Summary

- TSMC surpassed Intel to become the largest market cap semi as predicted about 5 years back.

- Economics of the semiconductor business dictate that Intel may not be able to invest to be at the cutting edge of the fab business by itself.

- The time has come for Intel to divest its fabs. CEO Bob Swan has a tough task ahead. We discuss our prediction for the next 5 years.

- This idea was discussed in more depth with members of my private investing community, Beyond The Hype. Get started today »

It has been a little over five years since we published an article about divergent fate of Intel (INTC) and TSMC (TSM). In that article, we predicted that TSMC will take over Intel as the #1 semiconductor company within 5 years. It took a few months longer than we expected but, since late September, TSMC sports a higher market cap than Intel. As of the close of market on Friday, TSMC's market cap of $247B comfortably exceeded Intel’s market cap of $228B. We also predicted that Intel was unlikely to succeed with its fab business and that too has materialized as forecasted. Having reasonably nailed the forecast for the last five years, this article discusses what may be in store for these two companies for the next five years.

To appreciate this thesis, a reader needs to be aware of Moore’s Law and Moore’s Second Law. Moore’s law, which is widely known, is the observation that the number of transistors in a leading-edge integrated circuit doubles about every two years. Moore’s Second Law, which is less well known, states that the capital cost of a leading-edge semiconductor fab increases exponentially over time.

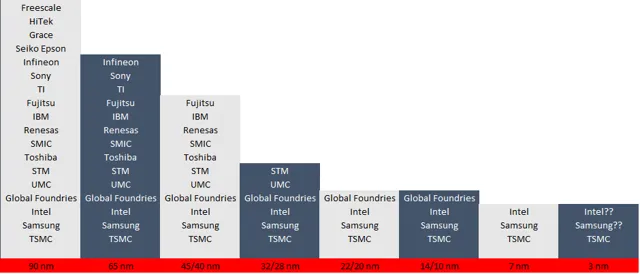

Historically, Intel CEOs from Robert Noyce to Brian Krzanich have all been believers of the Integrated Device Manufacturer, or IDM, model. This model, which integrates the design and the manufacturing components of semiconductors, served many industry players well into the 1990s until the foundry model started gaining and devouring IDMs in the 2000s. For this reason, the playing field at each new process node has thinned out (image below; note that Intel’s recent 10nm process is roughly equivalent to industry’s 7nm process).

Figure: Players at major process nodes since about 2000 (source: author data)

Semiconductor industry history shows us that once a company falls out of the leading-edge process race and moves to foundry model, it does not get back into the fab business. The foundry model plays to Moore’s Second Law by aggregating fab needs of these fabless players.

Despite the great strides of the foundry players, Intel management does not seem to have woken up to the cold reality of Moore’s Second Law even years after “Real Men Have Fabs” Jerry Sanders left Advanced Micro Devices (AMD) and AMD had to divest its fabs to survive. A series of Intel CEOs have been complacent mainly due to the vast x86 riches which likely gave them a false sense of security.

To be sure, Intel made some halfhearted efforts to build a foundry business in parallel, but the company failed to make significant gains. Critical time passed with half measures and Intel has now come to a stage where building on the current internal foundry model is increasingly infeasible and the x86 riches may no longer support a place at the front of the leading edge.

Consider the revised capex budget TSMC presented at its recent Q3 earnings call - $14B to $15B for 2019 and likely a similar amount for 2020. TSMC, it would appear that, has reached approximate capex parity with Intel in spite of roughly half the revenues.

In 2019, TSMC is expected to post revenues of approximately $35B whereas Intel is expected to post revenues of $69B. The revenue comparison is somewhat misleading because Intel’s revenues are from end customers whereas TSMC sales are to semiconductor companies who will resell those products to end customers with a roughly 100% markup (or 50% GM on sales). Adjusted for that disparity, the comparable revenues are much more even. With approximate revenue parity, TSMC now finds itself as the undisputed leader of process technology. Furthermore, market dynamics suggest that TSMC will continue to grow and Intel will likely stagnate or shrink.

To keep up with TSMC in this environment, especially to come back from the disaster that was 10nm, Intel will now have to increase its capex as a percentage of revenues. The problem is that Intel’s revenue opportunity is shrinking due to market share gains from AMD. On the other hand, TSMC revenues are growing leaving TSMC with the ability to spend more capex if it so desires. Intel’s margins will be reducing due to assault from AMD and increased capex spread over lower volumes. Simultaneously, TSMC will be maintaining or even expanding its margins due to lack of competition at the high-end. These dynamics imply that Intel’s cash flows and profitability are going to get worse which, in turn, will reduce Intel’s margin of error at the leading-edge nodes.

From an investor viewpoint, Intel should increasingly be two distinct businesses:

- A cutting-edge semiconductor design company focusing primarily on CPUs and GPUs. This part of the company, despite recent under performance against AMD, is a potent organization. Chances of this group gaining back performance leadership are high.

- A fab that has underperformed recently, is facing dis-economies of scale governed by Moore’s Second Law and is likely to fall further and further behind.

Tying the future of these two organizations together will almost certainly cause Intel to lose product leadership on an extended basis. Considering these dynamics, it is doubtful that Intel can now fight this battle for leading edge superiority by itself.

Interestingly, Samsung, having fallen behind TSMC at 7nm, is in a similar situation. If there is strategic desire, and we believe that there is plenty, there is an opportunity for these players to consolidate their forces and create a viable foundry alternative to TSMC. We estimate that Intel has about a two-year window to divest its fab operations and merge it with Samsung’s fab operations to have a strong chance of staying at the leading edge. After the two-year window, it may not matter much what Intel or Samsung will do as TSMC may gain an irreversible multi-year process leadership by that point in time. Most likely, the race to be the top dog in the semiconductor fab business will be over.

...Read the Full Article On Seeking Alpha

Author Bio:

Steem Account: @enertuition

Twitter Account: enertuition

Learn more about EnerTuition on Seeking Alpha

Steem Account Status: Unclaimed

Are you EnerTuition? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.