Part 1: Propagating uncertainty

Trying out narratives

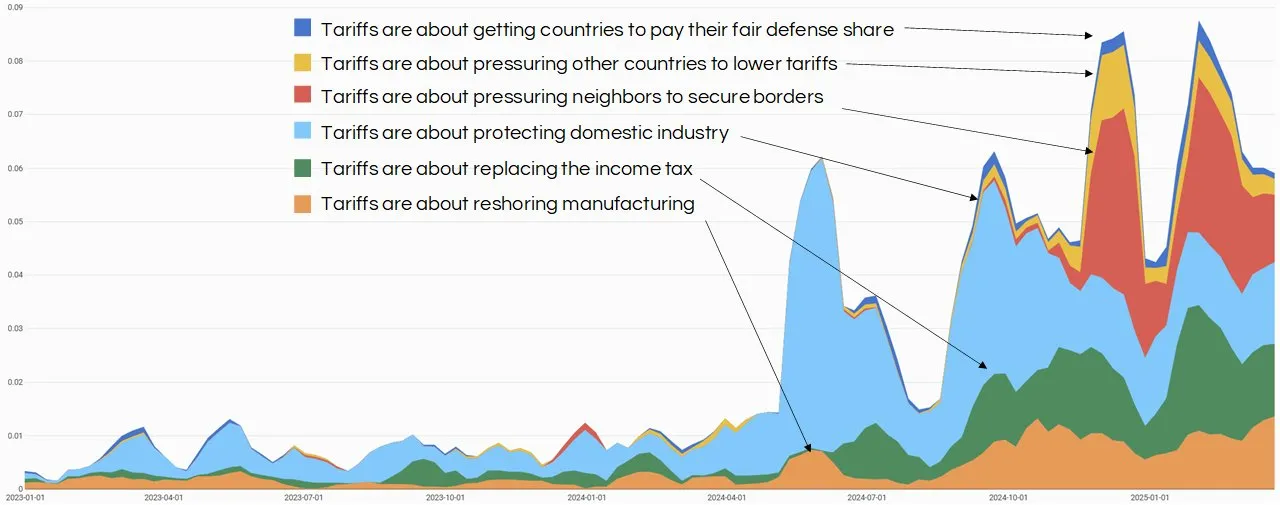

The most annoying part of the past two weeks was seeing the MAGA crowd turn on a dime to support Trump's latest decision, embracing multiple contradictory reasons for raising tariffs. On Ben Hunt's Epsilon Theory website, analyst Rusty Guinn tracked what they call narrative shopping:

In particular, the goals of using tariffs to generate revenue and using tariffs as a negotiation tactic are inconsistent with each other and with any goal to change the structure of the global economy, like reviving American manufacturing or protecting domestic production. And let's be clear, I'm not losing sleep about inconsistency in rhetoric; we're playing with real money here. Economic actors need to know which way the wind is blowing in order to make decisions about markets where trillions of dollars are traded.

https://x.com/WRGuinn/status/1909206637375598623

I'm going to be annoying in return by posting memes, but there are many more I could add. Speaking of memes, and to be fair and balanced, as well as switching to my own professional expertise for a moment, I disagree with the impression that it was stupid to include an uninhabited island on the 'Liberation Day' country list. It's hard to get these things right, and including too few territories might enable tariff evasion.

https://x.com/MadsPosting/status/1910377338975437252

The most sophisticated narrative was Treasury Secretary Bessent's attempt to lower the yield on Treasury bonds, in order to refinance the national debt cheaply. His expectation was that investors selling stocks would buy bonds instead, lowering the effective interest rate. Well, this failed immediately - the yield on 10-year Treasury bonds went above 5% rather than below 4%. Trump himself admitted that he was spooked by the bond market, which led to one of his reversals.

The general uncertainty is lowering investors' faith in the ability of the United States to pay off its debt. And as far as I can tell, this market move was simply due to hedge funds hedging, not any politically motivated dumping by China or Japan, which would have more serious effects.

On a meta level, you might consider it smart to promise multiple goals, so you can claim success when you achieve one of them. Yeah, that's how the Art of the Deal works in practice. Maybe I should have read the book in order to understand Trump better, but by now we've all seen how his method works out:

- Make an outrageous demand

- Add some vague promises about how the deal will make everyone better off

- Keep the other side guessing about your real intentions

- Trigger your worst opponents to respond in a way that makes them look bad

- Concede quickly if the other side doesn't yield

- Declare victory whether you made any progress or not

- Most likely outcome: what Trump genuinely considers a win will be bad for the country

The problem with this negotiating tactic is that the other side can see through you, while they'll lose any sympathy they might have for you, because they notice you're crudely trying to manipulate them. Your true believers might be convinced by the one narrative that turns out to be true, but normal people will want to see real results in their bank account eventually.

China retaliated, Xi didn't pick up the phone when Trump almost begged him to take the first step, and the American importers apparently did the lobbying for the Chinese. If you're wondering why China doesn't accept being bullied, look up 'century of humiliation' and 'unequal treaties'. Meanwhile, the EU retaliated moderately, the Europeans let the markets do the work for them, and kept most of their powder dry. Trump decided to declare victory anyway.

Stay tuned for...

- Part 3: Reindustrializing like it's 1999

- Part 4: Giving up America's soft power