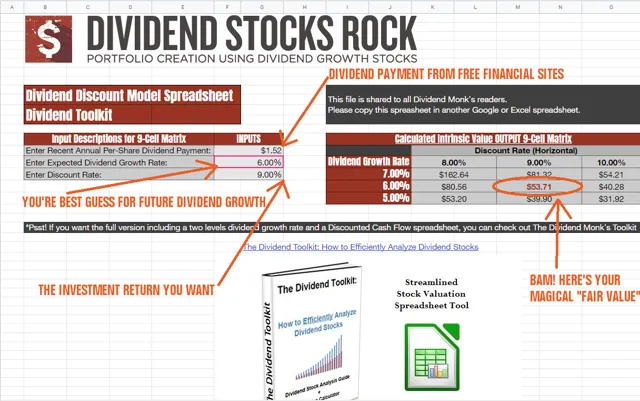

The numbers used for this example are as follow:

- Annual dividend payment per share: $1.52

- Expected (read best guess) dividend growth rate: 6.00%

- Discount rate (expected return on your investment): 9.00%

Plug all numbers in this calculator and get a magical stock valuation!

What you really get from the DDM calculator is the price you should pay if you were to buy a money printing machine paying $1.52 per year with a dividend growth rate of 6% while you want to make a 9% return on your investment. In this case, the price of your money printer is $53.71. If the stock is trading at $70 on the market, this means you are paying too much. If the stock is trading at $40, you technically have found a hidden gem at great discount.

If you buy the stock at $40, does it mean it will go up to $53.71 within the next 12 months? 18 months? Or even 5 years? Nope! The DDM is not giving you how much the stock will be worth on the market on any day.

Bummer.

All those years you have been calculating "fair value" for stocks and they never reach them. Now you know why. The DDM or the Discounted Cash Flow Model (DCF) are simply giving you a theoretical value for future dividend (or free cash flow for the DCF). This value will not likely translate in the real world for many reasons:

- Your assumptions on the dividend growth and the discount rate are at best wild guesses. Nobody predicts the future, sorry!

- Both models are highly sensitive and can give completely different valuations depending on your guesses… I mean assumptions. The example above showed that a 1% difference in the discount rate or the dividend growth rate could make the difference between a valuation at $162.64 (discount rate of 8%, growth rate at 7%) and $31.92 (same calculation but with a discount rate of 10% and growth rate of 5%).

- Several events/factors outside and inside the company will affect its value on the market (do you really think the market cared about the DDM in 2008?)

How I use the Dividend Discount Model to make investment decisions

Regular readers will know that I'm not a big fan of stock valuation. I'm a big fan of finding great dividend growth stocks and buying them on the spot. Why do I bother writing about the DDM then? Because I use it in a different way. In a way that helps me to make smart investment decisions.

... Read the Full Article on Seeking Alpha

Author Bio:

This article was written by The Dividend Guy. A well-known investment author on Seeking Alpha.

Steem Account: @thedividendguy

Twitter: thedividendguy

Steem Account Status: Unclaimed

Are you The Dividend Guy? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo team is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.